Trump Approval Rating Rises, Favorable Environment Created for Defense Industry

Increase in Defense Spending Amid US-China Hegemony Conflict

Ongoing Middle East Conflicts... "K-Defense Expected to Benefit"

As global defense demand continues to rise, there are expectations that K-Defense will benefit from this trend. Following former U.S. President Donald Trump’s mention of 'defense cost-sharing' during last week’s U.S. presidential candidate debate, where he achieved a 'landslide victory' over President Joe Biden, domestic defense companies have once again come into the spotlight. The securities industry anticipates that ongoing conflicts in Europe and the Middle East will positively impact K-Defense exports.

First TV Debate Trump’s 'Landslide Victory'... "The Stage is Set for K-Defense Exports"

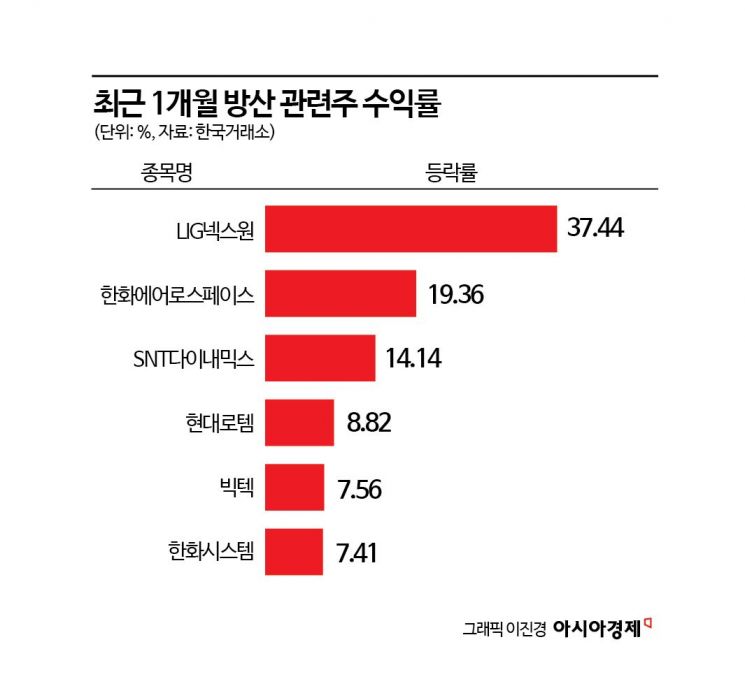

According to the Korea Exchange on the 2nd, comprehensive defense company LIG Nex1 has risen 37.44% over the past month. It surged 10.50% in just the last three trading days, hitting a 52-week high. Other defense-related stocks such as Hanwha Aerospace (19.36%), SNT Dynamics (14.14%), Hyundai Rotem (8.82%), VICTEK (7.56%), and Hanwha Systems (7.41%) also showed simultaneous upward trends.

The securities industry analyzed that the strong stock performance of domestic defense companies is influenced by the U.S. presidential election event. On the 27th of last month (local time), the first TV debate between presidential candidates was held at CNN headquarters in Atlanta, Georgia, where Republican candidate former President Trump faced off against Democratic candidate President Biden. Throughout the debate, Biden spoke with a hoarse voice, stammered, and appeared dazed. In a post-debate survey of viewers, 67% named former President Trump as the winner. Following this, U.S. media outlets reported repeatedly that "Biden’s age-related controversies have worsened significantly," evaluating the debate as a 'complete victory for Trump.'

Notably, during the debate, Trump repeatedly raised the issue of defense cost-sharing related to the North Atlantic Treaty Organization (NATO), asking, "Why do we have to pay almost 100% for NATO?" A financial investment industry official explained, "As Trump mentioned defense cost-sharing with allied countries, interest in domestic defense companies may increase," adding, "There is now a growing atmosphere where allied countries must strengthen their defense budgets independently, which could lead to increased arms imports." He continued, "In the second half of the year, global exports of K-Defense may increase further," and said, "If Korea Aerospace’s advanced trainer aircraft succeeds in exporting to the U.S., K-Defense’s influence in the global market will grow even more."

Gunfire Heard Around the World... "Buy Defense Stocks on Dips"

Experts advise that if the defense sector shows stock price volatility, it is effective to increase holdings for the time being. This is based on the judgment that the positive spillover effect for domestic defense companies may be prolonged amid the ongoing Russia-Ukraine war and U.S.-China hegemony conflict. Jin-Hyuk Kang, a researcher at Shinhan Investment Corp., noted, "Global defense spending is on a steep upward trend amid unstable international circumstances," adding, "The U.S. plans to increase its defense budget from $880 billion this year to $1.058 trillion by 2033." He also said, "Recently, the U.S. has mentioned the need for cooperation with domestic companies to strengthen naval power, citing Navy Secretary Del Toro and the Heritage Foundation," and added, "At the same time, defense demand is increasing in countries neighboring conflict zones such as the European Union (EU), and K-Defense’s export items and export countries are diversifying, so long-term growth is expected."

The continuous gunfire in the Middle East is also one of the factors increasing the likelihood of K-Defense securing orders. Hain-Hwan Ha, a researcher at KB Securities, analyzed, "The war in the Middle East has escalated in the first half of this year following last year," and said, "Ongoing conflicts provide grounds for Middle Eastern countries to continue purchasing weapons." He added, "In the case of the United Arab Emirates (UAE), they officially signed the Comprehensive Economic Partnership Agreement (CEPA) during their visit to Korea at the end of May, which includes 'immediate elimination of tariffs on weapons in the future,' so this point needs attention," and continued, "Saudi Arabia is also maintaining high defense-related fiscal spending, so there is a possibility of hearing news of orders from the Middle East again in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)