Kakao to Implement Revised Operating Policy on the 14th of Next Month

All Stock, Coin, NFT, and Real Estate Leading Rooms Prohibited

Starting from the 14th of next month, so-called 'investment leading rooms' operated by illegal quasi-investment advisory firms will disappear from KakaoTalk.

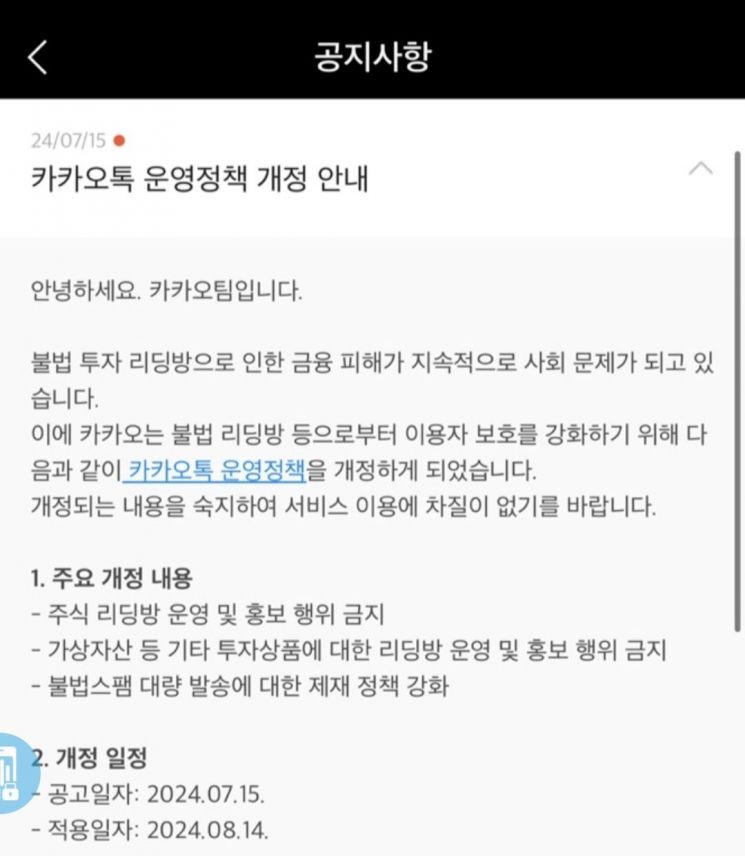

On the 15th, Kakao announced a revision of its operating policy through a KakaoTalk notice. The revised KakaoTalk operating policy, effective from the 14th of next month, includes new provisions banning the operation and promotion of stock leading rooms, as well as strengthened sanctions against mass illegal spam sending.

Kakao stated regarding this revision, "Financial damages caused by illegal investment leading rooms have continuously become a social issue, so we have revised the KakaoTalk operating policy to strengthen user protection from illegal leading rooms."

The main revisions include ▲ prohibition of operating and promoting stock leading rooms ▲ prohibition of operating and promoting leading rooms for other investment products such as virtual assets ▲ strengthening sanctions against mass illegal spam sending.

Kakao has newly established a subcategory called 'quasi-investment advisory, etc.' under the policy category of 'illegal or regulated product/service-related content.' By explicitly specifying quasi-investment advisory as a separate category, the number of prohibited items has been significantly increased, clearly defining the scope of prohibition.

In particular, the act of creating or operating group chat rooms (group chats) for quasi-investment advisory is prohibited. Furthermore, the creation of all group chat rooms other than open chats related to quasi-investment advisory is banned, regardless of whether compensation is received. In other words, both paid and free stock leading rooms are subject to sanctions.

The provision of quasi-investment advisory services through one-on-one chat rooms is also prohibited. Ultimately, providing quasi-investment advisory services via KakaoTalk and promoting such services are completely banned. Kakao cited examples of prohibited acts including impersonating experts, celebrities, financial institutions, or investment company employees, advertising phrases guaranteeing profits, inducing subscription to private home trading systems, inviting other users to leading rooms, and sending spam messages. The illegal leading room policy applies equally not only to stock investments but also to virtual assets such as coins, non-fungible tokens (NFTs), and real estate investments.

Sanctions against mass illegal spam sending will also be further strengthened. If prohibited acts are confirmed through user reports, the reported user and the administrators of the relevant chat room, such as the room owner and sub-owners, may be permanently restricted from using all services within KakaoTalk immediately. However, Kakao does not view messages or content exchanged between users to protect user privacy, so users must report problematic chat rooms and messages through the 'Report' function within the service for Kakao to determine violations of laws, terms, or operating policies and take usage restriction measures against the reported users.

Meanwhile, in recent years, various illegal leading rooms have impersonated celebrities or experts on social networking services (SNS) to conduct investment fraud or sent mass spam, becoming a serious social problem. Accordingly, a partial amendment to the Capital Markets Act, passed by the National Assembly plenary session in January, is scheduled to take effect on the 14th of next month. This amendment effectively prohibits the creation of two-way channels such as stock leading rooms except by officially registered investment advisory firms. It also bans displays or advertisements that may cause misunderstanding as financial companies, false advertising of returns, and prohibits including services that quasi-investment advisory firms cannot provide in advertisements.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)