Lotte Construction Purchase Card Agreement Reaches 180 Billion Won in Two Months

Construction Costs Increase While Fund Recovery Delays

Expansion of Fundraising Using Credit Cards

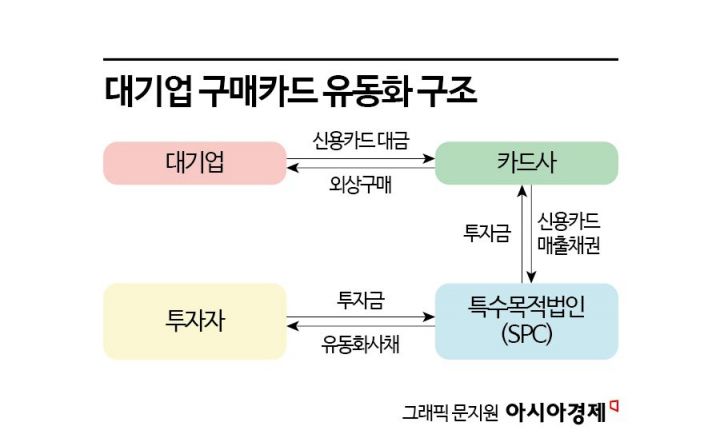

Construction companies facing multiple challenges such as a downturn in the real estate market and rising construction costs are overcoming financial difficulties by utilizing corporate purchasing cards. This method involves signing a credit card agreement with a set credit limit with a credit card company and using the card to pay for materials and supplies. It allows construction companies to purchase necessary materials and supplies for construction sites without immediate cash outflow, thereby easing the increasing burden of working capital.

Lotte Construction Secures 180 Billion KRW in Liquidity in Two Months Using Purchasing Cards

According to the investment banking (IB) industry on the 11th, Lotte Construction recently signed a purchasing card agreement worth 100 billion KRW with Hyundai Card. Under this contract, when Lotte Construction purchases materials and supplies using the credit card, Hyundai Card pays the amount on behalf of Lotte Construction within the agreed credit limit.

Hyundai Card issued securitized bonds worth 100 billion KRW backed by the card receivables (assets) generated from Lotte Construction’s card usage. When Lotte Construction repays the card payment on the due date, the card company returns the principal and interest to investors who invested in the securitized bonds.

Through this transaction, Lotte Construction reduced its cash expenditure burden by 100 billion KRW. Since it can purchase raw materials and supplies needed for construction sites and corporate operations using the card without cash burden, Lotte Construction also signed a purchasing card agreement worth 80 billion KRW with Lotte Card in April. In about two months, it has resolved 180 billion KRW of working capital burden through purchasing cards.

In the first quarter of this year, Lotte Construction’s sales amounted to 1.4213 trillion KRW, an 18.9% increase compared to the same period last year (1.195 trillion KRW). However, operating profit decreased by 24.4% to 44.3 billion KRW. During the same period, Lotte Construction’s unbilled construction amount increased by 19.8%.

Unbilled construction refers to accounts receivable for construction work that has been carried out but not yet billed. Since expensive construction costs are being invested at construction sites, it takes time to recover funds, leading to an increased working capital burden for construction companies.

An IB industry official said, "At the beginning of the year, Lotte Construction secured liquidity worth 2.3 trillion KRW from commercial banks and others to extend the maturity of bridge loans (initial project financing before permits) for unstarted construction sites," adding, "Working capital burdens are also arising at projects that have started construction due to disputes over construction costs."

Construction Companies with Rising ‘Unbilled Construction’ Expand Use of Purchasing Cards

As the construction industry suffers from increased working capital burdens due to rising construction costs and unbilled construction, the use of purchasing cards by construction companies is expected to continue increasing for some time.

At the end of the first quarter, the unbilled construction amount of the top 30 construction companies by construction capability evaluation stood at 22.4075 trillion KRW, a 12.3% (about 2.4 trillion KRW) increase compared to the same period last year (19.9474 trillion KRW).

Hyundai Construction, a top-tier construction company ranked first in construction capability, was no exception. Hyundai Construction’s unbilled construction at the end of the first quarter was 6.1921 trillion KRW, showing a steep upward trend for several years. Until unbilled construction is sufficiently recovered, liquidity burdens are increasing.

In May, Hyundai Construction signed a one-year purchasing card agreement worth 62 billion KRW with its affiliated card company, Hyundai Card. Although the scale is not large, it is interpreted as a measure to ease working capital burdens.

An IB industry official forecasted, "The construction industry as a whole is facing a phase where financial burdens due to rising construction costs and unbilled construction are increasing, so the use of purchasing cards by construction companies will continue to grow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.