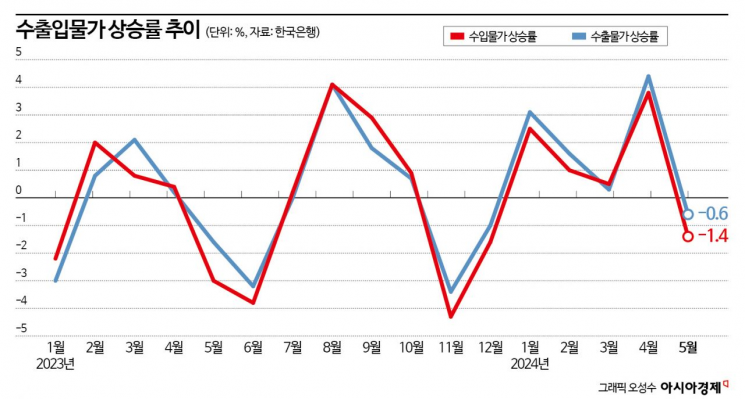

May Import and Export Prices Both Fall for the First Time in Five Months

Impact of Exchange Rate and International Oil Price Decline

As the exchange rate and international oil prices fell, import prices declined for the first time in five months. With import prices dropping, the likelihood of a continued slowdown in inflation in the second half of the year has increased. Import prices affect domestic consumer prices with a time lag.

According to the "May Export and Import Price Index and Trade Index (Provisional)" released by the Bank of Korea on the 14th, import prices (based on the Korean won) in May fell 1.4% compared to the previous month. This is the first time in five months that import prices have shown a downward trend since December last year (-1.6%).

The decline in import prices was due to decreases in both the exchange rate and oil prices. In April, the average price of Dubai crude oil was $89.17 per barrel, which fell 5.8% to $84.04 in May. The won-dollar exchange rate dropped 0.2% from an average of 1,367.88 won in April to 1,365.39 won in May.

Looking at import prices by item, raw materials such as crude oil and natural gas fell 3.7% compared to the previous month. Intermediate goods, including coal, petroleum products, and chemical products, decreased by 0.3% month-on-month. Specifically, crude oil prices fell 5.9%, and natural gas prices dropped 2.9% compared to the previous month.

Yoo Seong-wook, head of the price statistics team at the Bank of Korea, explained, "Import prices fell as mining products declined due to the drop in international oil prices."

With import prices falling for the first time in a while, it is expected to impact consumer prices in the future. Yoo said, "The decline in import prices can be reflected in producer and consumer prices with a time lag," adding, "The extent of the time lag and how producers reflect the price decreases may vary, so the impact could differ."

Export prices (based on the Korean won) also fell 0.6% month-on-month in May due to the exchange rate decline. This is the first drop in export prices in five months since December last year (-1%).

By item, export prices of manufactured goods, including coal and petroleum products such as diesel and gasoline, fell 0.6% compared to the previous month. Among these, diesel prices dropped 7.5%, and gasoline prices fell 11%. On the other hand, prices of agricultural, forestry, and fishery products rose 1.9% month-on-month.

Excluding the exchange rate effect, import prices based on contract currency in May fell 1.2% month-on-month, and export prices decreased 0.5%. Compared to the same month last year, import prices rose 4.6%, and export prices increased 7.5%.

The May export volume index rose 6.3% year-on-year due to increases in computers, electronics and optical devices, and chemical products. The export value index increased 10.3% year-on-year. Conversely, the import volume index fell 0.6% year-on-year due to decreases in machinery and equipment and chemical products.

The net barter terms of trade index rose 4.9% year-on-year, maintaining an 11-month consecutive upward trend. This was due to export prices rising 3.8% and import prices falling 1.1%. The income terms of trade index increased 11.5% compared to a year ago as both the export volume index and net barter terms of trade index rose.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)