Concentrated Corporate Dividends in April, Current Account Deficit After One Year

Exports Remain Strong Centered on Semiconductors, Surplus Expected Again in May

Bank of Korea Announces 'April International Balance of Payments'

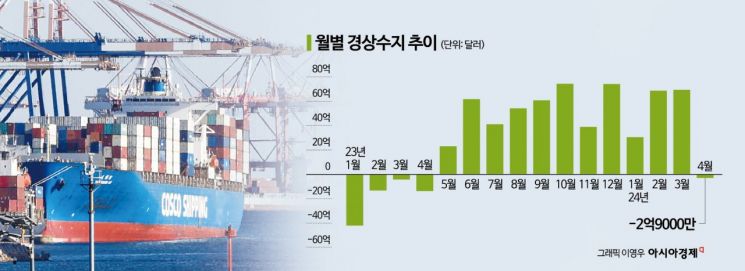

The current account balance turned to a deficit in April for the first time in a year as dividend payments to foreigners increased and the surplus in the goods balance narrowed. However, with the continued improvement in exports and the dividend payments being seasonal factors, the current account is expected to return to a surplus from May.

According to the "April Balance of Payments (provisional)" released by the Bank of Korea on the 11th, the current account recorded a deficit of $290 million in April. The current account had posted a surplus for 11 consecutive months since May last year but turned to a deficit after one year.

Current Account Turns to Deficit in April as Foreign Dividend Payments Increase

The current account deficit in April was due to a significant increase in dividend payments by companies to foreigners, which expanded the deficit in the dividend income account. The dividend income account recorded a deficit of $3.58 billion in April, up from a $1.2 billion deficit in the same period last year. This is the largest deficit in three years since April 2021. As the dividend income account turned to a deficit, the primary income account also recorded a deficit of $3.37 billion.

Song Jae-chang, head of the Financial Statistics Department at the Bank of Korea, explained, "In April, dividend payment dates for companies were concentrated, leading to large-scale dividend payments to foreigners, causing the dividend income account to turn to a deficit. As a result, the current account also recorded a deficit."

However, with continued export improvements, the current account deficit was smaller compared to the $1.37 billion deficit recorded in April last year. The cumulative current account from January to April showed a surplus of $16.55 billion, a significant improvement compared to the $7.33 billion deficit in the same period last year.

Exports in April increased for seven consecutive months to $58.17 billion, with improvements not only in IT items such as semiconductors but also in non-IT items like petroleum products and passenger cars. Based on customs clearance, semiconductors rose 54.5% year-on-year, petroleum products 18.7%, information and communication devices 16.7%, passenger cars 11.4%, machinery and precision instruments (7.9%), and chemical products (1.9%) also increased. On the other hand, steel products decreased by 4.9%.

By region, exports increased compared to the same month last year to Southeast Asia (26.1%), the United States (24.3%), Japan (18.4%), and China (9.9%), but decreased in the European Union (-7.1%).

Imports amounted to $53.06 billion, up 9% year-on-year. Imports returned to an increasing trend after 14 months as raw materials, capital goods, and consumer goods all increased. Based on customs clearance, raw materials such as petroleum and gas increased 5.5% year-on-year, capital goods including semiconductors and information and communication devices rose 3.7%, and consumer goods such as home appliances and direct consumer goods increased 8.4%.

Deputy Director Song said, "In April, crude oil prices rose, increasing import amounts, and as refiners’ operating rates went up, import volumes also increased, leading to an overall rise in imports."

Although export improvements continued in April, imports also increased, causing the surplus in the goods balance to decrease to $5.11 billion from $8.09 billion recorded the previous month.

The service balance recorded a deficit of $1.66 billion in April, mainly due to travel and processing services. Construction (310 million dollars) continued to post a surplus, but travel (-820 million dollars) and processing services (-590 million dollars) remained in deficit. The travel deficit narrowed somewhat compared to March (-1.07 billion dollars) as travel income increased, centered on tourists from Southeast Asia and China.

On the morning of the 11th, the 2024 April Balance of Payments (provisional) briefing was held at the Bank of Korea in Jung-gu, Seoul. From the left in the photo: Kim Tae-ho, Manager of the Balance of Payments Team; Song Jae-chang, Head of the Financial Statistics Department; Moon Hye-jung, Head of the Balance of Payments Team; Ahn Yong-bi, Manager of the Balance of Payments Team. (Photo by Bank of Korea)

On the morning of the 11th, the 2024 April Balance of Payments (provisional) briefing was held at the Bank of Korea in Jung-gu, Seoul. From the left in the photo: Kim Tae-ho, Manager of the Balance of Payments Team; Song Jae-chang, Head of the Financial Statistics Department; Moon Hye-jung, Head of the Balance of Payments Team; Ahn Yong-bi, Manager of the Balance of Payments Team. (Photo by Bank of Korea)

With Continued Export Improvement, Current Account Expected to Return to Surplus in May

The Bank of Korea expects that although the current account turned to a deficit in April due to temporary factors such as increased dividend payments, it will return to a surplus in May.

Deputy Director Song stated, "Exports continue to perform well in May, expanding the trade surplus based on customs clearance, and with the effect of the April dividend payments disappearing, the current account will return to a surplus."

Professor Kang In-su of the Department of Economics at Sookmyung Women's University said, "The current account deficit in April is likely temporary due to concentrated dividend payments to foreigners. Global demand for semiconductors and automobiles is expected to remain strong at least through this year, so the current account will return to a surplus from May."

Professor Kim Sang-bong of the Department of Economics at Hansung University also said, "The April current account deficit appears to be due to temporary factors. Since April is typically a month when dividend payments are made, a deficit can occur, but with the temporary factors disappearing in May, it will return to a surplus."

Meanwhile, the financial account net assets, which indicate capital inflows and outflows, decreased by $6.6 billion in April. This marked a reversal to a decrease for the first time in a year since April last year. Direct investment increased by $1.57 billion. Overseas investment by domestic residents increased by $3.93 billion, and foreign investment in Korea increased by $2.36 billion.

Securities investment in April decreased by $2.12 billion. Overseas investment by domestic residents increased by $3.51 billion, mainly in stocks, while foreign investment in Korea increased by $5.62 billion, mainly in bonds. Reserve assets decreased by $5.55 billion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.