High Exchange Rates Likely to Persist for a While

More Positive with Higher Export Share

"Government Policies Encouraging Dollar Inflow Gain Momentum"

The won-dollar exchange rate is approaching 1,400 won, maintaining a high exchange rate. This is due to the weakness of major currencies such as the euro and yen, and the delayed timing of the U.S. interest rate cuts, which continue to strengthen the dollar. Accordingly, the securities industry has diagnosed that a strategy focusing on export stocks rather than domestic stocks is still valid. In addition, it was advised to pay attention to stocks related to the value-up program, judging that the attraction of foreign capital following the government's capital market opening policy will have a positive effect on defending further exchange rate increases.

Approaching 1,400 Won Again... "High Exchange Rate Likely to Persist for the Time Being"

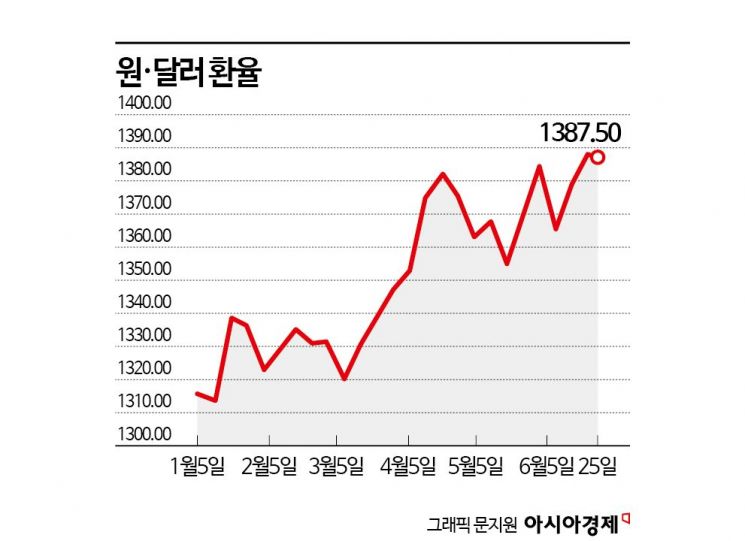

According to the financial investment industry on the 26th, the won-dollar exchange rate closed at 1,387.5 won the previous day. After briefly surging to 1,400 won for the first time in 17 months during intraday trading in April, it seemed to stabilize again, but it has risen once more in about two months, showing an upward trend.

The securities industry expects that this rise in the won-dollar exchange rate may continue for the time being due to the strong dollar. Hee-jin Kwon, a researcher at KB Securities, explained, "Usually, when the strong dollar persists, there are remarks that U.S. companies do not welcome it, but currently, the strong dollar actually helps stabilize prices in the U.S.," adding, "There is little incentive in the U.S. to actively resolve discomfort about the strong dollar." Furthermore, she said, "Major currencies other than the dollar, such as the euro and yen, seem to have limited capacity to curb the strong dollar trend," and "It is highly likely that the strong dollar trend will continue, and there will be a need to adapt to the elevated won-dollar exchange rate level."

Focus on Export Ratio... "Value-Up Could Become Stronger"

Experts advise that a strategy focusing portfolios on companies with export growth momentum remains valid as the won-dollar exchange rate continues to exceed historical averages. Jae-eun Kim, a researcher at NH Investment & Securities, said, "The profit growth of the KOSPI will be led by export stocks," adding, "When the won-dollar exchange rate rises, it is positive if the proportion of exports in total sales is high and the proportion of imported raw materials is low." He continued, "The macro environment, including exchange rates and oil prices, is similar to the last quarter," and analyzed, "Assuming exchange rates and oil prices rise by a certain percentage, sectors such as electronics, automobiles, and machinery and equipment are expected to benefit, while chemicals and utilities may see deteriorating performance."

Some analyses suggest that when the won-dollar exchange rate rises, not only export companies but also companies related to the value-up program could benefit. In-hwan Ha, a researcher at KB Securities, said, "Opportunities can be found not only in companies earning dollars but also in stocks related to the value-up program, which is a policy to bring in dollars," explaining, "Considering the impact of exchange rate increases on the Korean economy, a weak won can raise import prices, burdening the economy. The government's policy to solve this problem is the value-up program." He added, "The value-up program aligns with the government's capital market opening policy through the advancement of the foreign exchange market," and "It aims to attract foreign capital to defend against exchange rate increases." He further noted, "The rise in the exchange rate will strengthen the government's determination to promote the value-up program."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)