Dairy Promotion Association Negotiation Subcommittee Discussed for One Month

Decision Made Within 0~26 KRW per Liter Range

Price Increase Factors Due to Rising Production Costs for Dairy Farmers

Concerns Over Decreased Consumption and Inflation

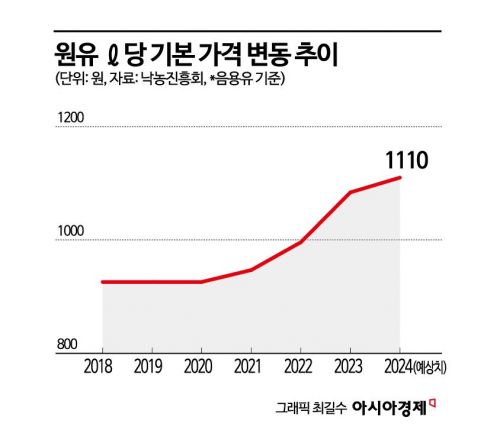

The negotiation for the base price of raw milk, which will serve as the standard for determining milk prices this year, is about to begin. The production costs for dairy farmers, which are reflected when setting the raw milk price, have increased, creating a factor that necessitates a rise in the base price again this year. On the other hand, considering that raw milk prices have been rising continuously over the past few years, milk consumption is declining, and consumers are burdened by inflation, there is also a forecast that the increase could be minimized or prices might be frozen.

According to the Ministry of Agriculture, Food and Rural Affairs on the 11th, the Dairy Promotion Committee, composed of dairy farmers and dairy industry representatives, has formed a negotiation subcommittee to discuss raw milk prices starting from this day. The negotiations will proceed for one month and can be extended if no progress is made. Once the negotiation results are derived in the subcommittee, they will be approved by the Dairy Promotion Committee’s board of directors, and the finalized base price of raw milk will be applied from August 1. Each dairy company will then recalculate product prices based on the increase rate.

Domestic dairy companies have followed the base price of raw milk decided by the Dairy Promotion Committee. Last year, the production cost for dairy farmers was approximately 1,003 KRW per liter, an increase of 4.6% compared to the previous year. The Ministry of Agriculture, Food and Rural Affairs instructed that the price increase should be carried out within a range of 0 to 26 KRW per liter, which is 0 to 60% of the production cost increase (44.14 KRW per liter), reflecting a 2% decrease in the usage volume of drinking milk compared to the previous year.

During last year’s raw milk price negotiations, the increase range was discussed between 69 and 104 KRW per liter, and the drinking milk base price was raised by 88 KRW per liter to 1,084 KRW. The base price of raw milk used for processed dairy products such as cheese, condensed milk, and powdered milk was set at 887 KRW, an increase of 87 KRW from the previous year. This was the second-largest increase since the introduction of the raw milk price linkage system in 2013, when the increase was 106 KRW.

Although an increase in raw milk prices is inevitable this year considering the rise in production costs for dairy farmers, dairy companies are concerned that raising product prices due to higher raw milk costs amid a continuous decline in milk consumption each year may lead consumers to turn away. According to the Dairy Promotion Committee, recent domestic milk consumption, based on white milk (plain milk), decreased from 26.7 kg per capita annually in 2018 to 25.9 kg last year.

The competition from imported sterilized milk, which is about 70% cheaper than domestic white milk and has a longer shelf life, is also intensifying. According to the Korea Customs Service’s export-import trade statistics, last year, South Korea’s milk import value was 30.94 million USD (approximately 41.3 billion KRW), an increase of about 33% compared to the previous year. In terms of weight, imports reached 37,361 tons, up 19% from one year earlier. Compared to 2019, before the COVID-19 outbreak, both import value and volume have increased roughly fourfold.

Last year, dairy companies reflected the increase in drinking milk and processed milk prices in product prices, causing the consumer price of white milk sold in the market to exceed 3,000 KRW per liter for the first time. As criticism spread mainly from consumer groups, some channels such as large supermarkets temporarily kept the price of their main white milk products in the high 2,000 KRW range.

An industry insider said, "Since the base price of raw milk has been rising continuously for the past three years, both dairy farmers and the dairy industry feel the burden of additional increases," adding, "Cautiously, there is a possibility that negotiations will proceed with price freezes or minimal increases." The government also announced plans to mediate so that producers and dairy companies freeze or raise the base price of raw milk at minimal levels, considering the severe inflation situation.

Meanwhile, this year’s negotiations will also include discussions on adjusting the volume of raw milk by usage (for drinking milk and processed milk) to be applied in 2025?2026, according to the usage-based differential pricing system introduced last year. Each company can reduce the volume of drinking milk, which has a relatively higher price, and increase the volume of processed milk. Since the excess volume of drinking milk exceeded 5% last year, the reduction range for drinking milk in this negotiation is between 9,112 and 27,337 tons. The adjusted raw milk volume will be applied from January next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.