Sales Approximately 9 Trillion KRW · Net Profit Approximately 462.9 Billion KRW

Exceeded Forecasts but... "Did Not Meet High Expectations"

'HBM Competition' Samsung and SK Earnings Also in Focus

Second Quarter Earnings Announcements Scheduled Consecutively Next Month

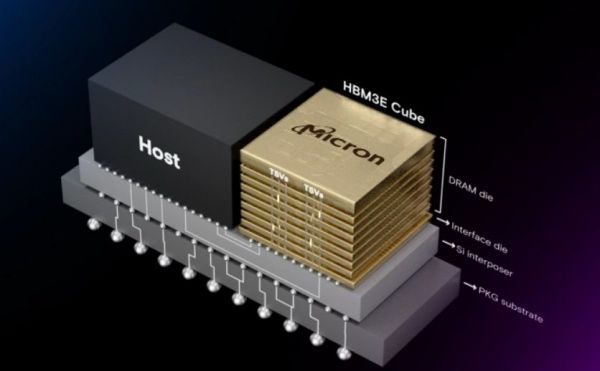

US semiconductor company Micron, which supplies high-bandwidth memory (HBM) to AI chip leader Nvidia, posted somewhat flat results for the third quarter of fiscal year 2024 (March-May), slightly exceeding market expectations, drawing attention to the upcoming earnings reports of other competitors.

On the 26th (local time), Micron announced that it recorded sales of $6.81 billion (9.4965 trillion KRW) and a net profit of $332 million (approximately 462.9 billion KRW) in the third quarter of this year. The net profit per share was $0.62. These results were slightly higher than Wall Street’s forecast of $6.67 billion in sales and $0.51 earnings per share.

Nevertheless, US media and market experts evaluated the performance as "underwhelming despite the benefits." The industry had initially expected Micron to deliver an "earnings surprise" in the third quarter, noting the expanding market size of HBM used in AI chips and the strong performance of related businesses. However, the actual results fell short of these expectations. Particularly, there is significant disappointment over Micron’s forecast that fourth-quarter sales will not greatly exceed the market’s estimate of $7.6 billion and earnings per share of $1.08. Bloomberg reported, "Some on Wall Street had expected Micron’s fourth-quarter sales to exceed $8 billion," diagnosing that "the fourth-quarter outlook failed to meet high expectations." Following the earnings announcement, Micron’s stock price fell about 5% in after-hours trading on the New York Stock Exchange, interpreted as the beginning of investor sell-off due to disappointment. Sanjay Mehrotra, Micron’s CEO, emphasized, "There is a high likelihood of price increases for AI-related products, and the data center industry has grown by 50%," adding, "All HBM has been sold through next year," attempting to manage expectations.

Following Micron’s earnings release, interest is rising in the second-quarter results to be announced by Korean competitors Samsung Electronics and SK Hynix, which also compete in HBM and other areas. Samsung Electronics is scheduled to announce its second-quarter earnings on the 5th of next month, while SK Hynix is likely to report in the last week of July. Given the high expectations confirmed for Micron’s second-quarter results, cautious speculation is emerging in the industry that Samsung Electronics and SK Hynix may face similar situations. Forecasts are already quite high. Securities firms expect Samsung Electronics’ operating profit to be between 8 trillion and 8.5 trillion KRW, based on analyses that it will benefit from rising prices of general-purpose memory such as DRAM and NAND flash, as well as increased demand for HBM.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.