Bloomberg Reports Possible Strengthening of Chinese Regulations

High GAA·HBM Correlation in Korean Semiconductors

Various Opinions Emerge on Regulatory Direction and Scope

Questions Raised About Effectiveness of Additional Regulations

As the United States expands its scope of artificial intelligence (AI) regulations against China, it is reportedly considering extending restrictions to advanced semiconductor technologies such as Gate-All-Around (GAA) and High Bandwidth Memory (HBM). Although the direction and nature of these regulations are not yet clear, there is growing interest in their direct and indirect impact, given that these technologies are areas where the domestic semiconductor industry holds competitive advantages.

Bloomberg News reported on the 11th (local time), citing multiple sources, that the U.S. government is discussing measures to block China’s access to GAA technology, which is regarded as the next-generation transistor technology. The U.S. Department of Commerce’s Bureau of Industry and Security (BIS) recently sent a draft of GAA regulations to a technical advisory committee composed of industry experts. The process is said to be in the final stages before the introduction of regulations, but nothing has been finalized yet.

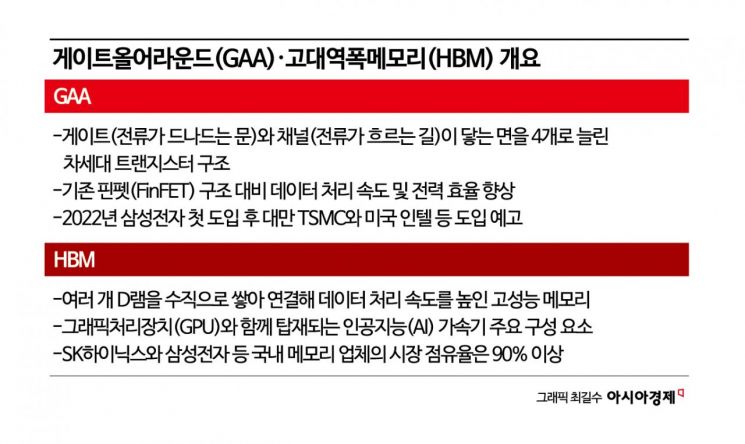

GAA is a technology that offers faster data processing speeds and higher power efficiency compared to the existing transistor structure, FinFET, and is used in advanced semiconductor production at 3 nm (nanometer; 1 nm = one billionth of a meter) and below. Samsung Electronics was the first in the industry to introduce GAA in its 3 nm foundry process in 2022, and other foundry companies such as Taiwan’s TSMC and Intel have also announced plans to adopt GAA in processes below 2 nm. This means that future advanced products from major semiconductor companies like Nvidia, Intel, and AMD will be produced based on GAA technology.

The semiconductor industry is closely monitoring the direction of the ongoing GAA regulation discussions. Even locally, there is uncertainty about whether the regulations will restrict China’s development of GAA technology or limit the export of GAA-based chip products from U.S. and other foreign semiconductor companies to China.

Various forecasts have emerged regarding the potential impact of these regulations on the domestic market. If the focus is on restricting GAA technology development, exports of related equipment could be limited. There is also the possibility that China’s foundry orders using the GAA process could be blocked.

Kim Yang-peng, a senior researcher at the Korea Institute for Industrial Economics and Trade, said, "There could be regulations instructing foundry companies like Samsung Electronics or TSMC not to accept orders for GAA processes from Chinese products, but the only company capable of making advanced products using GAA is Huawei." He added, "Huawei is already on the export control list, and transactions have been halted." He further evaluated, "Even if GAA regulations are established this time, their effectiveness will be minimal."

There are also rumors about possible regulations on HBM, which is included in AI accelerators. Bloomberg noted that discussions on restricting HBM exports are still in the early stages. HBM is a high-performance DRAM that stacks multiple DRAM chips vertically and connects them to increase data processing speed, often referred to as AI memory. According to foreign media, unlike GAA, no specific regulatory procedures have yet been initiated for HBM. However, since domestic memory companies such as SK Hynix and Samsung Electronics hold the majority market share for this product, concerns have been raised about potential damage. If exports of HBM products to China are restricted, partial damage could occur. However, questions remain about the effectiveness of such regulations.

Senior researcher Kim said, "There are only three companies producing HBM: Samsung Electronics, SK Hynix, and U.S.-based Micron. If they are asked not to sell products to China, they might comply." He added, "However, it would be difficult to prevent China from circumventing this by importing products through friendly countries, including those in Africa."

There are also claims that these measures aim to block China’s attempts at HBM self-sufficiency. Previously, foreign media reported that Chinese memory companies such as Changxin Memory Technologies (CXMT) and other local related firms are actively working on HBM development.

Yeon Won-ho, head of the Economic Security Team at the Korea Institute for International Economic Policy, explained, "If the goal is to prevent China from developing HBM, it could involve blocking the use of equipment used in the manufacturing process."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.