KOSPI Rises Above 2890, Approaching 2900

Individuals Buy Most KODEX200 Futures Inverse 2X This Month

Institutions and Foreigners Net Buy Leverage ETFs, Supporting Index Rise

The KOSPI is on the verge of breaking through the 2900 level, but individual investors have been the largest net buyers of "Gopbus" this month, indicating they are betting on a KOSPI decline. In contrast, institutions and foreigners have shown a tendency to bet on further KOSPI gains.

According to the Korea Exchange on the 12th, the KOSPI closed at 2,891.35, up 23.36 points (0.81%) from the previous day, reaching the 2890 level and coming close to the 2900 mark. Since the beginning of this month, the KOSPI has recorded gains on all but two days, participating in the global rally and maintaining a favorable trend. Kang Daeseok, a researcher at Yuanta Securities, analyzed, "In the U.S., the S&P 500 and Nasdaq indices hit all-time highs, and Japan's Nikkei 225 index surpassed its late March peak to resume a high-price rally. Taiwan and India stock markets also reached new highs last week, signaling the start of a global market rally again," adding, "The KOSPI has joined the global rally. It has risen for five consecutive weeks, ranking among the top performers in this rally and beginning to recover from relative underperformance since the start of the year."

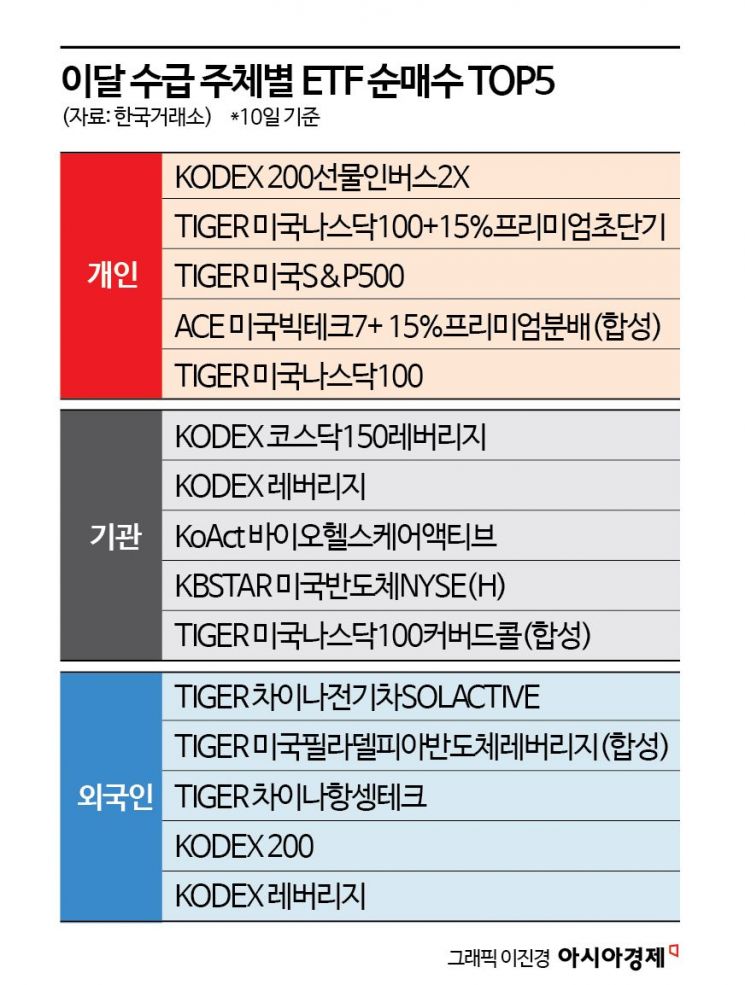

Although the KOSPI continues its upward trend, individual investors are betting on a KOSPI decline. This month, individuals have net purchased 197.6 billion KRW worth of KODEX 200 Futures Inverse 2X, known as "Gopbus" (a combination of "multiply" and "inverse"), making it the most bought among all listed ETFs. This product inversely tracks the KOSPI 200 futures index at twice the rate, allowing investors to earn double profits when the KOSPI 200 index falls. Last month, when the KOSPI completed its correction and began rising again, individuals also net purchased 437 billion KRW of KODEX 200 Futures Inverse 2X.

Additionally, individuals bought KODEX Inverse ETFs, reinforcing their bearish outlook on the KOSPI. They also heavily net purchased U.S. stock market and big tech-related ETFs, showing a focus on the U.S. market. Among the most purchased were TIGER U.S. Nasdaq 100 +15% Premium Ultra Short-Term, TIGER U.S. S&P 500, ACE U.S. Big Tech 7+ 15% Premium Distribution (Synthetic), and TIGER U.S. Nasdaq 100.

On the other hand, institutions and foreigners appear to be placing more weight on further gains in the domestic market. Institutions have net purchased KODEX KOSDAQ 150 Leverage the most this month, followed by KODEX Leverage. Leverage ETFs provide double the profit when the underlying index rises. Other top net purchased ETFs by institutions include KODEX 200 and KODEX KOSDAQ 150, indicating expectations for continued strength in the domestic market.

Foreigners also included KODEX 200 and KODEX Leverage among their top net purchases, similarly betting on further KOSPI gains.

Lee Jinwoo, a researcher at Meritz Securities, said, "While domestic investors seem to have a negative view of the domestic market, foreigners appear to be betting on a bull market."

Considering the perspective of foreigners who have led this year's rise in the domestic market, there is a forecast that the KOSPI could continue to rise. Foreigners have net purchased nearly 27 trillion KRW in the domestic market so far this year. Lee explained, "July is expected to mark the start of a bull market," adding, "With the U.S., Taiwan, and Japan consecutively setting new all-time highs, and considering the domestic market's industry, exports, and supply-demand environment, it is possible for the domestic market to challenge new highs similar to those in the U.S., Taiwan, and Japan."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)