Korea·KB Securities Lead Capital Asset Securitization

Transfer Over 9.4% of Total Operating Assets

'Rising Delinquency and Non-Performing Assets' to Secure Liquidity

Korea Capital, a capital company affiliated with the Military Mutual Aid Association, has secured cash by securitizing assets worth around 300 billion KRW. This move is interpreted as a preemptive measure to secure liquidity amid rising delinquency rates and increasing non-performing assets due to project financing (PF) defaults. The company explained that the strategy is to raise funds at relatively low interest rates to expand its operating assets.

According to the investment banking (IB) industry on the 19th, Korea Capital, with Korea Investment & Securities and KB Securities as lead managers, securitized financial assets worth 325 billion KRW into cash. Korea Capital transferred the assets to a trust account at Woori Bank, which then issued trust beneficiary certificates as collateral to issue bonds.

The assets sold by Korea Capital consist of auto-secured loans, industrial and medical equipment leases, and installment financing. The total number of assets sold is 9,970, with an average asset value of about 32.6 million KRW per case. As of the end of Q1 this year, Korea Capital’s operating assets amounted to 3.457 trillion KRW, meaning it securitized 9.4% of its total operating assets at once.

Although a large volume of assets was transferred, they were not completely sold off. When the financial assets transferred to the trust are recovered, priority repayment is made to holders of senior beneficiary certificates (Type 1 beneficiary certificates) within a limit of 200 billion KRW, and any recovery amount exceeding 200 billion KRW is taken by Korea Capital, which holds the subordinated beneficiary certificates (Type 2 beneficiary certificates).

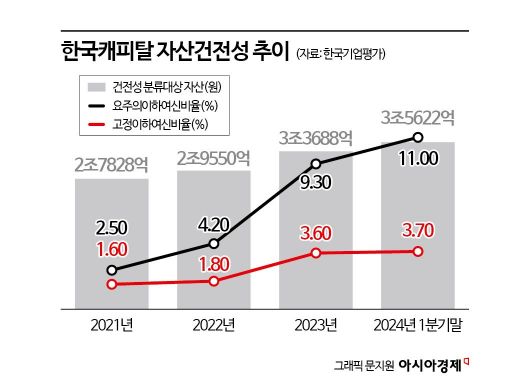

Industry insiders view Korea Capital’s large-scale asset securitization and cash securing as a preparation against expanding defaults. This is because the burden of securing funds is increasing due to rising delinquency rates caused by interest rate hikes and PF defaults, along with an increase in watchlist loans (delinquent for 1 to less than 3 months) and non-performing loans (delinquent for 3 months or more).

According to Korea Ratings, as of the end of Q1 this year, Korea Capital’s PF-related assets amounted to 879.6 billion KRW, accounting for 23% of total operating assets. Among these, the ratio of watchlist and below loans (watchlist, substandard, doubtful, estimated loss) delinquent for over one month is 24.9%, and non-performing loans (substandard, doubtful, estimated loss) account for 5.7% of total PF assets.

An IB industry official said, "Watchlist assets increased sharply in Q1," adding, "Since March, PF delinquencies have increased, and the proportion of non-performing assets with longer delinquency periods is expected to rise." A Korea Capital official explained, "The increase in watchlist loans is due to strengthened classification criteria."

The high proportion of mezzanine and subordinated loans, which are lower in repayment priority among PF loans, is also a concern. In particular, about 65% of the 339 billion KRW bridge loans (pre-construction initial business cost loans), which have a high possibility of default, are mezzanine and subordinated loans, making recovery less likely.

An IB industry insider said, "As restructuring of PF projects accelerates, Korea Capital’s asset soundness is deteriorating, and liquidity burdens are likely to increase," adding, "It appears they are securitizing capital assets rather than PF assets to prepare for an expansion of defaults."

A Korea Capital official said, "This asset securitization is to raise a large amount of funds at low interest rates, unrelated to PF defaults," and added, "We plan to use these funds to strengthen the stability and operational capacity of capital business outside of PF."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)