'Survey on High-Interest Burden of SMEs and Small Business Owners'

More than Half Face Management Burden Due to Prolonged High Interest Rates

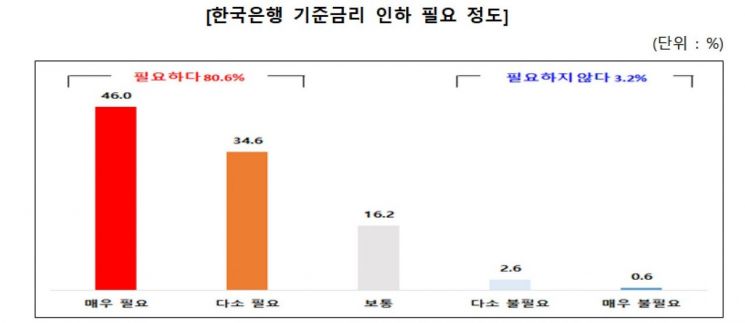

It was found that 80% of small and medium-sized enterprises (SMEs) want the Bank of Korea to lower its base interest rate.

The Korea Federation of SMEs announced the results of the "Survey on the Burden of High Interest Rates on SMEs and Small Business Owners" containing this information on the 1st. The survey was conducted from the 18th to the 27th of last month, targeting 300 small businesses and small business owners, and 200 medium-sized enterprises.

Regarding the necessity of lowering the Bank of Korea's base interest rate, 80.6% responded that it is "necessary." Among them, 46.0% said it is "very necessary." In particular, 57.0% of small businesses and small business owners responded that it is "very necessary," which is about twice as high as medium-sized enterprises (29.5%).

The reasons for needing a base rate cut (multiple responses allowed) were led by "alleviating the burden of principal and interest repayment" at 77.4%. This was followed by "achieving the target inflation rate (around 2%)" at 47.4%, "expanding investment and employment" at 40.4%, "increasing consumption capacity" at 22.6%, and "interest rate cuts by major countries" at 6.5%.

Regardless of company size, the most common outstanding loan balance was "less than 500 million KRW." For small businesses and small business owners, "less than 500 million KRW" accounted for 91.7%, making up the majority. For medium-sized enterprises, the distribution was "less than 500 million KRW" at 49.0%, "1 billion to 2.5 billion KRW" at 16.5%, "500 million to 1 billion KRW" at 12.0%, "over 10 billion KRW" at 9.5%, "5 billion to 10 billion KRW" at 7.5%, and "2.5 billion to 5 billion KRW" at 5.5%.

The average loan interest rates by funding source were surveyed as 4.6% for "first-tier financial institutions," 7.2% for "second-tier financial institutions," and 5.4% for "others."

Regarding the degree of management burden due to prolonged high interest rates, 58.2% responded that it is "burdensome," exceeding half. The response of "very burdensome" was 45.0% for small businesses and small business owners, which is about 2.5 times higher than medium-sized enterprises (17.5%). It was analyzed that the financial cost burden is relatively higher for small businesses and small business owners.

The measures to cope with the high interest burden (multiple responses allowed) were "cost reduction" at 42.4%, "unable to respond" at 30.0%, "utilizing low-interest refinancing loans" at 20.0%, "using the right to request interest rate reduction" at 11.4%, and "others" at 4.6%.

Lee Min-kyung, Head of Policy at the Korea Federation of SMEs, said, "The prolonged high interest rates are increasing the financial cost burden on SMEs and small business owners," adding, "The delinquency rate on loans for self-employed individuals increased more than threefold from 0.5% at the end of Q2 2022 to 1.52% at the end of Q1 this year. Due to the prolonged high interest rates, there is growing concern about simultaneous insolvency risks not only for our customers, SMEs and small business owners, but also for banks."

Lee also said, "In early June, the European Central Bank (ECB) and the Bank of Canada (BOC) cut their base interest rates, and the U.S. Federal Reserve (Fed) is also expected to lower the base interest rate once within this year," adding, "It is necessary for the Bank of Korea to lower its base interest rate to alleviate the financial cost burden on SMEs and small business owners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.