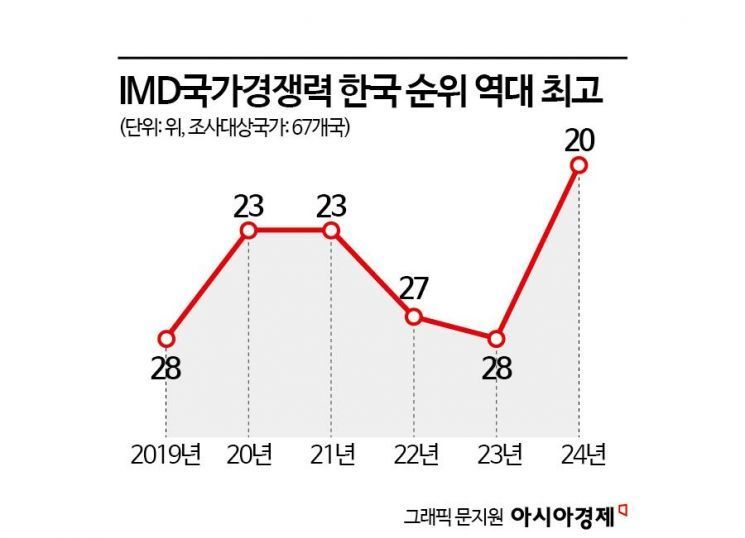

South Korea ranked 20th in the National Competitiveness Index by the International Institute for Management Development (IMD) in Switzerland, rising 8 places from last year. This is the highest ranking ever since South Korea was included in the survey. The significant rise in corporate efficiency and infrastructure rankings primarily drove the overall improvement.

According to the Ministry of Economy and Finance on the 18th, South Korea was ranked 20th in the IMD National Competitiveness Index evaluation. The survey covered a total of 67 countries, including members of the Organisation for Economic Co-operation and Development (OECD). IMD evaluates and ranks countries based on four areas: economic performance, government efficiency, business efficiency, and infrastructure.

South Korea’s national competitiveness index ranked 23rd in both 2020 and 2021, then dropped to 27th in 2022 and 28th last year. Last year, the fiscal sector’s ranking fell sharply from 32nd to 40th, pulling down the overall ranking. This was due to expanded fiscal spending leading to fiscal deficits since 2020, which caused key indicators such as fiscal balance relative to gross domestic product (GDP) to decline across the board.

This year, among the seven countries in the "30·50 Club"?those with a per capita income of over $30,000 and a population exceeding 50 million?South Korea ranked second, behind only the United States (12th). It surpassed Germany (24th), the United Kingdom (28th), France (31st), Japan (38th), and Italy (42nd). Among 30 countries with populations over 20 million, South Korea ranked 7th.

In particular, the business efficiency sector jumped 10 places, leading the overall ranking improvement. Specifically, productivity and efficiency rose 8 places (41st → 33rd), labor market 8 places (39th → 31st), finance 7 places (36th → 29th), management practices 7 places (35th → 28th), and attitudes and values 7 places (18th → 11th). All five subcategories showed significant gains. Among detailed indicators, overall productivity growth (28th → 15th), talent attraction (14th → 6th), corporate agility (28th → 9th), and citizens’ flexibility and adaptability (30th → 14th) saw substantial rank increases.

An official from the Ministry of Economy and Finance explained, “The rise in survey rankings related to business efficiency indicators drove the overall ranking improvement,” adding, “Overall productivity increased and the use of digital technology expanded.” The official also noted, “In the labor market, motivation to work and talent attraction improved.” The competitiveness ranking reflects responses from global business leaders to online surveys conducted by IMD and partner institutions in each country. The stock market ranking improved because business leaders responded positively to questions about whether companies can sufficiently raise funds through the stock market.

The infrastructure sector also rose 5 places. Basic infrastructure, which reflects the level of fundamental infrastructure such as roads and railways, jumped 9 places (23rd → 14th), and technological infrastructure rose 7 places (23rd → 16th). Notably, scientific infrastructure rose 1 place to rank first this year. Scientific infrastructure includes indicators such as research and development personnel per capita (1st → 1st). Education improved 7 places (26th → 19th). Among detailed indicators, distribution infrastructure efficiency (8th → 3rd), availability of excellent engineers (47th → 29th), and university education index (22nd → 12th) all saw significant rank increases.

However, the economic performance sector fell 2 places. Weaknesses in international trade (42nd → 47th) and international investment (32nd → 35th) caused the ranking to drop to 16th from 14th last year. The Ministry of Economy and Finance explained that the decline was due to a drop in the ranking on a survey question about the impact of corporate relocation on the future economy of the country. Particularly, the growth rate ranking fell 10 places (44th → 34th). Among international trade sub-indicators, the overall trade balance ranking improved (54th → 49th), but the private services balance ranking dropped sharply (38th → 62nd). The decline in private services ranking was influenced by worsening transport and travel balances.

The government efficiency sector also fell 1 place. The tax policy subcategory dropped 8 places (26th → 34th). The Ministry of Economy and Finance noted that since statistics from both 2022 and last year were used for international competitiveness comparison, the relatively high ranking of tax burden as a percentage of GDP in 2022 caused the decline. Increases in income tax (35th → 41st) and corporate tax (48th → 58th) burdens also contributed significantly to the ranking drop.

However, among the five sectors, four showed improved rankings: fiscal (40th → 38th), institutional framework (33rd → 30th), business environment (53rd → 47th), and social environment (33rd → 29th). Detailed indicators with improved rankings included real increase rate of government debt (56th → 43rd), fiscal balance relative to GDP (24th → 20th), bureaucracy (60th → 54th), capital market accessibility (27th → 20th), fairness of subsidies and distortion of economic development (45th → 30th), equal opportunity (40th → 23rd), and gender unemployment gap (37th → 21st).

A Ministry of Economy and Finance official stated, “Based on the evaluation results, we will more actively support improving business efficiency under the policy direction of a ‘dynamic economy led by the private sector and supported by the government.’ We plan to strengthen comprehensive national competitiveness by enhancing government efficiency through securing fiscal sustainability, rationalizing the tax system, promoting equal opportunity, and improving economic performance by strengthening service industry competitiveness and improving the balance.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.