InventageLab, Voronoi, Peptron, and Other Bio Stocks Surge

Improved Investor Sentiment in Bio Sector Amid US Interest Rate Cut Expectations

Warmth is returning to the bio sector this month. As the U.S. Federal Reserve (Fed) is expected to start cutting the benchmark interest rate from September, investor sentiment appears to be reviving. Attention is focused on the bio sector, which had seen investor sentiment shrink during the rate hike period, with stock prices rising mainly in bio companies with high expectations for technology exports.

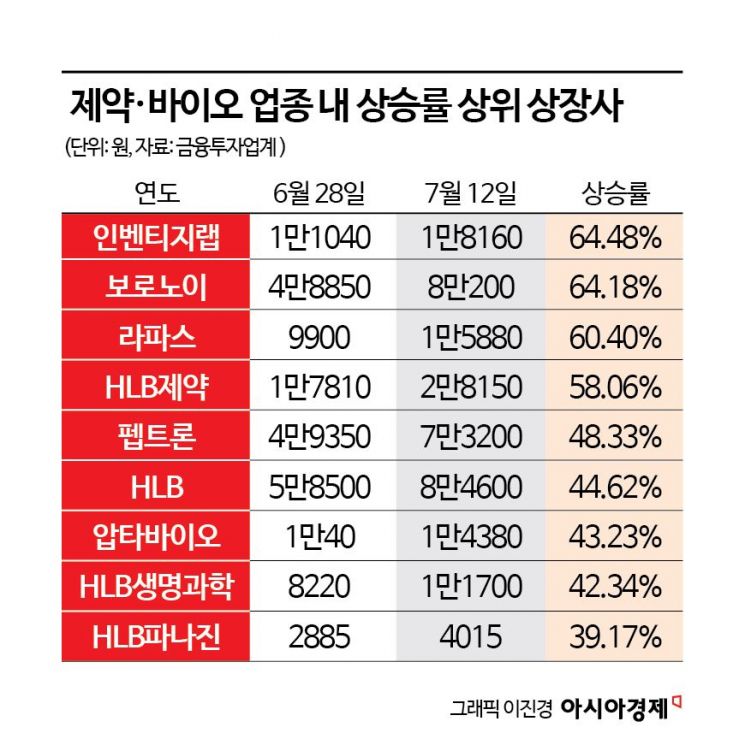

According to the financial investment industry on the 15th, the stock prices of listed bio companies such as InventageLab, Voronoi, Lapas, and Peptron have surged this month. InventageLab's stock price rose 64.5% compared to the end of last month.

InventageLab is a company developing drug delivery systems (DDS) based on microfluidics technology. It is developing long-acting injectable drugs and gene therapies. Long-acting injectable drugs are injected into the body by mixing drugs with biodegradable polymers. As the polymer dissolves, the drug is gradually released. The effect lasts from as short as one month to as long as six months. Si-on Kang, a researcher at Korea Investment & Securities, explained, "InventageLab's technology, which produces microspheres of a consistent size, has overcome the limitations of existing long-acting injectable drugs," adding, "It reduces side effects by not releasing excessive drugs at the initial stage of administration."

As competition for developing obesity drugs intensifies overseas, the value of companies developing long-acting injectable drug technology is rising. Peptron, which is developing peptide technology lasting more than one month, has a market capitalization exceeding 1.5 trillion won. Its stock price has risen 48.3% this month.

Voronoi, which is developing targeted therapies in the fields of lung and breast cancer, also saw its stock price rise 64.2% compared to the end of last month. Voronoi is developing a treatment for non-small cell lung cancer and will release interim clinical results in the first half of this year. Expectations for the efficacy of the new drug are increasing, driving the stock price up.

The Yeouido securities industry cites expectations of interest rate cuts as one of the reasons the bio sector, which showed poor performance last year, has recently attracted attention. Developing new drugs requires enormous funds, and the higher the interest rates, the more difficult it becomes to raise capital. Hyemin Heo, a researcher at Kiwoom Securities, said, "The pharmaceutical and bio sectors are greatly affected by interest rates," adding, "We expect the interest rate environment to gradually improve toward the end of the year." She also judged, "The market is responding to technology transfer achievements, and if there are results, there is substantial latent investment demand for the bio sector."

Expectations for interest rate cuts are growing in the United States. The U.S. Consumer Price Index (CPI) for June rose 3.0% year-on-year, falling short of market expectations. The monthly increase rate declined compared to the previous month for the first time in 4 years and 1 month since May 2020, during the COVID-19 pandemic. The core CPI, excluding food and energy, rose 3.3%.

Jinwook Heo, a researcher at Samsung Securities, said, "The Fed is expected to cut rates six times from September this year until the end of next year," forecasting, "By the end of next year at the latest, inflation in most countries will reach the 2% target level."

Hayeon Lee, a researcher at Daishin Securities, explained, "The U.S. Fed is cautious about further weakening in the labor market," adding, "There is a high possibility of rate cuts as part of monetary policy normalization before employment indicators further deteriorate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.