Household debt surged by more than 20 trillion won in the first half of this year alone, prompting financial authorities to hit the 'emergency brake.' They convened the banking sector to order a slowdown in household debt growth and have also begun written and on-site inspections to review the management status of household loans at frontline institutions.

However, the financial sector expects the upward trend to continue for the time being, citing the real estate market recovery centered on certain regions, the ongoing decline in bank bond interest rates, and the high likelihood of last-minute loan demand surging due to the postponement of the second phase of the stress Debt Service Ratio (DSR) regulation to September.

According to the financial sector on the 15th, Shinhan Bank raised the mixed-type mortgage loan interest rate by 0.05 percentage points starting today. As a result, as of today, the mixed-type mortgage loan interest rates of the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) ranged from 2.91% to 5.68% per annum, showing a slight increase at both the upper and lower ends compared to the rates on the 12th (2.87% to 5.67%).

Shinhan Bank is not the only one raising mortgage loan interest rates. Earlier this month, KB Kookmin Bank increased its mortgage loan interest rate by 0.13 percentage points, while Hana Bank and Woori Bank raised their mixed-type mortgage loan and mortgage loan interest rates by 0.2 percentage points and 0.1 percentage points, respectively.

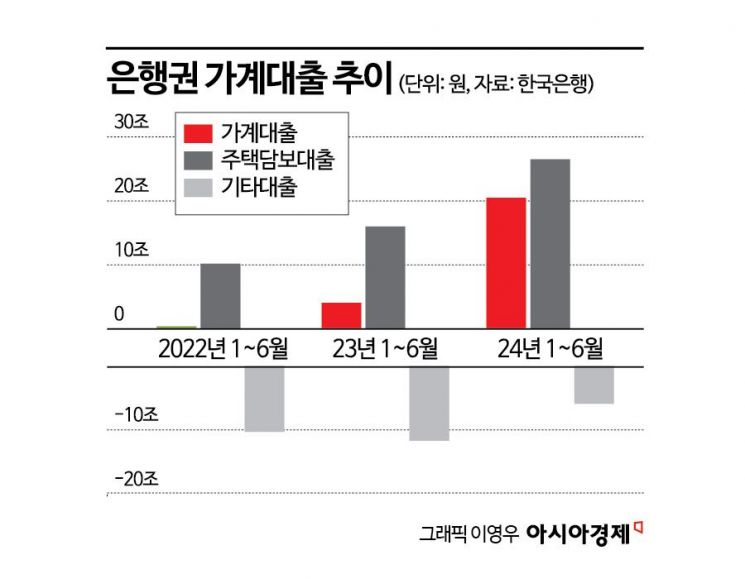

The banking sector's decision to raise mortgage loan interest rates, contrary to the falling market interest rates, is aimed at controlling the rapidly increasing household loans. According to the Bank of Korea, household loans from banks increased by 20.5 trillion won from January to June. This far exceeds the levels of 4.1 trillion won in 2023 and 1 trillion won in 2022. The increase in household loans was mainly driven by mortgage loans (including jeonse deposit loans). During the same period, the increase in mortgage loans reached 26.5 trillion won, marking the highest level in three years.

The authorities have also taken emergency measures. The Financial Services Commission convened banks last week for a household debt meeting and ordered a slowdown, while the Financial Supervisory Service decided to conduct written and on-site inspections starting today on the five major commercial banks and KakaoBank to review the management status of household loans. This is to closely monitor compliance with the Debt Service Ratio (DSR) regulations.

However, some believe that despite these emergency brakes, the trend of increasing household loans is likely to continue for the time being. First, expectations for interest rate cuts in the second half of the year are growing, and the bank bond interest rates, which serve as the benchmark for mixed-type mortgage loans, have been declining continuously.

According to the Bond Information Center of the Korea Financial Investment Association, as of the 12th, the 5-year bank bond interest rate stood at 3.356%, marking the lowest point of the year. This is nearly 0.5 percentage points lower than the rate at the beginning of the year (3.820%) and the lowest level since April 2022, before the interest rate hike began in earnest. Moreover, although the Bank of Korea has premised its policy on stabilizing household debt, it has also raised the possibility of cutting the base interest rate within the year.

A financial industry official said, "The current market interest rates already reflect expectations of a base rate cut, so even if an actual cut occurs, the decline may not be as significant as expected. Nevertheless, if bank bond interest rates continue to fall, loan interest rates will inevitably be adjusted accordingly."

There are also views that the postponement of the implementation of the stress DSR phase 2 regulation, which limits loan amounts, from July to September will have an impact. When the stress DSR phase 2 regulation is applied, loan limits decrease by about 3 to 9% depending on the loan type. Since the timing to avoid this regulation has been delayed by about two months, loan demand for last-minute borrowing before the deadline may increase.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.