Ministry of the Interior and Safety 'Status of Real Estate Transfer Tax by Basic Local Governments'

Han Byung-do "Some Local Governments Face Delayed Salaries Due to Reduced Real Estate Transfer Tax"

Last year, local finances suffered a significant blow due to the reduction in comprehensive real estate tax.

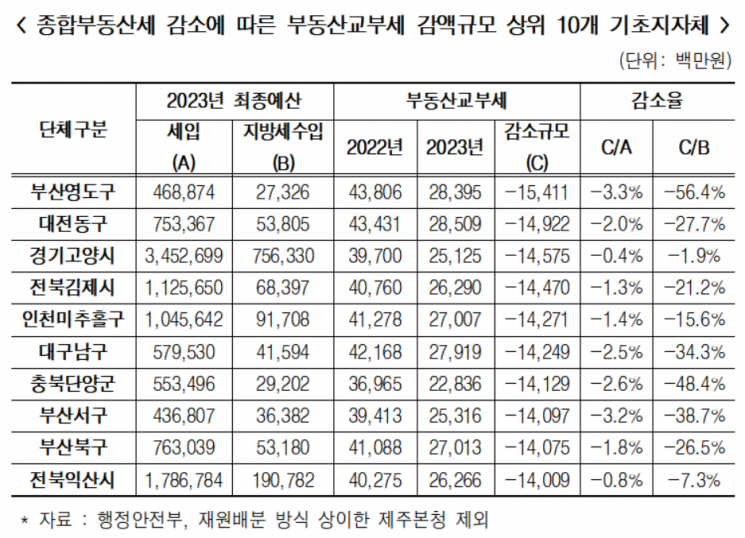

According to data from the Ministry of the Interior and Safety's 'Status of Real Estate Grant Tax by Basic Local Governments,' disclosed on the 17th by Han Byung-do, a member of the Democratic Party of Korea, the real estate grant tax decreased by 2.6068 trillion KRW in 2023 compared to 2022 as a result of the comprehensive real estate tax reduction. This has been analyzed to have caused substantial financial damage to some local governments. Under the current 'Local Grant Tax Act,' the comprehensive real estate tax is fully allocated to local governments. When the comprehensive real estate tax decreases, local governments' revenues also decline, worsening the financial situation especially for those that received a large amount of real estate grant tax.

Looking at individual local governments, the real estate grant tax decreased by 15.4 billion KRW in Busan Yeongdo-gu, 14.9 billion KRW in Daejeon Dong-gu, 14.5 billion KRW in Gyeonggi Goyang-si, 14.4 billion KRW in Jeonbuk Gimje-si, and 14.2 billion KRW in Incheon Michuhol-gu. As a result, local government revenues significantly declined. Particularly, local governments with a high dependence on real estate grant tax relative to their total finances were hit hard. In Busan Jung-gu, the reduction in real estate grant tax amounted to 4.8% of total tax revenue. This was followed by Gyeongbuk Ulleung-gun (3.8%), Incheon Dong-gu (3.7%), Busan Dong-gu (3.4%), and Busan Yeongdo (3.3%), all experiencing worsened financial conditions.

Based on this data, Representative Han predicted that the abolition of the comprehensive real estate tax would severely impact local governments. He stated, "With national tax revenue decreasing, the revenue distributed to local governments has also declined, and with the reduction in real estate grant tax due to the comprehensive real estate tax cut, some local governments have even delayed paying public servants' salaries," adding, "If the comprehensive real estate tax is abolished, local finances will take a direct hit." He further emphasized, "According to the calculation method of the real estate grant tax, regions that received more grants are already financially vulnerable areas," and stressed, "Discussions regarding the comprehensive real estate tax must include countermeasures for local finances in response to the decrease in real estate grant tax."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.