Q2 DS Operating Profit Expected at 5 Trillion Won

Thanks to Memory ASP Increase

Impact of Expanded Sales of HBM and Enterprise SSDs

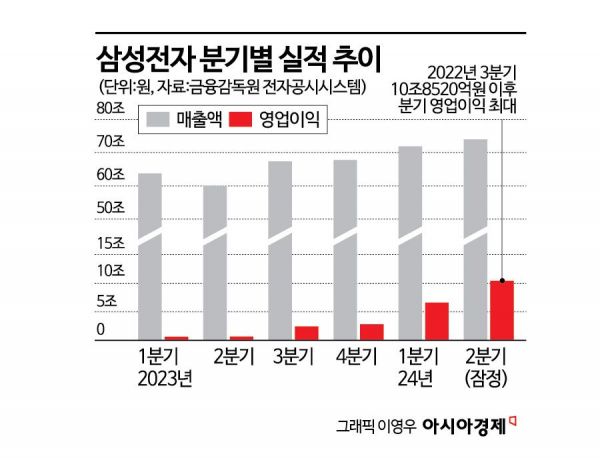

Samsung Electronics' surprise earnings, approximately 2 trillion won higher than market expectations for the second quarter of this year, are attributed primarily to the revived semiconductor market conditions. The average selling price (ASP) of memory semiconductors such as DRAM and NAND flash rose significantly, and the expansion of the artificial intelligence (AI) market increased demand for high-value-added DRAM products like high-bandwidth memory (HBM) and double data rate (DDR)5, driving the strong performance.

Initially, securities firms forecasted the Device Solutions (DS) division, responsible for the semiconductor business, to post operating profits of 4 to 5 trillion won in the second quarter. This represented a 2 to 3 times increase compared to the previous quarter (1.91 trillion won) and was more than 1000% higher than the same period last year (a 4.36 trillion won loss).

However, with Samsung Electronics' overall operating profit reaching 10.4 trillion won, the actual DS division results are expected to far exceed 5 trillion won. Typically, the DS division accounts for more than half of the company's total operating profit.

Samsung Electronics announced its preliminary results for the second quarter of this year, with sales of 74 trillion won and an operating profit of 10.4 trillion won. These earnings represent a surprise-level increase of 23.31% and 1452.24%, respectively, compared to the same period last year. Samsung Store at Gangnam Station, Seoul, on the 5th. Photo by Jo Yongjun jun21@

Samsung Electronics announced its preliminary results for the second quarter of this year, with sales of 74 trillion won and an operating profit of 10.4 trillion won. These earnings represent a surprise-level increase of 23.31% and 1452.24%, respectively, compared to the same period last year. Samsung Store at Gangnam Station, Seoul, on the 5th. Photo by Jo Yongjun jun21@

The earnings surprise is mainly due to increased shipments and price rises in the memory business unit. As the semiconductor market recovers, sales of high-value-added memory products have grown with the expansion of the AI market. Favorable exchange rates and memory semiconductor price increases exceeding market expectations appear to have offset the profitability slump in smartphones.

DRAM shipments in the second quarter rose 3-6% compared to the previous quarter, with average selling prices increasing by 13-18%. NAND shipments increased by about 1% quarter-on-quarter, but prices rose 15-20%. Particularly, demand for premium NAND products such as enterprise SSDs (eSSD) likely drove earnings growth. Samsung Electronics holds the top market share in the eSSD segment at 47.4% in the first quarter. However, the foundry and system LSI divisions are believed to have continued operating at a loss.

The Mobile Experience (MX) division, responsible for smartphones and laptops, is estimated to have posted operating profits between 2.1 trillion and 2.3 trillion won. Although this is lower than the previous quarter's 3.51 trillion won, it is considered a solid performance given the smartphone market's seasonal downturn and rising semiconductor prices. The success of the 'Galaxy S24' series, equipped with on-device AI, in the first quarter is also believed to have positively influenced second-quarter results.

Samsung Display (SDC) appears to have improved its performance compared to the first quarter, driven by increased OLED panel supply following the launch of Apple's new iPad. The market estimates operating profits around 700 billion won.

The Visual Display (VD) and Digital Appliances (DA) divisions are also expected to have earned between 500 billion and 700 billion won, benefiting from the peak air conditioner season. The Harman division, responsible for automotive electronics, is widely expected to show improved results in the second quarter compared to the first.

In the second half of this year, expectations are rising for the commercialization of HBM3E production, alongside rising prices for legacy (general-purpose) DRAM, which is expected to accelerate earnings improvement. Notably, it is anticipated that Samsung Electronics will see earnings growth after passing Nvidia's quality test for high-bandwidth memory (HBM) in the second half of the year. Samsung's third-quarter operating profit forecast stands at 12.0181 trillion won, a 393.86% increase year-on-year, with sales expected to rise 22.5% to 82.5722 trillion won. The annual operating profit estimate is 39.2 trillion won.

Dongwon Kim, a researcher at KB Securities, stated, "Considering the expansion of HBM production capacity and the transition to advanced processes, the actual DRAM production capacity will reach only about 80% of the capacity in the fourth quarter of 2022. The improvement in profitability of general-purpose DRAM is expected to lead the earnings recovery in the second half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.