Risks of Defaults in Bridge Loans and Subordinated Loans

Increase in Corporate Bond Issuance to Build Loan Loss Reserves

"Need to Reduce PF Loans and Find New Growth Opportunities"

Since the financial authorities announced the real estate project financing (PF) soft landing measures on the 13th of last month, the capital industry has been busy with cleanup efforts. They are issuing specialized credit finance bonds to build up loan loss provisions and seeking new revenue sources to replace real estate PF.

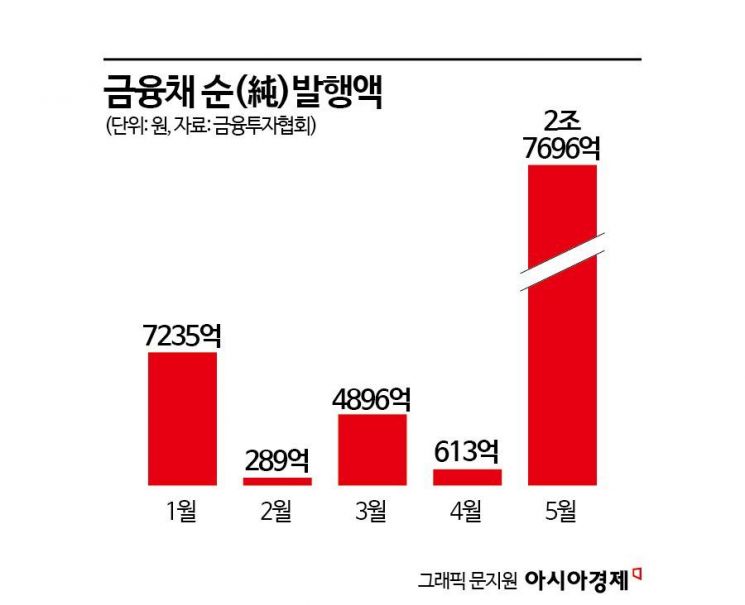

According to the Korea Financial Investment Association on the 17th, the specialized credit finance industry, including capital companies, issued net bonds worth 1.9973 trillion KRW from May 14 to June 14 this year. From January to May 13 this year, the net issuance of specialized credit finance bonds was only 1.7135 trillion KRW. The net issuance of specialized credit finance bonds in the recent month has surpassed that of the previous four months.

By capital company, Hana Capital issued the largest amount of specialized credit finance bonds in the recent month, totaling 585 billion KRW. IBK (500 billion KRW), JB Woori (480 billion KRW), and Hyundai Capital (330 billion KRW) followed. Small and medium-sized capital companies with credit ratings below AA- were also active in bond issuance. Meritz and Lotte Capital, both rated A+, issued 290 billion KRW and 250 billion KRW respectively. Aequan Capital (A) succeeded in issuing a total of 143 billion KRW.

The rapid increase in the supply of specialized credit finance bonds is closely related to the restructuring of real estate PF. As of the end of last year, the outstanding real estate PF loans of the capital industry amounted to 25.8 trillion KRW, second only to banks and insurance companies. Capital companies mainly provided loans for bridge loans at the early stages of projects, and generally handled mezzanine and subordinated loans, which carry high default risks.

As a result, concerns about the need for additional loan loss provisions have emerged. On April 12, NICE Credit Rating issued a report titled “Current Status of Real Estate PF Loss Recognition and Additional Loss Outlook,” estimating the expected loss amount for the capital industry’s real estate PF at 2.4 trillion to 5 trillion KRW, and analyzing the need to additionally set aside loan loss provisions ranging from 900 billion to 3.5 trillion KRW. This corresponds to 2.8% to 11.1% of their equity capital.

An industry insider from the capital sector said, “The overall funding capacity across the industry has significantly decreased, and to prepare for losses from real estate PF, we need to expand the issuance of specialized credit finance bonds,” adding, “Unlike banks, capital companies do not have deposit functions, so bond issuance is virtually the only way to raise funds.”

The improved conditions for issuing specialized credit finance bonds also contributed to the increase in fundraising. A bond broker said, “It seems to be an effort to secure funds in advance amid abundant market liquidity.” He added, “Especially capital companies with credit ratings around A to A+ have appropriate interest rates and risks, so market demand is high. They have even succeeded in ‘under-issuance,’ issuing bonds at rates lower than the private bond average rate, so recently specialized credit finance bonds have been strong.”

As the real estate market downturn continues, the capital industry has reduced the scale of real estate financing and turned its attention to new revenue sources. There is a mood to explore investment finance such as equity and private equity fund (PEF) investments, even if the returns are somewhat lower. Plans have also emerged to extend into non-performing loan (NPL) finance, an industry that thrives on crises, or to refocus on core businesses such as installment and lease financing.

An industry insider said, “As an extension of managing real estate PF risks, new PF loan issuance has been stopped or operated on a limited basis,” adding, “There are concerns that real estate PF defaults may materialize from the second half of this year, so the outstanding balance of real estate PF loans within the industry is expected to continue decreasing for the time being.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.