Seoul Housing Prices Stir, But Construction Firms Avoid Bids

Procurement Interest Rates and Construction Costs High Amid Market Uncertainty

Public Orders Increase... Ministry of Land, Infrastructure and Transport Says "Using Next Year's Budget Early"

The monthly order amount for domestic construction companies fell below 10 trillion won for the first time in nine months. Although there is a rising atmosphere in housing prices mainly in the Seoul area, construction companies are currently cautious. With procurement interest rates and construction costs still high and uncertainties in the real estate market unresolved, the impact of selective ordering to reduce risks is reflected in decreased performance. In particular, private sector orders such as housing have sharply declined, raising concerns that the housing supply shortage problem may become severe in the future.

Lowest in 4 years when comparing January to May

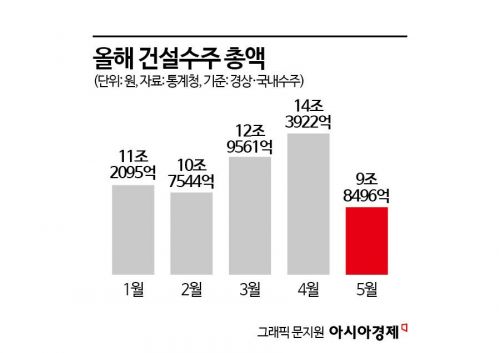

According to Statistics Korea's announcement on the 10th, the construction order amount for May (current and domestic orders) was 9.8496 trillion won. Since August last year (8.2774 trillion won), the monthly order amount had exceeded 10 trillion won, but it fell below the 10 trillion won mark for the first time in nine months.

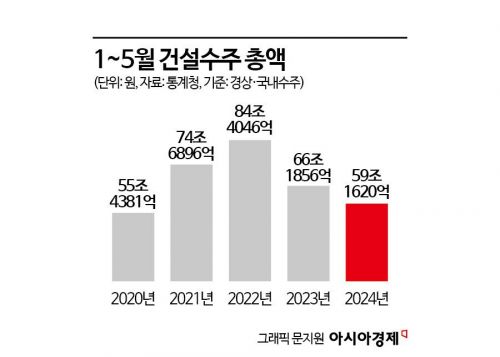

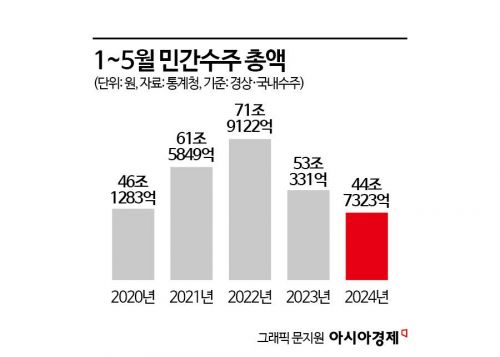

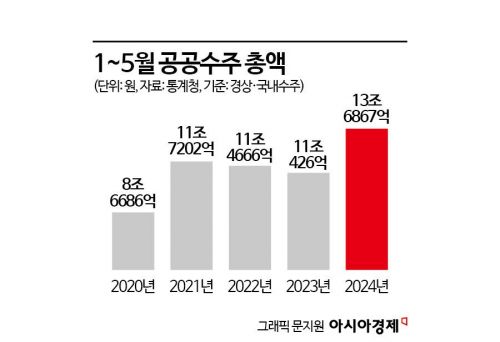

Comparing the total construction order amounts from January to May each year since 2020, this year recorded the lowest in the past four years. The total construction order amount from January to May this year (59.162 trillion won) was the lowest since 2020 (55.4381 trillion won). Compared to the same period last year (66.1856 trillion won), it decreased by about 7 trillion won. Public orders increased by about 2.6 trillion won (from 11.0426 trillion won to 13.6867 trillion won), but private orders decreased significantly by about 8.3 trillion won (from 53.0331 trillion won to 44.7323 trillion won).

An official from the Ministry of Land, Infrastructure and Transport explained, "2020 was before construction costs began to rise significantly," adding, "If the order amounts in 2020 and this year are similar, it can be estimated that the volume of orders this year has decreased compared to 2020."

Procurement interest rates and construction costs remain high

The sharp rise in construction costs and high procurement interest rates have reduced the profitability of new orders, causing construction companies to avoid new projects. The construction cost index released by the Korea Institute of Civil Engineering and Building Technology in May was 130.21 (2020=100), a 31% increase compared to May 2020 (99.25).

