Consulting Firm AlixPartners Report

Advantages of Low Cost, Localized Factories, and Rapid New Product Development

The photo shows the Chinese BYD automobile 'Qin EV300'. This photo is provided to aid in understanding the article.

The photo shows the Chinese BYD automobile 'Qin EV300'. This photo is provided to aid in understanding the article.

Analysis suggests that Chinese-made cars will account for one-third of the global market by 2030. The main growth drivers cited are the cost advantage of producing Chinese cars and the rapid pace of new product development.

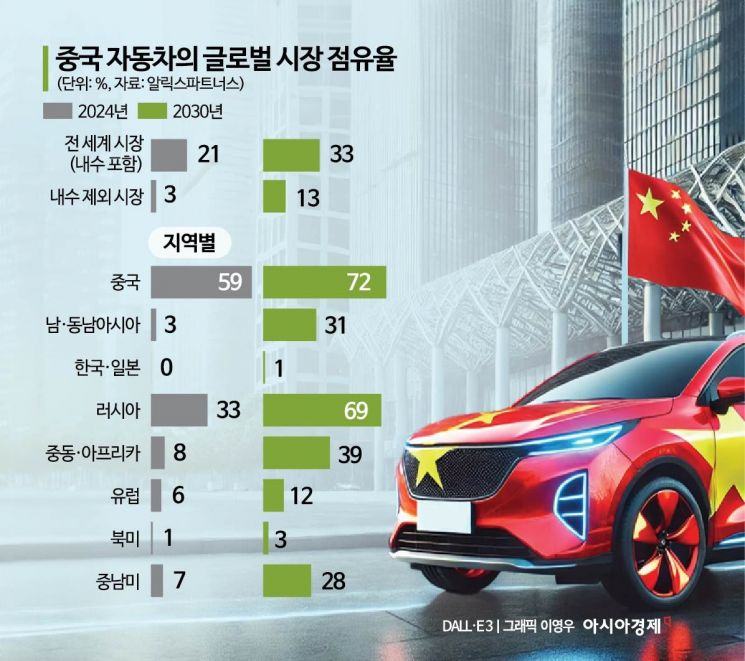

Global consulting firm AlixPartners announced in a report on the 27th (local time) that "while growth in the US and European automotive markets is slowing, China is leading short-term volume growth," and predicted that by 2030, Chinese brands will hold a 33% share of the global automotive market. This year, they expect the share to be 21%.

AlixPartners stated, "A significant portion of China's automotive growth will occur in overseas markets," forecasting that car sales outside China will triple from 3 million units this year to 9 million units by 2030. Accordingly, the market share outside China is expected to surge from 3% this year to 13%.

During this period, the market share of Chinese cars is expected to increase sharply in countries such as Russia (33%→69%), Latin America (7%→28%), the Middle East and Africa (8%→39%), and Southeast Asia (3%→31%). Even in Europe, which recently announced plans to raise tariffs on Chinese electric vehicles, market share is projected to double from 6% to 12%. However, growth is expected to be sluggish in North America, including the US?which imposed a 100% punitive tariff on Chinese electric vehicles (1%→3%)?and in the South Korean and Japanese markets (0%→1%).

AlixPartners identified production cost advantages, factory localization strategies, and designs and advanced technologies that meet consumer demands as the driving forces behind the growth of China's automotive industry. In particular, they emphasized that the development period for new cars by Chinese automakers is only half (20 months) of the traditional industry average (40 months). Chinese brand cars have an average market launch period of 1.6 years, which is 2 to 3 years faster than non-Chinese brands.

Mark Wakefield, Global Co-Head of Automotive and Industrial at AlixPartners, explained, "China has emerged as a new disruptor in the industry by accelerating new car launches and lowering purchase costs," adding, "Traditional automakers will need more than just a change in business direction to keep pace with strong Chinese brands."

Andrew Bagdaum, Co-Head, also pointed out, "Chinese brands focus on features that customers can actually experience, such as design and in-car technology," warning, "It would be a mistake to expect aging traditional automakers to continue managing their businesses under the same old principles."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)