Samsung Electronics Affiliate Semes

Emerging Leader in Expanding New Equipment Supply

Hanmi Semiconductor Supplying SK Hynix

Aiming to Triple Sales in 2 Years

Expanding Materials and Components for HBM No.1 Competition

Competition between Samsung Electronics and SK Hynix to dominate the high-bandwidth memory (HBM) market is expanding to materials, parts, and equipment (SoBuJang) companies. TC (Thermal Compression) bonders, essential core equipment for HBM manufacturing, are also emerging as a key battleground.

TC bonders are devices that thermally compress and bond individual DRAM chips used in HBM stacking. This process is repeated 8 to 12 times to build up the number of layers. The performance of the product depends on how many layers can be stacked accurately and quickly.

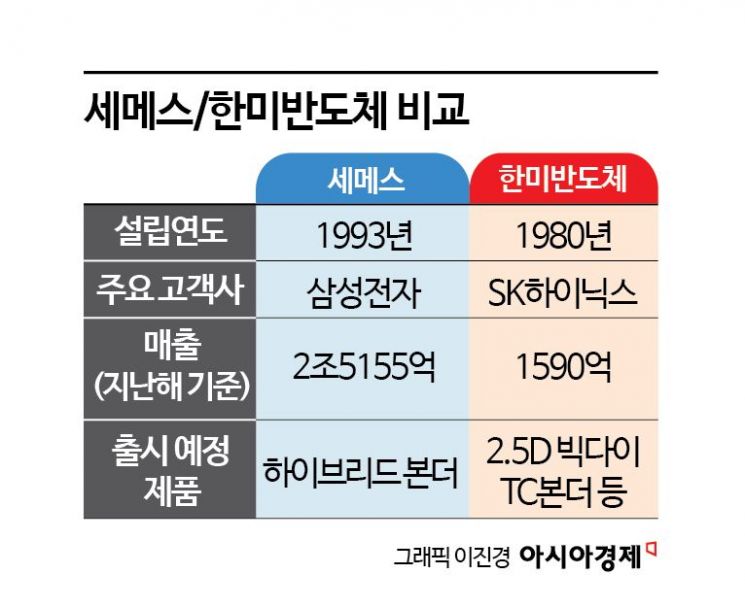

Recently, competition in the domestic TC bonder market has become a hot topic between Semes and Hanmi Semiconductor. Semes is a Samsung Electronics affiliate that manufactures semiconductor equipment. Along with Japan's Toray and Shinkawa, it supplies TC bonders to Samsung Electronics. Hanmi Semiconductor, regarded as the market leader in TC bonders, supplies SK Hynix. Because of this, industry insiders refer to the competition between the two companies as a ‘proxy war’ between Samsung Electronics and SK Hynix.

Semes Emerging as a Rising Power

According to industry sources on the 16th, the announcement of Nvidia’s quality test results for Samsung Electronics’ 12-layer 36GB HBM3E is imminent. It is expected to be released as early as next month. If Samsung Electronics’ HBM3E product passes the quality test and is confirmed for supply to Nvidia, it will be a boon for Semes as well. If Samsung Electronics significantly increases HBM production, Semes will be able to supply more TC bonders.

Until now, Semes had a lower share of TC bonder supply to Samsung Electronics compared to Toray and Shinkawa. However, it is reported that the supply share has increased recently as Semes improved its TC bonder equipment to suit the ‘TC-NCF’ process. The TC-NCF process is one of the HBM stacking methods, where a film-type material is laid down each time a chip is stacked. Samsung Electronics introduced this process to improve HBM production yield. Considering Samsung Electronics’ long-term policy to localize semiconductor equipment, Semes’ position is likely to strengthen further. Riding this trend, Semes recently received approval from Yongin City, Gyeonggi Province, to build the ‘Giheung Future Urban High-Tech Industrial Complex’ including a 20-story technology development center by 2026 on a 94,399㎡ site in Gomae-dong, Giheung-gu.

Hanmi Semiconductor’s ‘Triple Sales in Two Years’

Hanmi Semiconductor, regarded as a leader in TC bonders, recently unveiled its development roadmap and set a sales target of 2 trillion won for 2026, which is three times higher than this year’s expected amount. The development cycle for TC bonders has also been significantly accelerated. Dongshin Kwak, Vice Chairman of Hanmi Semiconductor, said, "We plan to launch the ‘2.5D Big Die TC Bonder’ in the second half of this year, the ‘Mild Hybrid Bonder’ in the second half of next year, and the ‘Hybrid Bonder’ in the second half of 2026." Last month, the company opened its sixth factory in Seo-gu, Incheon. Hanmi Semiconductor is expected to be capable of producing 420 TC bonders annually, or 35 units per month, next year. The company claims this is the ‘world’s largest scale.’

There is a high possibility that SK Hynix, a customer, will increase HBM production in the future. According to foreign media such as Taiwan Economic Daily, Nvidia plans to increase production of its AI semiconductor ‘Blackwell’ chips by up to 25% due to rising orders from major customers. Consequently, the quantity of HBM that SK Hynix must supply is also expected to increase significantly. Accordingly, the number of TC bonders that Hanmi Semiconductor needs to support is also likely to grow.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.