KCCI Surveys 400 Domestic Companies

31.3% Say "Financial Deterioration Due to Interest Expenses"

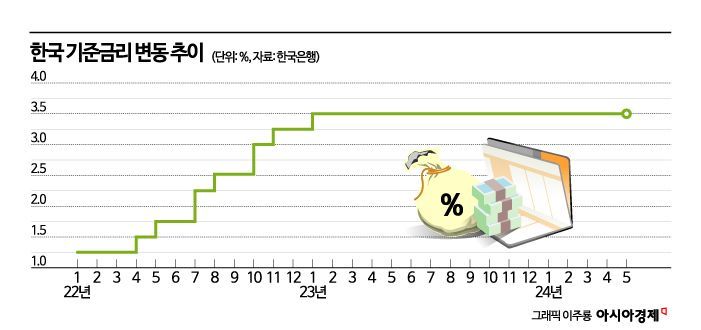

Base Rate Maintained at 3.5% for 19 Months

It has been revealed that our companies are experiencing financial difficulties due to the high level of the base interest rate.

The Korea Chamber of Commerce and Industry announced on the 10th that, based on a survey of 400 domestic companies on 'Corporate outlook and response to base interest rate cuts,' 31.3% of companies reported experiencing 'deterioration of financial condition due to interest expenses' as the biggest management difficulty during the high interest rate period.

Companies citing 'difficulty in raising new funds' accounted for 27.8%, followed by 'introduction of emergency management systems for cost reduction' (16.5%), and 'delays or suspension of facility investment and research and development' (10.5%).

The base interest rate has been maintained at 3.5% for 19 months since January last year. Amid this, it was confirmed that companies especially feel a heavy burden from interest expenses due to the high interest rate in the recent situation of deteriorating performance. Regarding business performance in the first half of this year, 55.2% of responding companies expected to be 'profitable with operating profit exceeding interest expenses,' but 44.8% answered that 'operating profit and interest expenses are at similar levels' (30.2%) or 'in deficit' (14.6%). The Korea Chamber of Commerce and Industry analyzed that, overall, 44.8% of companies are at breakeven or deficit when paying interest expenses.

Small and medium-sized enterprises (SMEs) faced relatively greater difficulties than large and medium-sized companies. The proportion of companies with interest expenses exceeding operating profit or operating deficits was 24.2% for SMEs, more than twice as high as large companies (9.1%) and medium-sized companies (8.7%).

Companies were pessimistic about interest rate cuts. 47% of companies expected 'one cut' in interest rates this year, while 40% believed there would be 'none.' Only 12.8% of companies responded that there would be 'two or more cuts.'

The Korea Chamber of Commerce and Industry analyzed, "It appears that companies expect the effects of interest rate cuts but also believe that active rate cuts within this year are unlikely due to high exchange rates, high inflation, and the discussion trends of the U.S. Federal Open Market Committee (FOMC)."

Regarding the most important factors to consider when lowering the base interest rate, companies most frequently cited 'the pace of U.S. interest rate cuts' (32.5%). 'Current economic conditions' (26.3%) and 'inflation rate' (26.3%) followed. Also, one in two responding companies said there would be changes in management and fund operations when interest rates are cut. The other 50% said there would be no significant changes.

Among companies that expected changes in management, the first action to be taken was 'strengthening financial structure such as debt repayment' (65%), followed by 'expansion of facility investment' (22.5%).

Furthermore, policies deemed necessary for interest rate cuts to have a synergistic effect in revitalizing the economy included 'incentives to activate corporate investment' (37.3%), 'support for boosting domestic consumption' (34.3%), 'removal of burdensome regulations on companies' (19.2%), 'support for developing overseas markets' (5.7%), and 'support for startups and venture investments' (3.5%).

Kim Hyun-soo, head of the Economic Policy Team at the Korea Chamber of Commerce and Industry, said, "With corporate investment sluggish due to recent domestic and international conditions, it is expected that lowering interest rates will reduce interest burdens, improve financial conditions, and positively impact investment expansion. However, since low interest rates alone are not a sufficient condition for corporate investment, it is necessary to create an environment where companies can actively invest by combining policies such as direct subsidies for advanced industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)