660,000 Active Users Last Month... Monthly Net Increase Trend

From 2,000-Won Ultra-Low-Priced Clothes to Electronics and Furniture

Fashion Industry "Watching Closely... Doubtful If It Will Satisfy Consumers"

The online fashion platform Shein has officially announced its entry into the Korean market. With its ultra-low prices and a wide variety of clothing, domestic consumers are expanding their purchasing experiences. The domestic fashion industry collectively agrees that considering the characteristics of Korean consumers who value quality, Shein's attack on the domestic market is not seen as a significant threat.

"Shall I try Shein once?"... Shein targets Korean consumers

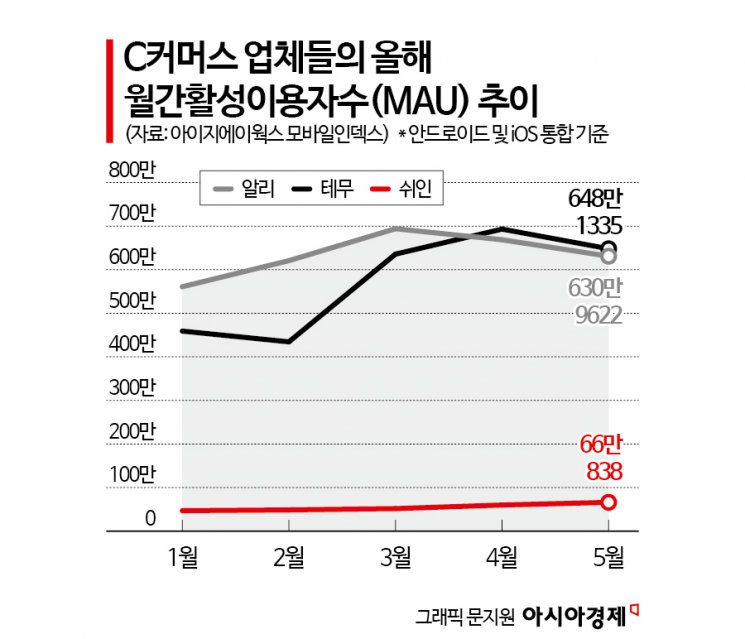

According to Mobile Index, a data analysis solution by IGAWorks, Shein's monthly active users (MAU, combined Android and iOS) reached 660,000 last month. This is a 10.3% increase compared to the previous month (599,000). Compared to January this year (469,000), the number of users has increased by nearly 41%. The number of new app installations for Shein is also showing an upward trend.

This contrasts with other C-commerce platforms like Ali and Temu, which have experienced a decline in user numbers. During the same period, Ali's MAU dropped 5.6% from 6,687,000 to 6,310,000, and Temu's users decreased 6.5% from 6,932,000 to 6,481,300. These companies have aggressively targeted the domestic market since their entry by offering ultra-low prices, large-scale discount events, and advertising, showing rapid annual user growth.

Shein is a Chinese online fashion platform. It operates shopping malls under brands such as Shein, Daisy, and Onestar. Recently, it has expanded its product range to include furniture, electronics, and automotive supplies in addition to clothing and accessories. Shein's biggest feature is that customers can purchase a wide variety of trendy clothes at affordable prices. The prices of clothes sold through the app or website start from 2,000 KRW. Shipping is done from China. When a consumer orders clothes, garments produced in Chinese factories are sent, with delivery taking 10-14 days for free shipping or 5-7 days for express shipping (3,000 KRW).

Shein is strengthening its marketing efforts to increase Korean consumers. In April, it launched a Korea-dedicated website and is currently running marketing campaigns such as offering discount coupons. Selecting actress Kim Yoo-jung as a global ambassador and showcasing outfits personally coordinated by her is also part of the strategy to target domestic consumers. Marketing manager Bonnie Liu said, "We will continue to provide high-quality products with great cost-effectiveness to meet the fashion and lifestyle needs of Korean customers."

Shein has expanded to over 150 countries including the United States and Europe. Its global monthly active users reach approximately 300 million, and in the North American market, its sales surpass SPA (Specialty retailer of Private label Apparel) brands like Zara and H&M. Shein holds a market share of around 50% in the U.S. fast fashion market. It is reported that Shein's global revenue last year was $45 billion, nearly doubling from $22.7 billion the previous year. Currently, Shein is headquartered in Singapore, having relocated in 2021 to avoid Chinese government restrictions on U.S. IPOs. The founder, Chris Xu (Xiangten), a former system developer, is known to hold a 37% stake.

Fashion Industry: "Watching Closely but Not a Major Threat"

According to reports from the fashion industry, the companies expected to be threatened by Shein's emergence are individual shopping malls that purchase clothes from Dongdaemun and resell them. Domestic fashion platforms that gather individual sellers are also presumed to be within Shein's influence. Some clothes sold in domestic malls are produced in Chinese factories and then sold to individual sellers in Dongdaemun, but in terms of price, Shein has overwhelming competitiveness. If the number of shopping mall users decreases, the sales and users of fashion platforms will naturally decline as well.

However, fashion platform companies are cautiously monitoring Shein's moves but believe it does not pose a significant threat. Domestic fashion platforms offer personalized recommendation services and understand Korean consumers' tastes best, so consumer churn is unlikely to happen easily. A representative from a fashion platform company said, "The fashion sector involves many exchanges and returns, and it is questionable whether Chinese companies can satisfy Korean consumers' satisfaction. Important aspects in fashion are emotional appeal, convenience, and recommendation services, none of which Shein has demonstrated so far."

SPA brands selling affordable clothes share the same view. A representative from a domestic SPA brand explained, "Domestic SPA brands focus on offering high-quality clothes at low prices through material development. Since they do not simply sell cheap clothes, they are outside Shein's influence."

Threatening if Global Brands Enter

However, there is an opinion that if Shein grows into a global shopping mall by onboarding domestic and global brands, it could pose a significant threat to the domestic fashion industry. It is analyzed that consumers might shift from platforms they previously used if Shein hosts domestic brands aiming to expand overseas and sells products from global brands. A fashion industry insider said, "Shein is likely to target the global market by incorporating Korean content rather than merely aiming to attract Korean consumers. Its capital scale is much larger than domestic platform companies, so in the long term, it could become the most formidable competitor."

Meanwhile, Shein's user numbers are still minimal compared to major domestic fashion specialty malls (vertical commerce). Last month, Musinsa's MAU was about 5.24 million, roughly eight times more than Shein's 660,000. Other fashion specialty malls like Ably (4.89 million) and Zigzag (2.94 million) also showed a significant gap compared to Shein.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.