As financial authorities continue policies to ensure a smooth landing for real estate project financing (PF), analyses suggest that there is a growing concern over PF project site insolvency mainly outside the metropolitan area, necessitating careful management. This is because the contraction in housing sales demand is making it difficult to resolve unsold housing inventory.

Choi Young-sang, a research fellow at the Korea Housing Finance Corporation’s Housing Finance Research Institute, and researcher Kang Young-shin recently stated in their “Analysis of Housing Construction Market Trends” that “recent policy responses will gradually ease concerns over PF insolvency,” but also noted that “concerns over loan defaults in the PF market persist due to the accumulation of unsold housing mainly outside the metropolitan area.” They explained that due to the contraction in housing sales demand outside the metropolitan area, difficulties in resolving unsold housing inventory are expected in the future, and especially, insolvency concerns at non-metropolitan project sites are relatively higher compared to metropolitan sites, requiring efficient management.

The researchers pointed out that a notable feature in the first quarter of this year was the high proportion of unsold housing outside the metropolitan area. In particular, the volume of unsold housing in Gyeonggi, Gyeongbuk, and Jeju increased sharply from last year through the first quarter of this year. According to statistics from the Ministry of Land, Infrastructure and Transport, as of May, the nationwide unsold housing stock was 72,129 units, a 0.2% increase from the previous month (71,997 units). Starting from 63,755 units in January this year, the number has increased every month through April. Especially in Daegu, the largest number of unsold houses (9,533 units) was recorded, followed by Gyeonggi (8,876 units) and Gyeongbuk (8,244 units).

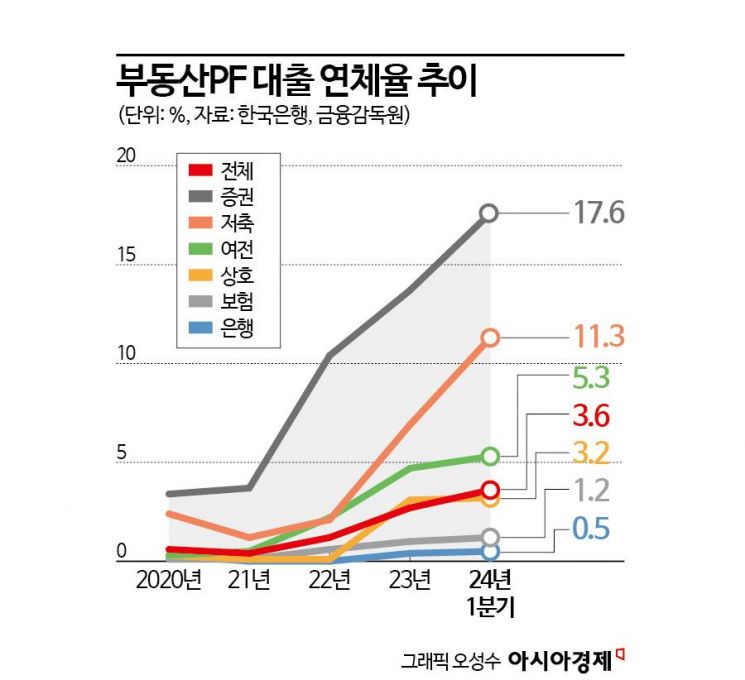

PF loan delinquency rates also showed an increasing trend, centered on securities firms, savings banks, and credit finance companies. According to Financial Services Commission statistics, the delinquency rate for real estate PF loans at the end of the first quarter this year was 3.6%, continuously rising since December 2021 (0.37%). The delinquency rate for securities firms, which had surged to 17.3% in June last year, dropped to 13.7% in December but rose again to 17.6% in March this year. Savings banks have steadily increased from 1.2% in December 2021 to 11.26% in March this year without any decline. Credit finance companies also rose from 0.47% to 5.27% during the same period. The researchers stated, “The accumulation and increase of unsold apartments are structurally linked to the risk of PF insolvency,” adding, “Due to rising construction costs and inflation, adjusting sale prices is difficult, raising concerns about an expansion of PF market insolvency in the future.” In fact, although the construction market was generally sluggish last year compared to 2022, the trend of rising construction costs continued. According to the Construction Cost Index by the Korea Institute of Civil Engineering and Building Technology, the index was 153.2 in December last year, up from 148.5 in 2022. The researchers foresee that continuous construction cost increases will persist this year due to overall domestic inflation and a global shortage of construction materials.

Regarding the public housing construction market, they expect an expansion of public housing supply in line with policies to increase housing supply, but considering the rising demand for rental housing, supply is expected to increase mainly in public rental housing. For the private housing market, they anticipate continued stagnation given the contraction in key supply indicators.

The researchers concluded, “Considering the rise in construction costs, contraction in housing sales demand, and increase in unsold housing, both public and private housing markets will contract, and a decrease in new housing supply is expected for the time being.” However, they noted that due to the large accumulated supply volume, a shortage of housing supply is unlikely to occur.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.