Game Market Recovery... Positive Momentum for New Releases in the Second Half

"Shift Up's IPO Will Also Bring a Breeze to Game Companies"

After experiencing fluctuations, gaming stocks are waiting for upward momentum in the second half of the year. Major companies are set to release new titles. Along with this, Shift Up, considered a major IPO, is preparing for its listing, which is expected to bring warmth to the market and create a positive trend.

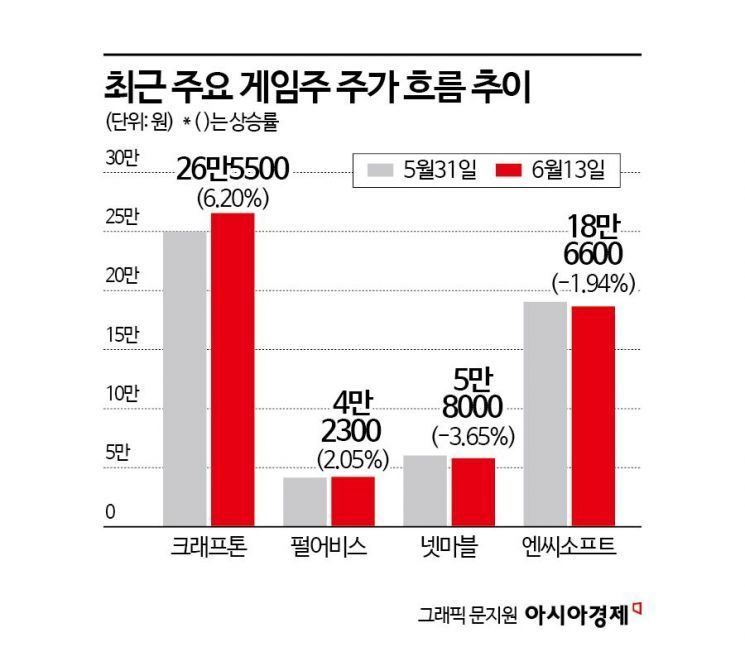

According to the Korea Exchange on the 14th, Krafton closed at 265,500 KRW the previous day, up 6.20% compared to the end of last month. Pearl Abyss also rose 2.05% during the same period to 42,300 KRW. On the other hand, NCSoft fell 1.94%, and Netmarble dropped 3.65%, showing differentiation among individual stocks. During the same period, the KOSPI and KOSDAQ rose 4.49% and 3.73%, respectively.

However, securities firms advise maintaining interest in the gaming sector, judging that the gaming market itself is in a recovery phase. KB Securities upgraded its investment opinion on the gaming sector from 'Neutral' to 'Positive' just the day before.

Lee Seonhwa, a researcher at KB Securities, said, "Since 2022, the Korean gaming industry has contracted. From 2025, with the continuous release of AAA new titles, we expect expansion into PC and console platforms, global regional expansion, genre diversification, and an increase in operating leverage through cost efficiency."

Lim Heeseok, a researcher at Mirae Asset Securities, also said, "After a decline in 2023, the domestic market is showing signs of recovery. Overall, gaming companies delivered a first-quarter earnings surprise due to labor cost reductions." He added, "The earnings surprise centered on labor cost reductions is likely to continue into the second half of the year and beyond 2025."

Additionally, Shift Up's upcoming listing is expected to have a positive effect on gaming stocks. If Shift Up lists at the upper end of its public offering price band, it is anticipated to be a large IPO with a market capitalization of about 3.5 trillion KRW. The company owns the mobile subculture game Goddess of Victory: Nikke and the console AAA game Stella Blade pipeline.

Another positive factor is that new titles from various companies are lined up starting in the second half of the year. Devsisters plans to release 'Cookie Run: Tower of Awesomeness' on the 26th. Also, new releases are scheduled for the second half, including Netmarble's 'The Seven Deadly Sins: Grand Cross', Wemade's 'Legend of Mir', and Nexon Games' 'First Descendant'.

Researcher Lee Seonhwa said, "In the first half, Wemade's 'Knight Crow' global version and Netmarble's 'Solo Leveling: ARISE' were released, proving the global market appeal of K-games. The second half will also see various new titles targeting the global market."

Lee Ji-eun, a researcher at Daishin Securities, explained, "The second half has more new title events compared to the first half. When events such as release schedule announcements and pre-registrations occur, short-term stock price increases are possible." She emphasized, "Game shows like Gamescom are also considered short-term stock price drivers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)