KB Securities, First Issuance This Year

Funding Secured for 5 Companies Including Ceragem

Hana Financial Investment Launches Successive US CLO Products

Reflecting Increased Interest in High-Interest Products

KB Securities supported five mid-sized and small companies by issuing Collateralized Loan Obligations (CLOs). Five companies, including Seragem, a mid-sized company that grew through massage devices, and Kigwang Industry, an auto parts manufacturer, raised 80.6 billion KRW through CLO issuance. As investor interest in interest-bearing products such as corporate bonds has recently increased, CLO issuances led by securities firms are expected to continue to grow.

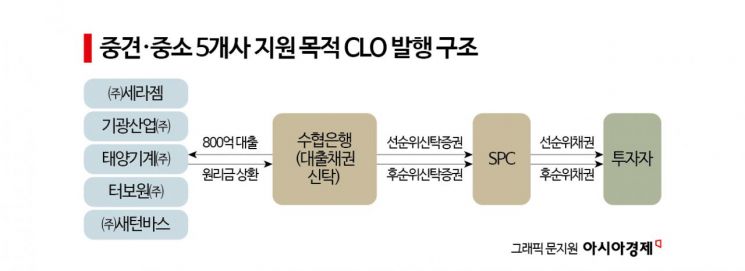

According to the investment banking (IB) industry on the 8th, KB Securities issued a total of 80.6 billion KRW in CLOs through a Special Purpose Company (SPC). The structure involves transferring loans executed to five companies to a trust at Suhyup Bank and then selling the issued trust beneficiary certificates to investors. The tranches were divided into senior bonds worth 25 billion KRW and subordinated bonds worth 55.6 billion KRW according to collateral rights and repayment priority, and sold to investors.

Korea Asset Management Corporation (KAMCO) provided a purchase commitment for the senior beneficiary certificates. This means that if the CLO bond recovery amount is insufficient to repay the principal and interest of the senior bonds, KAMCO will purchase all the senior beneficiary certificates. KAMCO guaranteed that senior investors would not incur losses.

CLOs are structured products that bundle loans executed to multiple companies and issue beneficiary certificates based on the cash flows generated from the overall loans. Companies receiving loans through CLOs usually find it difficult to issue corporate bonds due to their credit ratings and also face challenges in obtaining bank loans. By utilizing CLOs, companies can secure funds at relatively lower interest rates compared to raising funds independently. By pooling multiple loans into one beneficiary certificate, CLOs are evaluated by investors as having lower default rates and higher stability than high-yield bonds.

Through this CLO issuance, Seragem (29.7 billion KRW), Kigwang Industry (20 billion KRW), Taeyang Machinery (13 billion KRW), TurboWin (6.6 billion KRW), and Saturn Bath (11.3 billion KRW) secured funds at relatively low interest rates. These companies provided their land and real estate holdings as collateral to KB Real Estate Trust for the loans. The loan maturity is three years, with the option for early repayment starting 15 months after issuance if conditions permit.

CLO issuances led by securities firms are expected to continue increasing. Following this first CLO issuance of the year, KB Securities plans to identify companies in need of funds and execute additional structured loans. To find borrowers for corporate loans, KB Securities will also strengthen collaboration with its affiliated bank, KB Kookmin Bank, and affiliated trust company, KB Real Estate Trust.

Other securities firms are also expanding their CLO-related businesses. Korea Investment & Securities recently established a collaborative relationship with Anchorage Capital in the U.S. The New York branch of Korea Investment & Securities, ‘KIS US,’ committed to investing in Anchorage Capital’s credit fund, which invests in structured products such as CLOs. Previously, they also launched several CLO products in partnership with Carlyle Group, the world’s largest private equity firm.

An IB industry official said, "With the possibility of interest rate cuts in the U.S. emerging, institutional and individual investors are showing increased interest in credit products such as bonds," adding, "As corporate bonds remain strong, interest in CLOs is also growing alongside high-yield bonds, which have relatively higher interest rates." The official predicted, "Securities firms will introduce various CLO products that offer higher interest rates than high-quality corporate bonds while providing relatively enhanced stability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.