Kim Deok-rye, head of the Housing Policy Office at the Korea Research Institute for Human Settlements, said, "Looking at permits and groundbreaking status, private housing supply has significantly decreased," adding, "Due to controversies over construction costs, it is difficult for construction companies to secure orders for housing redevelopment projects, and the risks are high."

High interest rates are also blocking orders. A representative from a large construction company said, "Even though interest rates have recently dropped, that only applies to mortgage loans consumers take, while procurement interest rates for construction companies remain burdensome." He added, "Depending on each company's financial situation, large construction companies borrow at around 5-7%, and mid-sized companies at nearly 10% from financial institutions."

Another representative from a mid-sized construction company said, "Bridge loans from secondary financial institutions to buy land in the early stages of real estate projects have double-digit interest rates, so developers hesitate to start projects," adding, "Construction companies also avoid orders because they think there is no profit when considering costs."

Real estate market stirs but 'still watching'

More than half of the jeonse prices for the 'standard apartment size' in Seoul this year have exceeded 600 million won. On the 5th, a jeonse and sale price list was posted at a real estate office in Seoul. Photo by Kang Jin-hyung aymsdream@

More than half of the jeonse prices for the 'standard apartment size' in Seoul this year have exceeded 600 million won. On the 5th, a jeonse and sale price list was posted at a real estate office in Seoul. Photo by Kang Jin-hyung aymsdream@

Although housing prices are rising recently, mainly in the Seoul area, construction companies are still reluctant to jump on this trend. In Seoul, only Gangnam and some northern districts such as Mapo, Yongsan, and Seongdong, as well as Bundang in the metropolitan area, show noticeable upward trends in housing prices, while other areas are stagnant or even declining. The situation is even worse in provinces where unsold units are accumulating.

Kim from the Housing Policy Office said, "The places where people say 'the market has improved' are only some areas in Seoul and Gyeonggi-do," adding, "From the perspective of construction companies as housing suppliers, they have to sell what they build, but with regulations on multiple homeowners still in place, the situation is not favorable."

The construction industry is concerned about how long the current housing price increase will last. A construction company official said, "There are forecasts that supply will be insufficient from 2026 onwards, and the implementation of the Debt Service Ratio (DSR) to reduce mortgage loan limits is approaching," adding, "The current price surge may be temporary due to demand rushing to buy houses early." He added, "It is a difficult time to judge whether prices will continue to rise or just spike briefly, so construction companies are observing the market."

Public orders increased... Using budget early to put out urgent fires

It is fortunate that public sector orders have increased compared to previous years. Public orders from January to May this year (13.6867 trillion won) rose 24% compared to the same period last year. Kim Sang-moon, director of the Construction Policy Bureau at the Ministry of Land, Infrastructure and Transport, said, "Public sector efforts were made to offset the contraction in private sector orders," adding, "Korea Land and Housing Corporation (LH) and Seoul Housing and Communities Corporation (SH) actively issued orders, and local governments also increased their order volumes."

LH announced that it will start early construction of 10,000 public housing units this year in five 3rd phase new towns (Hanam Gyosan, Namyangju Wangsuk, Bucheon Daejang, Goyang Changneung, and Incheon Gyeyang). The total construction volume this year is 50,000 units, and it plans to increase to 60,000 units next year and the year after. The Ministry of Land, Infrastructure and Transport also announced it will supply 120,000 rental housing units at below-market monthly rent prices over the next two years.

An official from the Ministry said, "We executed the social overhead capital (SOC) budget early in the first half of this year, and plan to bring forward next year's budget for investment in the second half."

Recovery in orders unlikely within this year

Experts predict that construction order performance is unlikely to improve dramatically within this year. A report titled "Construction Market and Issues" released by the Korea Construction Policy Research Institute on the 1st stated, "Construction orders this year will be lower than in 2021 and 2022," adding, "Since 2022, leading indicators for construction have deteriorated, and the construction environment, including real estate project financing (PF), has not improved, so the construction downturn will continue."

There is also an expectation that in the second half of this year, construction companies will focus more on selectively starting construction on already secured orders rather than acquiring new ones. Kim Seong-han, associate researcher at the Korea Construction Industry Research Institute, said, "Construction companies are not actively pursuing new orders, but the real estate market is warmer than last year," adding, "Each company likely has projects whose construction was delayed, and in the second half, they will focus on starting projects that are profitable after assessing feasibility."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)