KB Management Research Institute 'Commercial Real Estate Market in the First Half of the Year' Report

Seoul Office Average Vacancy Rate at 2.88%, Much Lower Than Before

Office Market Shows Investment Recovery Trend

Logistics Warehouses That Caused PF Crisis to See Supply Decrease Starting This Year

Supply and Demand Expected to Stabilize

Small Retail Vacancy Rate Worsens Compared to COVID-19 Pandemic Period

On the 28th, with clear weather, the high-rise buildings and sky viewed from Yeouido, Seoul, look as beautiful as a watercolor painting. Photo by Jo Yongjun jun21@

On the 28th, with clear weather, the high-rise buildings and sky viewed from Yeouido, Seoul, look as beautiful as a watercolor painting. Photo by Jo Yongjun jun21@

The sales of Seoul office buildings, considered prime assets during economic downturns, are reviving. Vacancy rates are falling, and rents are rising. On the 20th, the KB Management Research Institute released the "First Half Commercial Real Estate Market" report, which analyzed that the Seoul office investment market is recovering based on the GenstarMate office index.

Office Vacancy Rate 2.88%

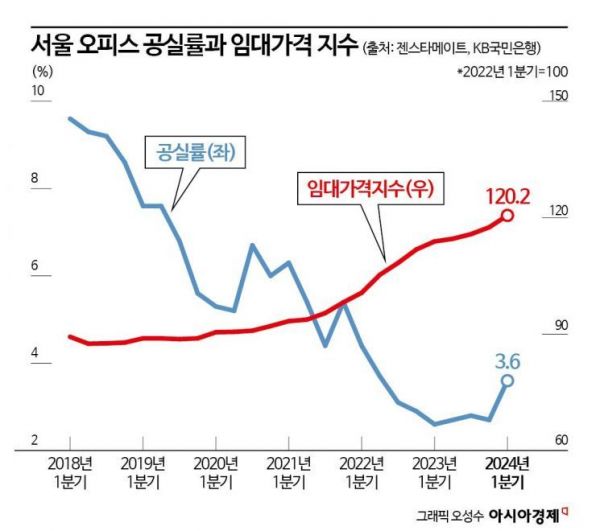

According to the report, the average vacancy rate for Seoul offices over the past year (Q1 2023 to Q1 2024) was recorded at 2.88%, significantly lower than the five-year average (Q1 2019 to Q1 2024) of 4.81%.

Kim Taehwan, a research fellow at KB Management Research Institute, explained, "Currently, office demand is high, and institutional investors tend to view offices as safe assets during economic downturns. When properties come onto the market, transactions happen quickly and smoothly." Accordingly, office rental prices have surged. The Seoul office rental price index surveyed by KB Real Estate rose 20% from 100 in Q1 2022 to 120.2 in Q1 2024.

As conditions in the Seoul office market improve, the total transaction amount has also increased. Researcher Kim said, "Due to prolonged high interest rates, the total transaction amount fell to 20.6 trillion won in Q4 last year but rebounded to 24 trillion won in Q1 this year," adding, "Consequently, the sales price index also rose 3.4% compared to the same period last year."

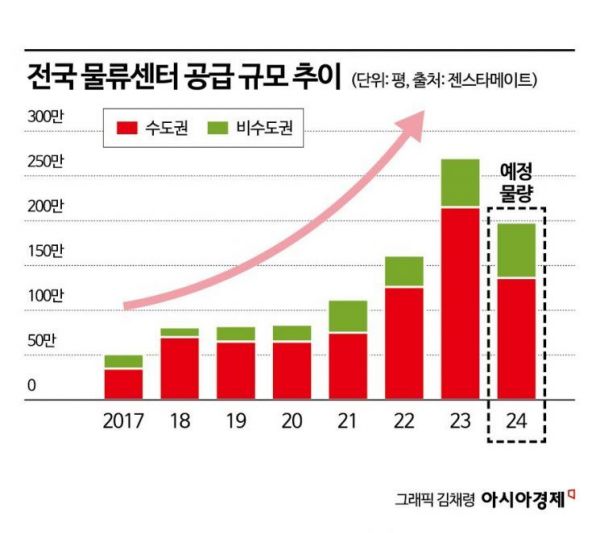

The KB Management Research Institute report predicted, "Logistics warehouses, which caused a real estate project financing (PF) crisis due to oversupply, are expected to see reduced supply starting this year."

Oversupply of Logistics Warehouses Eases Starting This Year

According to GenstarMate data, logistics warehouse supply expanded to 2.7 million pyeong last year (2.15 million pyeong in the metropolitan area and 550,000 pyeong outside the metropolitan area). The sharp increase in supply began in 2021. Until 2020, supply was only 840,000 pyeong, but it rose to 1.12 million pyeong in 2021 and 1.61 million pyeong in 2022. As logistics warehouses suddenly flooded the market, vacancy rates also surged. The vacancy rate of Grade A logistics centers rose from 1% in 2021 to 10% in 2020 and 19% last year.

The report stated, "As the logistics warehouse market deteriorates and interest rates and construction costs rise, real estate PF defaults have increased, leading to more logistics warehouses not starting construction. From this year, the rate of supply reduction will accelerate, stabilizing supply and demand." It added, "However, while ambient temperature logistics centers had an 11% vacancy rate last year, cold storage warehouses, which saw vacancy rates rise to 42%, are expected to continue facing vacancy risks."

Small Retail Stores Struggling More Than During the COVID-19 Pandemic

The small retail sector is in a difficult situation. According to the Korea Real Estate Board index, the vacancy rate for small retail stores (mainly retail stores, two floors or less, total floor area under 330㎡) has risen higher than during the COVID-19 pandemic. The data compiled by the Korea Real Estate Board shows that as of Q1 this year, the vacancy rate was 7.3%, higher than the 5.6% during the pandemic period (Q1 2020).

The report analyzed, "After the pandemic, retail sales indices centered on department stores and non-store retail businesses have shown recovery, but large supermarkets, supermarkets, convenience stores, and specialty retailers have declined this year, intensifying polarization among industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)