FSS Provides Financial Consumer Precautions on Unfair Sales Practices by Financial Companies

"Do Not Comply with Unfair Collateral, Guarantees, or Third-Party Joint Guarantee Requests"

Actively Use Interest Rate Reduction Requests and Withdrawal Rights... Refusal or Delay Constitutes 'Unfair Sales Practices'

#Mr. A visited a financial company last May to apply for a jeonse loan but was told that a credit card issuance was mandatory for the loan, so he obtained the loan from another financial company.

#B Corporation designated the scope of collateralized claims as a comprehensive collateral without justifiable reason while signing a real estate collateral contract with a financial company to receive a facility loan.

On the 8th, the Financial Supervisory Service (FSS) announced through consumer advisories on unfair business practices by financial companies that consumers can refuse to subscribe to unwanted savings/deposit accounts, insurance, credit cards, etc., when signing loan contracts. It also urged consumers not to comply with demands for unfair collateral, guarantees, or third-party joint guarantees during loan contracts.

According to the Financial Consumer Protection Act, unfair business practices include ▲forcing the conclusion of other financial product contracts related to loan contracts ▲demanding unfair collateral or guarantees related to loan contracts ▲unfairly reducing or changing linked or affiliated services ▲forcing specific loan repayment methods for the benefit of oneself or a third party, commonly known as 'kkyeokgi' (tying).

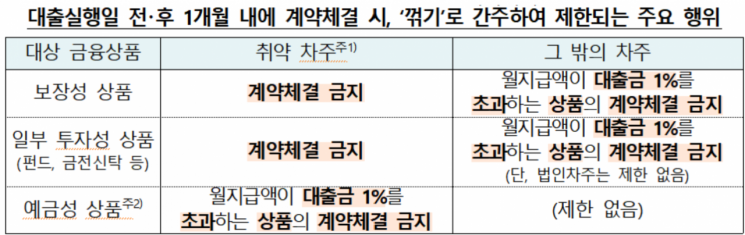

The FSS explained, "If a financial company guides that a loan is only possible upon subscribing to other financial products, suspected as ‘kkyeokgi’ behavior, consumers are advised to refuse subscription to such financial products," adding, "Entering into other financial product contracts within one month before or after the loan execution date is considered ‘kkyeokgi’ regardless of the consumer’s intention and is partially restricted."

Furthermore, financial companies cannot demand collateral or guarantees unnecessarily related to loan-type product contracts, nor can they demand more collateral or guarantees than what is customarily required for the contract. Except for legally permitted exceptions, demanding third-party joint guarantees is fundamentally prohibited.

Exceptions include cases where, for personal loans, the representative listed on the business registration certificate is the borrower, and other representatives listed on the certificate or the developer and construction company in the case of pre-sale payment loans. For corporate loans, exceptions include the corporation’s CEO, major shareholders holding more than 30% of shares, affiliated companies, corporations sharing profits from project financing (PF) businesses, and developers or construction companies in pre-sale payment loans.

The FSS urged, "If you are asked to provide unfair collateral, guarantees, or third-party joint guarantees during the loan process, do not comply as it may cause property rights infringement or other damages, and please contact the FSS."

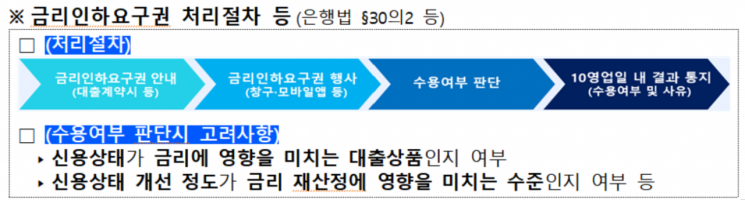

Acts such as unjustifiably refusing or delaying consumers’ requests for interest rate or insurance premium reductions and imposing disadvantages due to consumers’ withdrawal of subscription also fall under unfair business practices. Therefore, consumers are advised to actively exercise their rights to request interest rate reductions and to withdraw subscriptions.

The right to request an interest rate reduction allows financial consumers using loans, etc., to request a rate reduction from financial companies if their credit status has improved. Accordingly, financial companies regularly notify all borrowers of this right twice a year and additionally notify selected borrowers with a high likelihood of acceptance, such as those whose credit rating has improved.

The withdrawal period for subscription varies by financial product type: for insurance products, it is within 15 days from receipt of the insurance policy or 30 days from the subscription date, whichever comes first. For investment or advisory financial products, the withdrawal period is within 7 days from the date of contract document provision or contract conclusion.

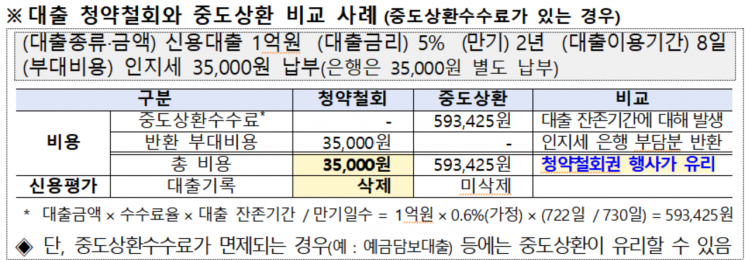

The FSS explained, "Financial consumers can request an interest rate reduction regardless of the number of applications or timing if they judge their credit status has improved," adding, "Even for high-interest credit card cash advances or revolving credit, interest rate reduction requests are possible just like loans." It further added, "For loan-type products, subscription withdrawal is generally more advantageous than early repayment as it does not incur fees, so please actively utilize this right."

Additionally, the FSS stated that early repayment fees are waived after three years from the loan date, but when refinancing, the three-year period for early repayment fee exemption may be newly calculated, so caution is required. Generally, financial companies cannot charge early repayment fees if the consumer repays the loan after three years from the loan execution date, and if the new contract is substantially the same as the existing contract, the combined duration of both contracts exceeding three years exempts the fee.

The FSS explained, "However, if the main contents of the new contract change and it is not substantially the same as the existing contract, early repayment fees may be charged if repaid within three years from the new contract date."

Meanwhile, the FSS urged consumers who have provided collateral to clearly express their intention to maintain or cancel the mortgage if the secured debt has been fully repaid. However, since cancellation costs are usually borne by the consumer who provided the collateral, it is advised to consider the possibility of obtaining a collateral loan again from the financial company before deciding whether to cancel.

The FSS stated, "We will actively respond to prevent unfair business practices that infringe on financial consumers’ rights," and added, "We will eradicate acts that hinder the exercise of financial consumer rights such as the right to request interest rate reductions and the right to withdraw subscriptions, and strengthen related consumer guidance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.