Song Young-sook, Lim Ju-hyun, and Shin Dong-guk 'Tripartite Alliance'

Including Friendly Shares, Approaching 48%

Shin Dong-guk's Personal Stake Reaches 19%

Disappointment in Brothers for Failing to Solve 'Immediate Issues'

Amid Professional Management System Restructuring

Foreseeing 'Direct and Indirect Management Participation'

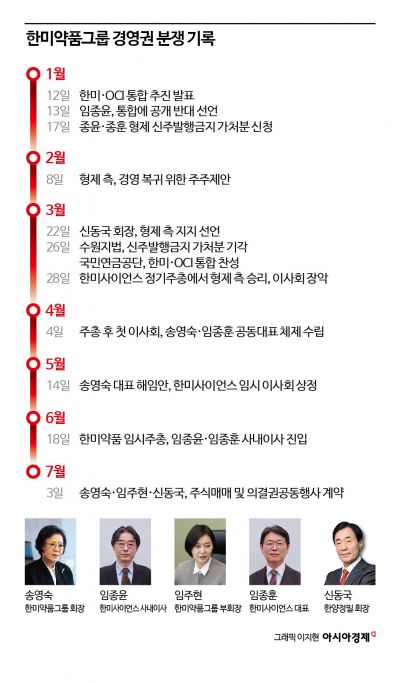

The management rights dispute within the Hanmi Pharmaceutical Group ownership has entered a new phase due to a shift in stance by Shin Dong-guk, chairman of Hanyang Precision, a 'key man' in the conflict. By forming a tripartite alliance with the mother-daughter side rather than the brothers, they have decisively reclaimed control of the group's management. Following Shin, who had held shares solely for investment purposes for 14 years, becoming the largest shareholder in name and reality and announcing his intention to directly participate in group management, attention is focused on the future direction of the group's management and the possibility of share sales.

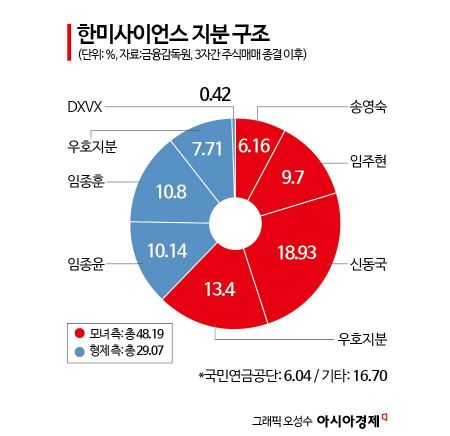

On the 3rd, Song Young-sook, chairman of Hanmi Pharmaceutical Group, Vice Chairman Lim Ju-hyun, and Chairman Shin jointly exercised their voting rights over Hanmi Science shares and signed a contract in which Shin purchased a portion (6.5%) of the shares held by Song and Lim. Song also disclosed Shin as her special related party. According to this, the total shares held by these special related parties?including Song (11.93%), Lim (10.43%) and their family relatives, Gahyeon Cultural Foundation (5.02%), Im Seong-gi Foundation (3.07%), and Shin (12.43%)?amount to 48.19%, approaching a majority of voting rights. After the actual share transaction, the shareholding ratios are expected to change to Song 6.16%, Lim 9.70%, and Shin 18.93%.

Since acquiring shares in Hanmi Science in 2010, Chairman Shin will participate directly in group management for the first time in over 14 years. Although he joined Hanmi Pharmaceutical as a non-executive director supporting the brothers, he did not take on direct management duties. Shin plans to have professional managers lead the company in principle, but intends to participate directly or indirectly in major decisions and the overall management of Hanmi Pharmaceutical Group.

Shin's decision is reportedly influenced by concerns over the lack of significant progress on pressing issues such as inheritance tax and additional funding for growth, despite the brothers having controlled the group's management for over three months. While Director Lim Jong-yoon of Hanmi Pharmaceutical and CEO Lim Jong-hoon of Hanmi Science claim to be in contact with various investors, actual funding has not materialized. Amid ongoing family conflicts, including Song's removal as co-CEO of Hanmi Science, and a continuous decline in stock prices, minority shareholders' dissatisfaction has grown. Shin's decision to join the mother-daughter side directly is seen as a move to resolve these issues more swiftly. Notably, the brothers were aware of Shin's move but reportedly misunderstood his intention as 'quickly helping resolve the mother-daughter's inheritance tax and supporting the brothers with the secured shares,' thus remaining passive.

Shin Dong-guk, Chairman of Hanyang Precision

Shin Dong-guk, Chairman of Hanyang Precision

The mother-daughter side secured funds to pay inheritance taxes through this transaction. The stock purchase price was 164.4 billion KRW, with a per-share price of 37,000 KRW. However, since this price matches the price Song intended to sell to OCI Group and considering the recent rapid decline in stock price, it is difficult to view this as a price reflecting a control premium. The mother-daughter side is expected to sufficiently cover their inheritance tax obligations with these funds.

Meanwhile, this turnaround is analyzed to have been hinted at even before the board meeting to appoint Director Lim Jong-yoon as CEO was held. Typically, companies announcing CEO appointments hold a board meeting immediately after the extraordinary general meeting to proceed with the process, but Hanmi Pharmaceutical's board has not convened even after two weeks. It is reported that the board meeting was blocked due to opposition from Park Jae-hyun, CEO of Hanmi Pharmaceutical, who is classified as part of the mother-daughter faction. With the formation of the tripartite alliance, the alliance holds a dominant 7 to 3 majority on the Hanmi Pharmaceutical board, effectively nullifying Lim's CEO appointment.

On the other hand, the holding company Hanmi Science's board is dominated by the brothers, who won at the regular shareholders' meeting in March, and they have immediately reacted with legal countermeasures. However, if the tripartite alliance holds, the three members' direct ownership amounts to 34.8%, and including friendly shares, it approaches 48.2%, close to a majority. Furthermore, if the National Pension Service (6.0%), which has consistently sided with the mother-daughter faction during the dispute, joins, the alliance would gain overwhelming superiority, making the recapture of the majority on Hanmi Science's board a matter of time.

However, whether this situation can be stably maintained remains uncertain. An investment industry insider explained, "Since Shin began investing in Hanmi Science, he has been more interested in maximizing profits through appropriate share sales rather than management participation. It will be difficult for him to continuously participate directly in management, so we need to keep an eye on when he might push for another sale." The disclosed contract also includes a tag-along clause.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.