Defense Industry Trend Report Published

"Investing in Technology in the Space Sector"

"Unmanned Systems and Drone Industry Also Require Attention"

It has been suggested that for K defense industry to maintain sustainable competitiveness, it must secure technological capabilities in the space sector and focus on the maintenance, repair, and overhaul (MRO) market, which generates stable revenue.

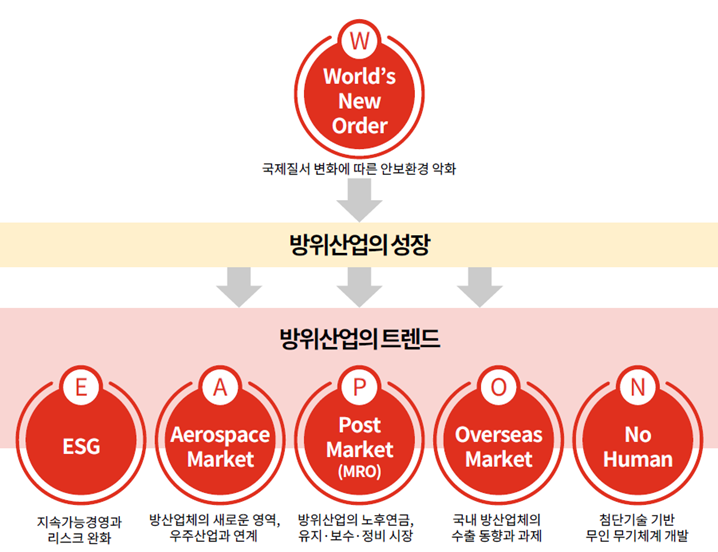

On the 10th, Samil PwC announced the publication of a report titled ‘W.E.A.P.O.N ? The Present and Future of the Defense Industry Seen Through Keywords,’ which contains these insights. This report was created to examine major trends in the domestic and international defense industries and to provide strategic directions for domestic defense companies.

Background and Trends of Defense Industry Growth Examined Through Keywords [Data Provided by Samil PwC]

Background and Trends of Defense Industry Growth Examined Through Keywords [Data Provided by Samil PwC]

Due to prolonged geopolitical risks and arms competition, the boom period in the defense industry is expected to continue for the time being. The report pointed out that while K defense’s competitiveness lies in high weapon performance relative to price and fast delivery speed, growth is limited when focusing mainly on existing weapon systems such as artillery.

In particular, it emphasized the need for mid- to long-term growth plans as major countries increase their checks on South Korea, whose defense exports have recently grown rapidly. As measures to overcome these challenges, the report proposed growth strategies including ▲ active response to ESG (environment, social, governance) risks ▲ linkage with the space industry ▲ entry into the MRO market ▲ expansion of export routes to the U.S. and Middle East regions ▲ development of unmanned weapon systems such as drones.

The report stressed the necessity of securing technological capabilities for entering the space sector as a future growth engine for defense companies, as well as cooperating with and investing in promising space startups. Since the maintenance market accounts for 60-70% of the weapon sales market, it is crucial to focus investments to secure global competitiveness.

The MRO market is a follow-up market encompassing maintenance, repair, and disassembly/reassembly of weapon systems, often called the ‘pension fund’ of defense companies. Even if geopolitical risks and arms competition ease in the future, it is considered a model capable of generating stable revenue over a long period. Additionally, the report analyzed that the U.S. and the Middle East will be promising new export markets.

Kim Taesung, leader (partner) of the Defense Industry Task Force at Samil PwC, stated, “To enter the U.S. defense procurement market, which exceeds 500 trillion won annually, defense companies must thoroughly prepare in advance by complying with U.S. Department of Defense procurement regulations and cost standards.” He added, “Along with securing unmanned technology in response to South Korea’s declining troop numbers, attention should be paid to the drone industry, which countries worldwide are actively deploying.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.