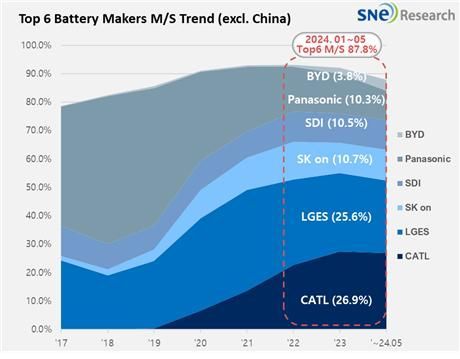

From January to May this year, global battery (for electric vehicles) usage excluding China reached approximately 130.0 GWh, showing a 13.1% growth compared to the same period last year. The market share of the three domestic battery companies was about 46%.

According to SNE Research on the 5th, in the global battery usage rankings excluding China from January to May this year, all three domestic battery companies ranked within the top 5. LG Energy Solution recorded 2nd place with a 5.9% (33.3 GWh) growth compared to the same period last year, and Samsung SDI showed the highest growth rate among the three domestic companies at 27.2% (13.7 GWh). SK On also showed growth with a 5.0% (13.9 GWh) increase. However, the market share of the three domestic companies fell by 1.4 percentage points from the same period last year to 46.8%.

Looking at battery usage according to the electric vehicle sales of the three companies, Samsung SDI saw strong sales in Europe with 'BMW i4/5·X', 'Audi Q8 e-Tron', and 'FIAT 500 electric', and in North America, the sales of 'Rivian R1T·R1S' drove high growth. Samsung SDI, targeting the premium electric vehicle battery market for both BEV (Battery Electric Vehicle) and PHEV (Plug-in Hybrid Electric Vehicle) types, newly supplied the high value-added battery P6 along with P5, and announced that from the second quarter, this will greatly help improve overall profitability in the automotive battery sector.

SK On experienced a decline in sales of Hyundai Motor Group’s Ioniq 5 and EV6 compared to the previous year, but showed growth due to steady sales of Ford F-150 and Mercedes EQA/B equipped with SK On batteries. SK On plans to convert its Georgia Plant 2 in the U.S., which is a dedicated Ford line, to a Hyundai line within this year, and to operate its Hungary Plant 3 with a capacity of 30 GWh in the second quarter, aiming for profitability turnaround in the second half of this year.

LG Energy Solution continued its growth with strong sales of local OEMs such as Ford Mustang Mach-E and GM Lyriq in North America, and Tesla Model 3/Y and Renault Megane in Europe. Recently, new models equipped with batteries produced by joint ventures between LG Energy Solution and global automakers have been launched.

Japan’s Panasonic recorded battery usage of 13.3 GWh this year, showing a 26.5% decline compared to the same period last year. The main reasons analyzed are the decrease in sales due to the partial facelift of Tesla Model 3 and the delayed launch of the Model 3 Performance trim equipped with Panasonic batteries. Currently, Tesla is highly likely to adopt Panasonic batteries for certain trims in North America to qualify for IRA tax credits, so changes in the share of battery suppliers are expected in the future. Meanwhile, in June, Panasonic announced that it lowered its forecast for North American electric vehicle penetration in 2030 from the original 50% to 30%, and plans to shift its strategy from focusing mainly on North America to a dual-region focus on North America and Japan.

China’s CATL, which is rapidly expanding its market share even in non-China markets, recorded a growth rate of 11.4% (34.9 GWh) and secured the top position. CATL’s batteries are installed in major automakers’ vehicles including Tesla Model 3/Y (Chinese-made units exported to Europe, North America, and Asia), BMW, MG, Mercedes, and Volvo.

SNE Research stated, "Compared to China, which has maintained steady high growth driven by the 'dual circulation' policy since April, the U.S. showed growth rates below expectations despite the implementation of the IRA, and Europe is facing a slowdown in electric vehicle growth due to subsidy reductions and carbon regulation relaxations." They added, "In particular, the three domestic battery companies, which have higher market shares in North America than in Europe where competition with Chinese companies is fierce, were significantly affected by the slowdown."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.