TrendForce, Taiwanese Market Research Firm, Forecasts

Impact of Increased Supply Rate and Weak Consumer Demand

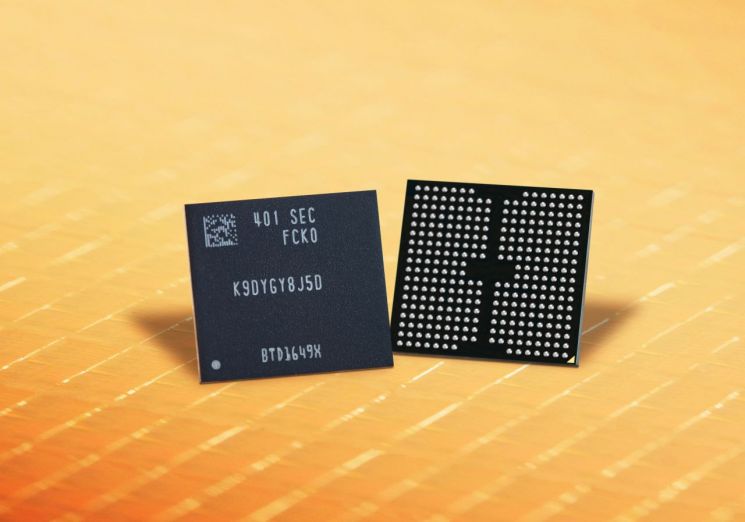

NAND flash (hereinafter NAND) prices, which showed an increase of around 20% in the first and second quarters of this year, are expected to rise by only 5?10% in the third quarter.

On the 28th, Taiwanese market research firm TrendForce predicted that while the spread of artificial intelligence (AI) is increasing demand for enterprise solid-state drives (SSDs), consumer SSDs are showing weakness, so prices are unlikely to rise sharply.

In particular, with NAND supply rates expected to increase by up to 2.3% in the third quarter and aggressive production growth, NAND prices are not expected to rise significantly. In the first half of this year, NAND prices rebounded due to manufacturers' production controls, and prices rose again as industry profitability recovered. However, currently NAND production is increasing while demand is sluggish, and some wafer prices have fallen by more than 20%, indicating that factors driving price increases are unclear.

TrendForce forecasted that consumer SSD prices will increase by 3?8% in the third quarter, while enterprise SSD prices will rise by 15?20%. For consumer SSDs, although suppliers' production capacity has improved, prices are not rising due to weak demand.

Additionally, due to the price difference between TLC products that store 3 bits of information per cell and QLC products that store 4 bits, demand has concentrated on QLC, intensifying price competition. In contrast, enterprise SSDs are experiencing increased demand due to the expansion of AI servers in companies. Large-capacity QLC enterprise SSDs are mainly supplied by Samsung Electronics and SK Hynix.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.