High Refunds Included in Guaranteed Insurance

Combines Both Protection and Savings Functions

"Advantageous for Insurers to Secure CSM"

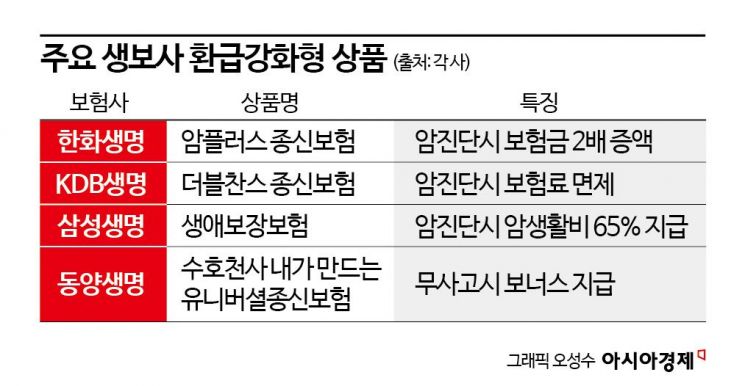

Life insurance companies are releasing a series of 'enhanced refund-type' products as the popularity of short-term payment whole life insurance wanes. These products combine high refund amounts with whole life insurance, offering both protection and savings functions. Attempts to compensate for the lowered refund rates by increasing benefits?such as adding cancer coverage or strengthening lifetime protection in addition to the death benefit guaranteed by whole life insurance?are also ongoing.

According to the insurance industry on the 18th, Hanwha Life launched the 'Cancer Plus Whole Life Insurance' this month, which combines cancer coverage with whole life insurance. When a customer is diagnosed with cancer, the death benefit is doubled, the remaining premium burden is waived, and the premiums paid so far are refunded as cancer diagnosis funds.

The death benefit of this product increases over time. For example, assume a 40-year-old male subscribes to a 25 million KRW death benefit whole life insurance with a 10-year payment term. The death benefit increases by 20% (5 million KRW) annually for five years starting from the 2-year mark, reaching up to 50 million KRW. If diagnosed with cancer, the death benefit at that time doubles, increasing up to 100 million KRW. Adding the increased death benefit of 23 million KRW paid for long-term policy maintenance, the maximum death benefit grows more than fourfold from the initial amount to 123 million KRW.

KDB Life introduced the 'Double Chance Whole Life Insurance' earlier this month. It is a short-term payment whole life insurance where premiums are paid for 5 or 7 years, and if the contract is canceled at the 10-year mark, about 120% of the paid premiums are refunded. If diagnosed with cancer or assessed to have a disability of 50% or more due to injury or illness, all premiums are refunded. In this case, the policyholder is exempted from future premium payments, and the contract remains valid. Although it appears to be a protection insurance, depending on cancer diagnosis and other factors, it effectively becomes a savings insurance product.

Samsung Life’s 'Lifetime Protection Insurance,' launched earlier this year, is also an enhanced refund-type product. It adds whole life insurance functions to cancer insurance. If diagnosed with cancer during the premium payment period, the premiums paid are refunded and future payments are waived. If diagnosed after completing premium payments, 50% of the paid premiums are refunded, and up to 65% of the premiums are paid as cancer living expenses. It also offers a surrender refund rate of 100-110% depending on the contract maintenance period, including death benefits, thus having the characteristics of short-term payment whole life insurance.

Dongyang Life’s '(Non-Participating) Guardian Angel Universal Whole Life Insurance,' launched last month, strengthens refund functions under the name of 'bonus.' From 10 years after the contract date until the policyholder reaches 60 years old, an annual maintenance bonus is paid. There is also a premium payment bonus benefit that pays a bonus based on the accumulated basic premiums over the previous five years at the 5- and 10-year marks. Additionally, if the policyholder does not contract cancer, cerebrovascular disease, or ischemic heart disease until the premium payment completion, a no-accident bonus is added to the main contract reserve.

Insurance companies are focusing on these products as a strategy to quickly secure insurance contract margins (CSM) favorable to their performance amid declining popularity of short-term payment whole life insurance due to financial authorities’ refund rate regulations and the potential abolition of tax benefits. They are also absorbing customer demand for preserving principal even with high premiums. Lim Hee-yeon, senior researcher at Shinhan Investment Corp., said, "Existing principal-guaranteed enhanced refund products were mainly sold through bancassurance channels, but recently they are actively handled by insurance planners (FPs) and general agencies (GAs) as well," adding, "They will become a new trend as life insurers’ unique products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)