Government Spending Expands Despite Rapid Increase in Debt and Deficit

Although regime changes occurred through general elections in the UK and France, the new governments are expected to face the barrier of massive public debt immediately upon taking office, the Wall Street Journal (WSJ) reported on the 7th (local time).

On that day, the left-wing coalition New Popular Front (NFP) emerged as the leading party in the French general election, and in the early UK general election held on the 4th, the Labour Party secured a majority with 412 seats, achieving a regime change for the first time in 14 years.

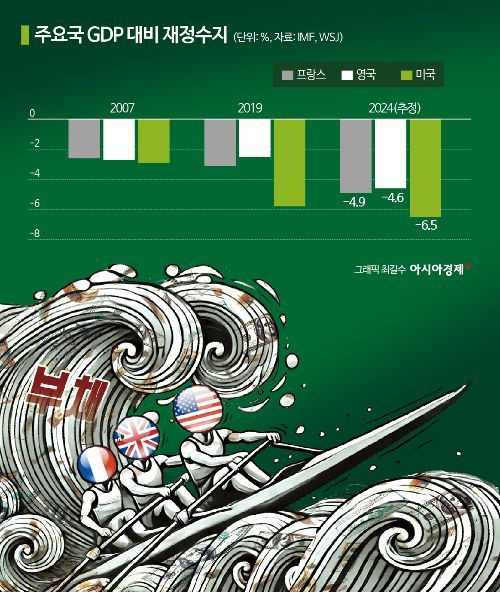

Public debt in the UK and France is assessed to be near its highest level in decades. Government spending and fiscal deficits relative to Gross Domestic Product (GDP) exceed pre-COVID-19 levels. Economists say fiscal restraint, such as spending cuts or tax increases, is necessary. However, the election pledges of political parties in these countries indicate a trend toward significantly increasing government spending.

The French NFP pledged to scrap the pension reform plan pushed through last year by President Emmanuel Macron after much difficulty and to lower the retirement age to 60. The pension reform plan involves gradually raising the retirement age from the current 62 to 64 by 2030 and increasing the contribution period required to receive 100% of the pension from the existing 42 years to 43 years. They also intend to raise the minimum wage from the current €1,398.69 per month (approximately 2.09 million KRW) to €1,600 (approximately 2.39 million KRW) and link it to inflation. The Macron government's unemployment insurance reform policy, which tightened conditions for receiving unemployment benefits, will also be abolished.

Moreover, with the formation of a 'Hung Parliament' without a majority party, analysts expressed concerns that parliamentary deadlock could delay efforts to reduce national debt.

France's public deficit this year is expected to reach about 5% of GDP. S&P downgraded France's credit rating to AA- in May.

The UK Labour Party pledged to build 1.5 million homes within five years to address the housing shortage, strengthen the National Health Service, and support clean energy. Although these pledges require significant national fiscal input, they declared there would be no tax increases on income tax, value-added tax, health insurance premiums, or corporate tax.

According to the UK Office for National Statistics, as of the end of last year, government debt stood at ?2.7 trillion (approximately 4,770 trillion KRW), equivalent to 101% of GDP, and the fiscal deficit was ?40.8 billion (approximately 7.2 trillion KRW), or 6% of GDP. The UK think tank Institute for Fiscal Studies (IFS) evaluated that the pledges were made without fiscal backing. Isabel Stockton, senior research economist at IFS, stated, "Growth is expected to be disappointing, and debt interest will remain at a high level."

UK public debt is estimated to rise from 43% of GDP in 2007 and 86% in 2019 to 104% this year. France's public debt is estimated to increase from 65% in 2007 and 97% in 2019 to 112% this year.

The WSJ assessed that the situation is even more severe in the United States, which is preparing for a presidential election in November. According to the International Monetary Fund (IMF), US public debt is expected to rise from 108% of GDP in 2019 to 123% this year. However, both President Joe Biden and former President Donald Trump show no interest in reducing the debt.

Holger Schmieding, chief economist at Berenberg, stated, "The United States has been implementing unsustainable fiscal policies longer than anyone else."

The WSJ noted that the last time public debt relative to GDP was this high was after World War II. At that time, governments reduced debt burdens through strong economic growth and cuts in military spending. For example, the UK reduced military spending from over 10% in the early 1950s to 2% currently. However, the current situation differs from the postwar period. The WSJ said, "With an aging population, public spending on healthcare and pensions is expected to increase, making it difficult to know which parts of government spending will be reduced this time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.