'Excessive Freight Charges' (79.1%) Major Reason

Logistics Difficulties Expected to Persist Until First Half of Next Year

More than half of export-oriented small and medium-sized enterprises (SMEs) are experiencing difficulties due to logistics issues.

The Korea Federation of SMEs announced on the 14th the results of a survey titled “Impact of Rising Ocean Freight Rates and Container Space Shortages on Export SMEs,” conducted from the 1st to the 5th of this month targeting 300 export SMEs. This survey was conducted to assess the impact of recent events such as the Red Sea incident and China’s push-export policies, which have caused an increase in ocean freight rates, on export SMEs.

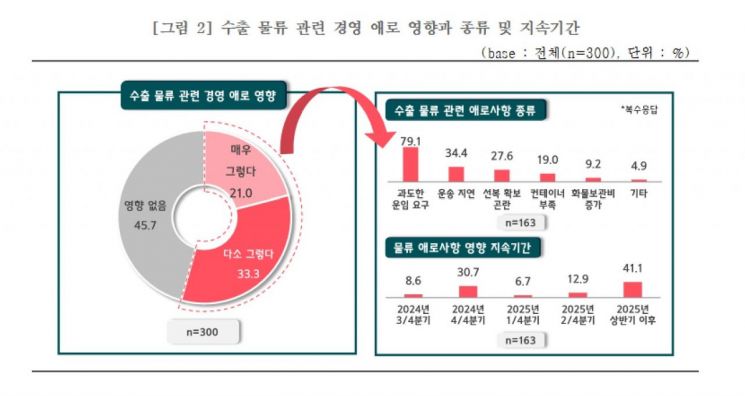

The survey results confirmed that 54.3% of export SMEs are currently facing management difficulties related to export logistics. Among them, 21.0% responded “strongly agree,” and 33.3% responded “somewhat agree.”

The main difficulties (multiple responses allowed) were “excessive freight charges” (79.1%), “transport delays” (34.4%), “difficulty securing container space” (27.6%), “container shortages” (19.0%), and “increased cargo storage fees” (9.2%), in that order.

Additionally, 61.0% of SMEs reported that logistics costs have risen compared to the beginning of the year, and 41.1% of companies expect logistics difficulties to continue until the first half of 2025 or later.

Regarding ocean freight contract methods, 96.0% of SMEs contracted through forwarding companies. Direct contracts with shipping companies accounted for only 4.0%. In terms of contract types, both forwarding companies and direct contracts with shipping companies showed a higher proportion of “per shipment contracts” at 93.8% and 83.3%, respectively, compared to “long-term contracts.”

Possible countermeasures considered by SMEs (multiple responses allowed) included “utilizing government support measures” (32.7%), “raising product prices” (17.0%), “changing transaction terms with buyers” (8.0%), and “seeking alternative transportation methods” (8.0%). However, 37.7% of SMEs reported having no specific measures.

Regarding experience with major government logistics support programs (multiple responses allowed), the “logistics voucher program” was the most utilized at 34.7%. This was followed by “special trade insurance support” (6.3%) and “SME-dedicated container space support program” (2.7%). However, 59.3% of SMEs had no experience using these programs, and among them, a majority (55.1%) cited “lack of awareness about the support programs” as the reason for not using them.

For future resolution of logistics difficulties, the top priority support item (multiple responses allowed) was “expansion of logistics cost support,” desired by 82.3% of companies. Other priorities included “expansion of SME-dedicated container space support” (22.3%), “liquidity support such as extension of loan repayment deadlines” (14.0%), “strengthening promotion of government support programs” (9.7%), and “increasing deployment of vessels to major countries” (6.0%).

Choo Moon-gap, Head of the Economic Policy Division at the Korea Federation of SMEs, stated, “Although various support measures, including SME-dedicated container space support, are being prepared as logistics difficulties continue, they are still insufficient to resolve the on-site difficulties faced by export SMEs. It is necessary to thoroughly prepare to prevent the export recovery trend of SMEs from faltering by actively expanding logistics cost support, which is highly demanded in the SME field.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)