Target Range for Overseas Stock Discretionary Management Ratio Lowered by 10%P

Poor Discretionary Management Performance, Strengthening Direct Management Capabilities

2023 National Pension Fund Return 14.14%, Highest Record Ever

The National Pension Service (NPS) has adjusted the range of its overseas stock delegated management ratio for the first time in seven years. The direction is to increase the proportion of direct management and reduce delegated management. This move is aimed at maximizing fund management returns through a 'sharp cut.'

Cho Dong-chul, President of the Korea Development Institute (Acting Chair of the Fund Management Committee, second from the left), is speaking at the Fund Committee on the 2nd.

Cho Dong-chul, President of the Korea Development Institute (Acting Chair of the Fund Management Committee, second from the left), is speaking at the Fund Committee on the 2nd. [Photo by Ministry of Health and Welfare]

At the 5th meeting of the 2024 National Pension Fund Management Committee (Fund Committee) held on the 2nd, the agenda to lower the target range of overseas stock delegated management from the existing 55-75% to 45-65% was reviewed and approved. This adjustment of the target range is the first since it was lowered by 10 percentage points from 65-85% in 2017. The NPS manages its funds through a combination of direct management and delegated management. Within the delegated management target range set by the Fund Committee, the Fund Management Headquarters determines the actual delegated management ratio.

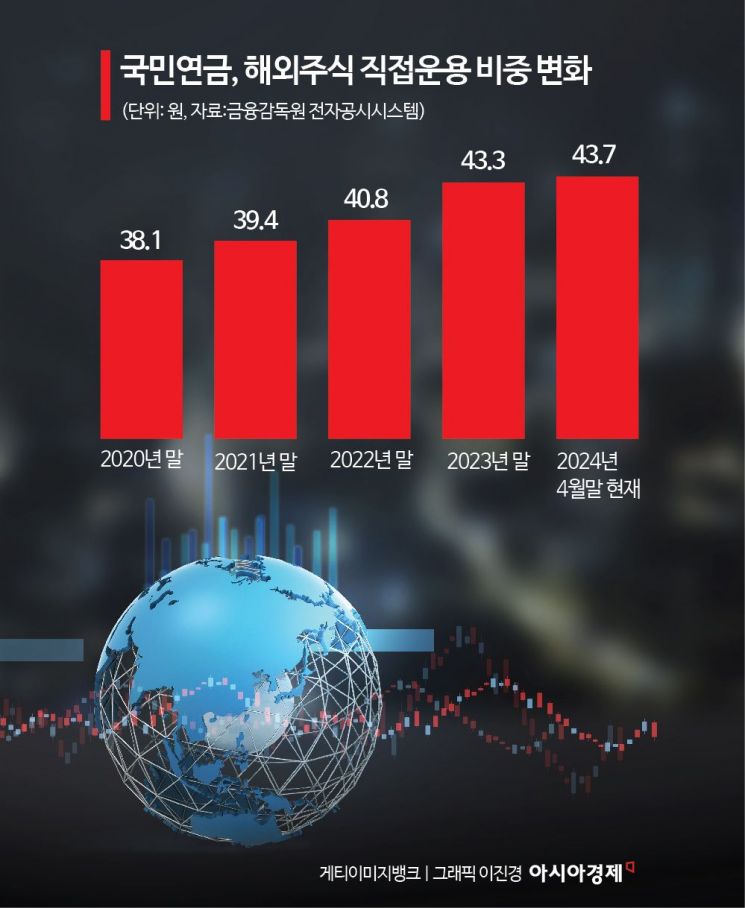

In the early days of overseas stock investment in 2002, the NPS was 100% delegated management. The delegated management ratio gradually decreased to 89.1% in 2011, 67.1% in 2016, 60.6% in 2021, and 56.7% last year. As of the end of April, the scale of NPS's overseas stock investment is 367 trillion won, with a delegated management ratio of 56.3%. This is at the lower limit (55%) of the existing target range. The proportion of overseas stock investment relative to total investment assets is 33.3%.

The main reason the NPS is reducing the delegated management ratio is that delegated management, which involves paying management fees, has underperformed compared to direct management. Additionally, the accumulation of direct management experience and strengthened capabilities is another reason for reducing the delegated management ratio. The overseas stock delegated management return rate has underperformed the benchmark for three consecutive years since 2021. It underperformed by 1.59 percentage points in 2021 and 0.61 percentage points in 2022.

In line with the expansion of the direct management ratio, detailed management strategies are also expected to change. Currently, direct management is operated 100% passively, but the range of investable stocks will be expanded to include active management. Passive management follows indices like the S&P 500 to track market returns but has limitations in generating excess returns. Active management carries relatively higher risks but aims to exceed average market returns by focusing on profitability. Previously, only delegated management was conducted actively.

Meanwhile, the NPS's 2023 return rate was finalized at 14.14% (time-weighted return). It exceeded the benchmark by 0.04 percentage points and is the highest return rate since the establishment of the Fund Management Headquarters in 1999. Returns by asset class were 22.14% for domestic stocks, 24.27% for overseas stocks, 8.08% for domestic bonds, 9.32% for overseas bonds, and 6.0% for alternative investments. The 2023 performance bonus payment rate for the NPS Fund Management Headquarters, calculated by reflecting the past three years' performance (excess returns over the benchmark) in a 5:3:2 ratio, was 39.9% (compared to base salary), down 11.2 percentage points from last year's 51.1%. Because the fund management performance bonus reflects the past three years, the bonus decreased despite achieving record-high returns.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)