PF Syndicated Loan Business Agreement for Banking and Insurance Sectors on the 20th

Beginning of Sorting the 230 Trillion Won Real Estate PF

The 'sorting out' process for the restructuring of real estate project financing (PF) worth a total of 230 trillion won has begun. Ten banks and insurance companies will jointly provide loans of up to 5 trillion won for the restructuring of real estate PF. The minimum loan amount is set at 30 billion won.

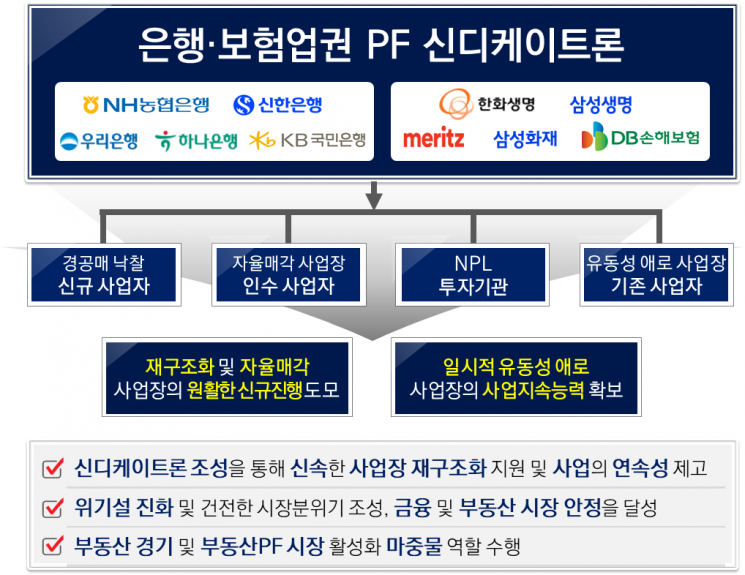

According to the Financial Services Commission and the Financial Supervisory Service on the 20th, five banks including KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup, and five insurance companies including Samsung, Hanwha Life, Meritz, Samsung, and DB Insurance signed a business agreement this morning at the Bankers' Hall to establish the 'Bank and Insurance Industry PF Syndicated Loan.' This is a follow-up measure to the 'Future Policy Direction for the Orderly Soft Landing of Real Estate PF' announced by the financial authorities on the 14th of last month.

The syndicated loan (joint loan) is a loan jointly established by banks and insurance companies to lend funds for purchasing PF auctioned or foreclosed properties. Banks will provide 80%, and the insurance sector will provide 20%. The minimum loan size for this joint loan, which ranges from a minimum of 1 trillion won to a maximum of 5 trillion won, is limited to 30 billion won. Regarding this, a financial authority official explained, "Small-scale loans are handled by individual financial companies, and large-scale loans are efficiently handled jointly by 10 financial companies. However, the lead arranger can adjust the minimum loan size considering borrower requirements, so specific details need to be discussed with the lead arranger."

The participating financial companies will first establish a syndicated loan of 1 trillion won to reinforce private demand and plan to gradually expand the scale up to a maximum of 5 trillion won if necessary, considering the loan status and market conditions. The target projects for loans will be real estate PF projects that have secured a certain level of feasibility and have no legal risks or disputes among major creditors. The target borrowers will be those capable of promptly carrying out the respective projects.

This syndicated loan is divided into four types according to borrower type and fund usage: ▲'Auction Fund Loan' supporting new developers who wish to proceed with new real estate PF projects by winning auctioned or foreclosed properties ▲'Voluntary Sale Project Acquisition Fund Loan' lending to borrowers who acquire project sites through private contracts by purchasing ownership or permits ▲'NPL Investment Institution Loan' providing funds needed by financial institutions or NPL funds during the discounted purchase of non-performing loans (NPLs) on real estate PF projects ▲'Temporary Liquidity Difficulty Project Loan' lending to projects that are progressing normally but experiencing liquidity difficulties such as construction cost shortages.

Developers wishing to apply for the syndicated loan can choose one of the five major banks to consult about the loan. The selected bank will provide guidance on loan availability considering the developer’s business plan and specific conditions. According to the financial authorities, it is expected to take about 30 days from application to execution.

Kim So-young, Vice Chairman of the Financial Services Commission, said, "The bank and insurance industry PF syndicated loan is expected to expand the purchasing power of participants in the auction and foreclosure market due to relatively low interest rates and the ease of converting bridge loans to main PF loans," and urged participating financial companies to "execute funds without delay to serve as a catalyst for the normalization of PF projects."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.