As insurers' required capital increased, the solvency situation at the end of the first quarter this year showed some deterioration.

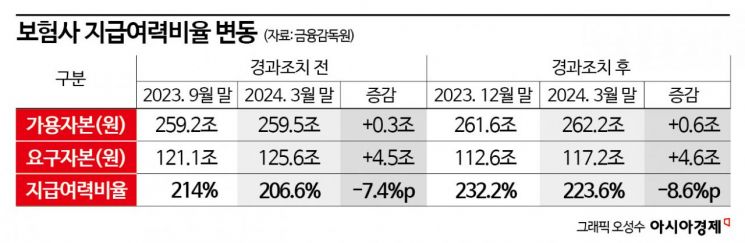

According to the Financial Supervisory Service on the 11th, the K-ICS ratio of insurers applying the transitional measures as of the end of March this year was 223.6%, down 8.6 percentage points from the previous quarter (232.2%).

The K-ICS ratio for life insurers was 222.8%, down 10 percentage points from the previous quarter, while the K-ICS ratio for non-life insurers was 224.7%, down 6.7 percentage points during the same period.

The solvency ratio is the value obtained by dividing available capital by required capital. The minimum standard under the Insurance Business Act is 100%, and the supervisory authority recommends maintaining it above 150%. Over the past three months, required capital increased more than available capital for insurers, causing the solvency ratio to decline.

As of the end of March this year, after the transitional measures, K-ICS available capital was KRW 262.2 trillion, an increase of KRW 600 billion from the previous quarter. This was because other comprehensive income decreased by KRW 10.3 trillion due to an increase in insurance liabilities caused by a decline in discount rates, while adjustment reserves increased by KRW 6.4 trillion due to new contract inflows, and first-quarter net income increased by KRW 4.8 trillion.

At the same time, K-ICS required capital was KRW 117.2 trillion, up KRW 4.6 trillion from the previous quarter. The Financial Supervisory Service explained that this was mainly due to an increase of KRW 1.9 trillion in market risk such as equity risk, and an increase of KRW 2.4 trillion in operational risk following the implementation of the basic assumption risk amount. The basic assumption risk amount is an item included in operational risk in the new solvency ratio calculation formula starting this year, and the greater the deviation between actual and expected results, the larger this risk amount is recorded.

Looking at the K-ICS ratios by insurer as of the first quarter, KDB Life (129.2%) and MG Non-Life (52.1%) remained below the standard (150%) following the previous quarter. Hana Non-Life also fell below the regulatory recommendation, dropping 23.8 percentage points from the previous quarter (153.1%) to 129.3%.

A Financial Supervisory Service official stated, "As of the end of March this year, insurers' solvency ratio after the transitional measures is 223.6%, maintaining a stable level," but added, "Given the continuously increasing uncertainty in financial markets, we will thoroughly supervise to ensure that vulnerable insurers secure sufficient solvency."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.