Naver Surges Over 5% This Month, Achieving Rebound

Inflow of Buy Orders at Low Prices After Record Low

Brokerages Lower Target Prices This Month

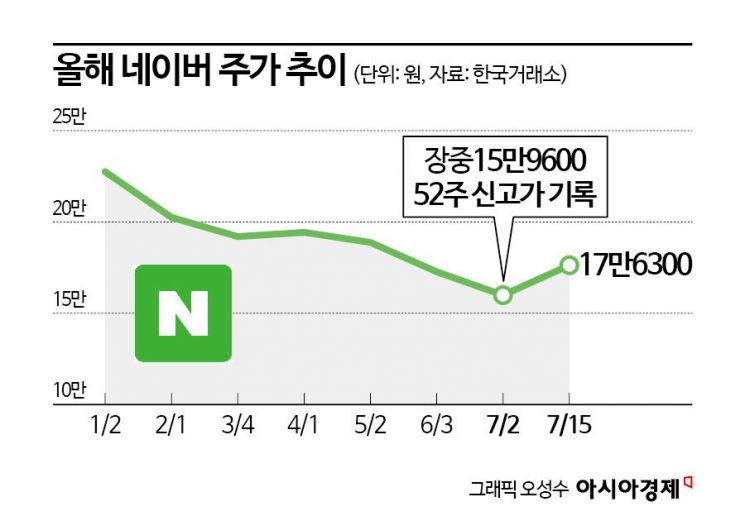

NAVER, which had been on a continuous downward trend since the beginning of this year, is showing a changed appearance this month. After hitting a 52-week low earlier this month, it successfully rebounded, rising more than 10% from the low. However, since market expectations are lowering, it remains to be seen whether this rare upward trend can be sustained.

According to the Korea Exchange on the 16th, NAVER rose 5.63% this month. Compared to the 52-week low recorded intraday on the 2nd (159,600 KRW), it has risen more than 10%. NAVER started the year in the 220,000 KRW range, but its stock price has been continuously falling this year. Earlier this month, it even dropped below the 160,000 KRW level. However, after hitting the low, NAVER immediately began to rebound. After recovering the 160,000 KRW level, it has now pushed the stock price up to the high 170,000 KRW range, attempting to break through the 180,000 KRW level.

The rebound is interpreted as a result of low-price buying reflecting the continued stock price decline. Institutions and foreigners who engaged in low-price buying laid the groundwork for the rebound. This month, institutions have net purchased NAVER by 76.2 billion KRW, and foreigners by 4.4 billion KRW, respectively.

Although NAVER has started to rebound, market expectations are trending downward. Securities firms have been lowering NAVER’s target price one after another this month. Kyobo Securities lowered NAVER’s target price from 280,000 KRW to 254,000 KRW, while KB Securities and Korea Investment & Securities each lowered it from 270,000 KRW to 240,000 KRW. Daol Investment & Securities cut it from 260,000 KRW to 210,000 KRW, and DB Financial Investment from 293,000 KRW to 233,000 KRW. Meritz Securities lowered it from 290,000 KRW to 260,000 KRW, and Mirae Asset Securities from 255,000 KRW to 240,000 KRW. KB Securities researcher Lee Seonhwa explained, "We have lowered the operating profit estimates for this year and next due to one-time costs related to the webtoon entertainment listing and increased infrastructure-related expenses as AI-related investments expand."

Since market expectations for NAVER are not high, opinions suggest that new growth drivers or shareholder return plans that can attract investor interest are needed. DB Financial Investment researcher Shin Eunjeong said, "Negative issues such as C-commerce, Line Yahoo, and YouTube Shopping have continued from the beginning of the year, resulting in a sluggish trend. While much of the concerns are believed to be reflected, new growth drivers seem necessary for a quick stock price recovery."

Overseas expansion achievements are expected to act as momentum for stock price increases. Kyobo Securities researcher Kim Gyudong predicted, "If the results of overseas expansion strategies such as securing original overseas content based on webtoon entertainment and expanding IP video adaptations are confirmed, they will serve as momentum for stock price increases."

There is also an opinion that strengthening shareholder returns is necessary for stock price growth. Meritz Securities researcher Lee Hyojin said, "If more aggressive asset liquidation policies are implemented, including utilization of non-liquid assets that have not generated synergy despite strategic partnerships, along with increasing the shareholder return ratio, investor interest could be revived."

Strong earnings are expected to defend against stock price declines. NAVER achieved record-high earnings in the first quarter of this year and is expected to post solid results in the second quarter as well. According to financial information provider FnGuide, NAVER’s second-quarter earnings consensus (average of securities firms’ forecasts) is 2.6455 trillion KRW in revenue and 432.8 billion KRW in operating profit. This represents increases of 9.87% and 16.13%, respectively, compared to the same period last year. Hi Investment & Securities researcher Yoon Yeji said, "Since operating profit is expected to grow 24% year-on-year this year with solid performance, the possibility of further decline is considered low."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)