"Full Support for Shipbuilding through Public-Private Cooperation

Profit Expectations Rise Due to High Exchange Rates

Supplier-Dominant Price Increases Expected to Continue"

Shipbuilding, which is considered to have entered a supercycle (period of booming growth), is expected to continue its stable upward trend in the second half of the year. Securities firms anticipate that domestic shipbuilders will maintain performance improvements driven by robust orders, supported by the high exchange rate effect and public-private support.

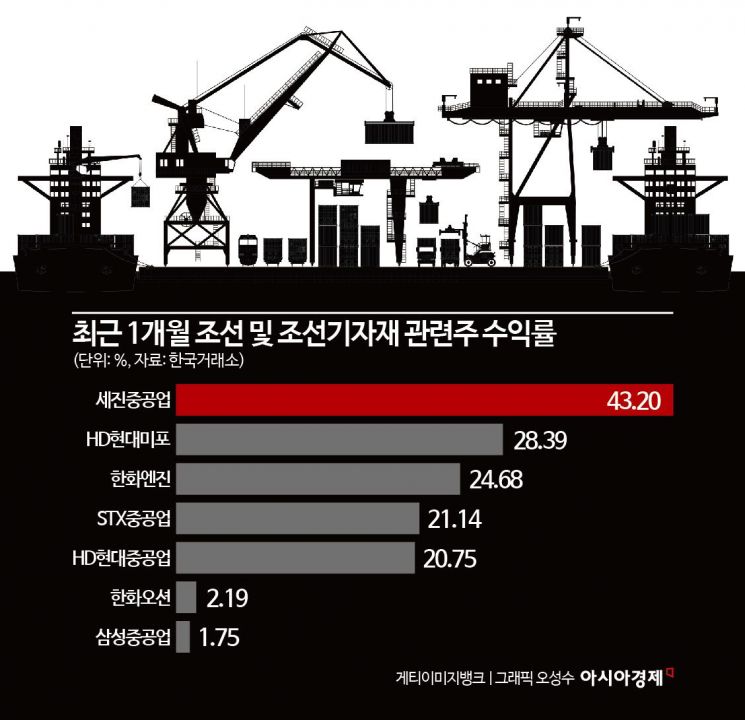

According to the Korea Exchange on the 1st, HD Hyundai Heavy Industries, a leading domestic shipbuilder, rose 20.75% last month. During the same period, related stocks such as Sejin Heavy Industries (43.20%), HD Hyundai Mipo (28.39%), Hanwha Engine (24.68%), and STX Heavy Industries (21.14%) also showed strong gains.

Experts analyzed that the recent public-private support announcements are behind this strong performance. According to the industry, last month the Ministry of Trade, Industry and Energy and banking sectors expanded financial support to help domestic shipbuilders secure global order competitiveness. For medium-sized shipbuilders, they supported the issuance of advance payment refund guarantees (RG) worth 1 trillion won, and for large shipbuilders, a total of 14 trillion won in new RG limits were granted.

An RG is a guarantee by a financial institution to refund the advance payment to the ordering party if the shipbuilder fails to build the ordered ship on time. Since ordering parties sign contracts only with shipbuilders who have secured RGs to avoid the risk of losing advance payments, shipbuilders without RGs are practically unable to secure orders.

Notably, this is the first time that commercial banks and regional banks have jointly participated in issuing RGs for medium-sized shipbuilders. Additionally, the issuance of RGs by the five major commercial banks to medium-sized shipbuilders comes 11 years after they experienced losses during the previous shipbuilding downturn.

Han Ji-young, a researcher at Kiwoom Securities, said, "The shipbuilding industry is a sector that requires government support to respond to China's low-price offensive," adding, "With the Ministry of Trade, Industry and Energy's expansion of RGs, shipbuilders can now stably establish an environment for building high-priced vessels." She further analyzed, "The shipbuilding industry aligns with the strategy to expand exports to the U.S., benefiting from the high exchange rate effect. Moreover, from the U.S. perspective, excluding China from strategic national industries like shipbuilding is a bipartisan policy, so the shipbuilding industry can receive structural benefits."

Furthermore, the 'New Ship Price Index,' which reflects the recent shipbuilding market conditions, is approaching the level of the industry's peak boom in 2008, leading to expectations of continued profitability improvements in the second half. Yoo Myung-gan, a researcher at Mirae Asset Securities, noted, "The shipbuilding industry's earnings are continuously being revised upward," pointing out, "The earnings trend is positive, similar to the strong stock performance from April to August last year driven by upward earnings revisions." He added, "In the first quarter of this year, the industry even posted an earnings surprise for the first time in nine quarters. The upcoming second-half earnings will reflect the construction volume of ships ordered at high prices, so performance exceeding market expectations can continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)