Metropolitan Area Sales Up 0.01%, Jeonse Up 0.02% Simultaneously Rebound

Seoul Housing Prices Rise 0.01% After 13 Weeks of Stability

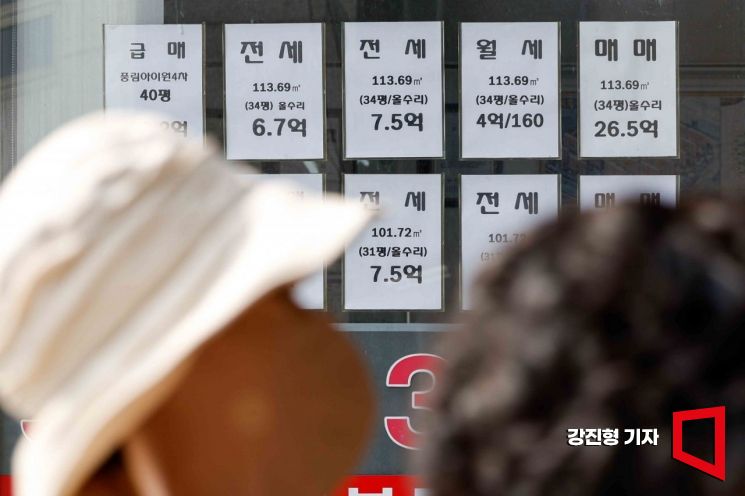

More than half of the annual lease contracts for 'standard-sized' apartments in Seoul have exceeded 600 million won in rent. On the 5th, a real estate office in Seoul displayed lease and sale price lists. Photo by Jinhyung Kang aymsdream@

More than half of the annual lease contracts for 'standard-sized' apartments in Seoul have exceeded 600 million won in rent. On the 5th, a real estate office in Seoul displayed lease and sale price lists. Photo by Jinhyung Kang aymsdream@

The apartment sale prices in the Seoul metropolitan area rebounded by 0.01% in the second week of June. After maintaining a nearly flat trend since the first week of November last year (0.01%), the metropolitan area sale prices turned positive for the first time this year on a weekly basis.

According to the 'Second Week of June Seoul Metropolitan Area Apartment Market Status' released by Real Estate R114 on the 15th, the number of areas with rising prices in Seoul expanded from just 2 last week to 11. In Gyeonggi Province, prices rose mainly in leading apartment complexes in areas such as Uijeongbu and Ansan.

In Incheon, the upward adjustment of prices for small to medium-sized apartments priced around 300 to 400 million KRW in Gyeyang and Bupyeong districts led the rebound in metropolitan area sale prices.

Seoul apartment sale prices rose 0.01%, breaking away from a 12-week streak of flat prices (0.00%). Reconstruction apartments remained flat (0.00%), while general apartments increased by 0.01%. New towns showed no significant price changes. Gyeonggi and Incheon saw a 0.01% upward adjustment for the first time in five months.

In Seoul, while most transactions involved low-priced listings, there was a slight increase in buyer inquiries in various locations. By individual areas, prices rose in the order of Jongno (0.05%), Mapo (0.05%), Yangcheon (0.02%), Dongdaemun (0.02%), Guro (0.02%), and Gangnam (0.02%).

On the other hand, Gangbuk fell by 0.05%, with places like Suyu-dong’s ‘Suyu Byeoksan 1st Complex’ dropping about 10 million KRW. All new town areas recorded flat prices (0.00%).

In Gyeonggi and Incheon, prices rose in Uijeongbu (0.06%), Ansan (0.04%), Gwacheon (0.01%), and Incheon (0.01%). Hwaseong (-0.03%) and Paju (-0.01%) fell by about 1 to 3.5 million KRW, mainly in large apartment complexes with over 2,000 households.

The jeonse (long-term lease) market saw steady inquiries centered on popular small to medium-sized units. Seoul, Gyeonggi, and Incheon, which recorded flat prices (0.00%) the previous week, each rose by 0.02%, while new towns increased by 0.01%.

In Seoul, jeonse prices rose in 15 out of 25 districts, accounting for more than half, showing a dominant upward trend. By individual areas, prices increased in the order of Gangseo (0.09%), Gangbuk (0.08%), Dobong (0.07%), Gwangjin (0.07%), Dongdaemun (0.06%), Nowon (0.06%), Jongno (0.05%), and Geumcheon (0.05%), while Seongbuk was the only district to fall by 0.01%.

In new towns, prices rose in Jungdong (0.07%), Pangyo (0.02%), Ilsan (0.01%), and Bundang (0.01%), with the remaining areas remaining flat (0.00%). Gyeonggi and Incheon had no areas with price declines this week, continuing the trend from the previous week. By individual areas, prices rose in Uijeongbu (0.05%), Hwaseong (0.04%), Incheon (0.04%), Ansan (0.03%), Suwon (0.03%), Siheung (0.02%), Seongnam (0.02%), and Gimpo (0.01%).

A Real Estate R114 official explained, "Seoul apartment sale prices, which had shown limited price movements within a box range of -0.01% to 0.00% on a weekly basis, rose for the first time in seven months along with the overall metropolitan area sale price change rate." He added, "Until April, the market showed a mixed pattern of rising and falling areas by district due to continued buyer hesitation, but in May, the absorption of urgent sale listings helped stabilize the bottom." He further noted, "Major urban areas such as Gangnam and Yongsan-gu have recovered to near previous record high sale prices."

He also said, "With the recent increase in transaction volume and price recovery phase, listings with raised asking prices are appearing," and "The rise in jeonse prices, increase in pre-sale prices, and continued lack of new supply are expected to continue stimulating apartment sale prices." He added, "Due to the expanded application of the Debt Service Ratio (DSR) in July and inflationary pressures, price fluctuations are expected to remain at a firm but stable level for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)