Economic 3 Organizations Hold 'Corporate Value-Up Seminar'

Discuss Amendments to Commercial Act, Tax Reform, and Management Rights Defense Measures

Lee Bok-hyun: "Balanced Protection Needed for Controlling and Minority Shareholders"

The business community has strongly opposed the proposed amendments to the Commercial Act, suggested as measures to protect minority shareholders and resolve the 'Korea Discount' (undervaluation of the Korean stock market). They argued that adding 'shareholders' alongside 'the company' as subjects of Article 382-3 of the Commercial Act, which concerns the 'duty of loyalty of directors,' would make innovative management activities difficult due to excessive civil liability.

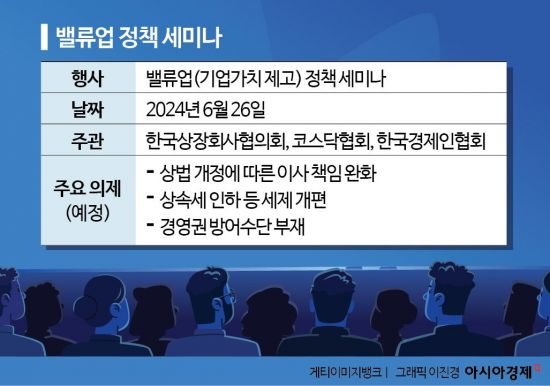

On the morning of the 26th at 10 a.m., the three major economic organizations (Korea Listed Companies Association, KOSDAQ Association, and Korea Economic Research Association) jointly held a 'Corporate Governance Improvement Seminar for Value-Up of Enterprises' at the Listed Companies Hall in Mapo-gu, Seoul. This event was organized as a countermeasure to the 'Corporate Governance for Capital Market Advancement' policy seminar jointly hosted by the Korea Capital Market Institute and the Korean Securities Association on the 12th. While the previous policy seminar focused on investors, this time the business community took the lead to share opinions on the same issues.

Professor Kwon Jae-yeol of Kyung Hee University Law School, who presented on the Commercial Act amendments, stated, "With over 14 million domestic stock investors and diverse purposes for stock ownership, it is practically impossible for directors to serve the proportional interests of all shareholders." He emphasized, "It is clear that excessive civil liability will make it difficult to expect directors to engage in innovative management activities." He also advocated for codifying the business judgment rule, introducing a director liability indemnification contract system for companies, and implementing a system allowing companies to participate in defendant-side litigation.

There were also calls for tax reform, including the high inheritance tax rate reaching up to 50%, to enhance corporate value. Professor Oh Moon-sung of Hanyang Women's University’s Department of Tax Accounting pointed out, "Among the tax items currently affecting the Korea Discount, the most powerful are inheritance and gift taxes," highlighting that "high tax rates, major shareholder surcharges, and unreasonable factors in the business succession deduction system create uncertainty in corporate succession." He also proposed expanding the scope of the business succession deduction system, deferring taxation until the disposal of inherited assets, and extending the installment payment period.

The necessity of introducing management rights defense measures was also mentioned. Attorney Kim Ji-pyeong of Kim & Chang Law Firm argued, "Fearing the abuse of management rights defense systems should not lead to outright rejection of more direct and efficient measures such as poison pills or dual-class voting rights, as this could hinder advanced corporate governance policies." He added, "Management rights defense measures should be based on judicial review of whether defense is necessary from the company's perspective."

In his congratulatory remarks, Lee Bok-hyun, Governor of the Financial Supervisory Service, said, "The Korea Discount will only be resolved when a new paradigm of corporate governance is established, ensuring balanced protection of interests between controlling shareholders and general shareholders." He also stated, "It is possible to improve systems that remove legal and institutional obstacles that have hindered predictability in corporate activities due to excessive regulations or tax burdens lacking international consistency, intertwined with the unique characteristics of Korean corporate governance, thereby actively encouraging creative and adventurous corporate activities." He added that discussions with academia, the business community, and related organizations will continue to avoid missing the golden opportunity.

Investor-side discussion panelists maintained their existing stance that discussions on amending the directors' duty of loyalty under the Commercial Act are still necessary. Professor Jung Jun-hyuk of Seoul National University Law School pointed out, "It is a clear reality that the perception widely spread among foreign and individual investors is that general shareholder protection is insufficient in Korea," and said, "Discussions on amending directors' duties are necessary to change this perception." Researcher Hwang Hyun-young of the Korea Capital Market Institute noted, "The duty of loyalty developed to regulate directors from forming conflicts of interest with the company or pursuing private interests does not mean that directors can disregard shareholders' interests during business execution." He added, "Especially in areas like mergers and acquisitions (M&A), where shareholders' interests may conflict, legislative discussions are needed to clarify directors' duties and responsibilities to protect minority shareholders."

Meanwhile, the business community and activist funds continue to debate the issue of amending the Commercial Act. Earlier, on the 24th, eight economic organizations including the Korea Economic Research Association and the Korea Chamber of Commerce and Industry submitted a joint petition opposing the amendment plan to the government and the National Assembly. The business community argued, "Current legal frameworks sufficiently protect shareholder rights, and amendments will only cause management confusion." In response, the Korea Corporate Governance Forum, composed of domestic and foreign activist funds, issued a statement on the 25th criticizing the economic organizations' joint petition opposing the Commercial Act amendment for distorting facts and legal principles. The Corporate Governance Forum rebutted, saying, "The eight economic organizations are polluting the rational discussion forum with lies and gaslighting through their joint petition," and emphasized, "The directors' duty of loyalty to shareholders is a very common-sense principle."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.