9 out of 258 Bills Submitted Since Opening

From Major Issues to Debt Relief and Other Livelihood Finance Bills Submitted

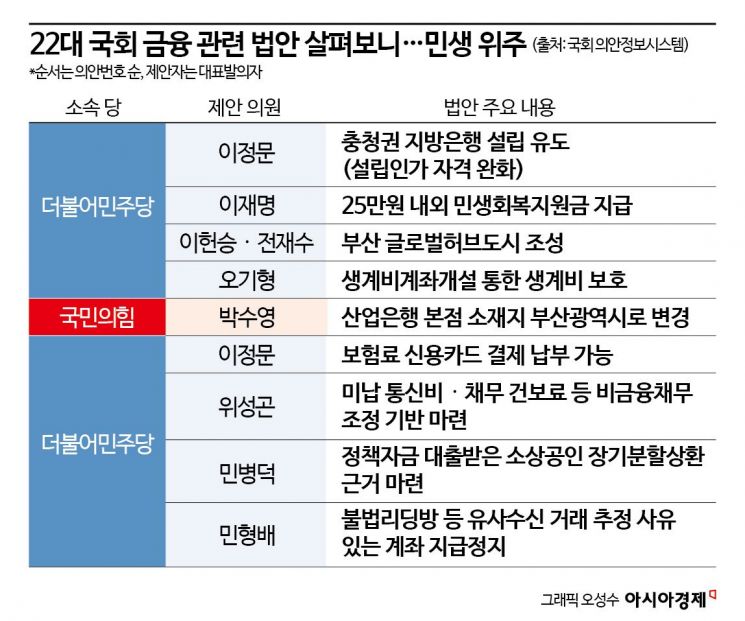

As the 22nd National Assembly convened, financial-related bills have begun to be submitted. These include bills related to livelihood recovery support funds promised by the Democratic Party of Korea in the recent general election, inducement of local banks establishment in the Chungcheong region, relocation of KDB Industrial Bank to Busan, relief of debt burdens for ordinary citizens, and suspension of payment of criminal proceeds from fraudulent fundraising activities such as stock leading rooms.

According to the National Assembly's legislative information system, out of 258 bills submitted since the opening of the 22nd National Assembly (as of 5 p.m. on the 10th), 9 are related to finance. The bill proposed by the largest number of lawmakers (171 members) is the livelihood recovery support fund bill, which the Democratic Party of Korea put forward as a campaign pledge in the last general election and submitted as the party's first priority bill. The bill is titled "Special Measures Act to Overcome the Livelihood Crisis in 2024," and Representative Lee Jae-myung explained in the rationale that it is an extraordinary measure to simultaneously revive domestic demand and the economy by increasing household income to activate consumption and boost sales of small business owners and self-employed individuals. Specifically, it proposes to provide all citizens with local love gift certificates ranging from 250,000 to 350,000 KRW.

A bill to relax the qualifications for establishment approval on the premise of establishing a local bank in the Chungcheong region also stands out. On the 30th of last month, Representative Lee Jeong-moon of the Democratic Party of Korea and nine others submitted a partial amendment bill to the Banking Act. Representative Lee stated, "Since the financial restructuring after the foreign exchange crisis, banks based in the Chungcheong region have been phased out, causing severe financial service imbalances in the Chungcheong area. Although local banks should be led by regional stakeholders due to their nature, current law excessively restricts stock ownership of local banks by the same person and non-financial major shareholders, making it difficult to establish local banks." Under the Banking Act, non-financial major shareholders (industrial capital) can only hold voting shares up to 15% of the total issued shares of a local bank. The minimum capital required for establishment is also 25 billion KRW. The bill aims to relax the ownership limit to 34% while raising the capital requirement to 100 billion KRW to find a realistic way to establish local banks.

Woo Won-shik, Speaker of the National Assembly, is giving an acceptance speech at the first plenary session of the 22nd National Assembly held at the National Assembly on the 5th. Photo by Hyunmin Kim kimhyun81@

Woo Won-shik, Speaker of the National Assembly, is giving an acceptance speech at the first plenary session of the 22nd National Assembly held at the National Assembly on the 5th. Photo by Hyunmin Kim kimhyun81@

A bill related to the relocation of the Industrial Bank to Busan has also been resubmitted. All 17 members of the People Power Party from the Busan region, including Representative Park Soo-young, recently submitted a partial amendment bill to the Korea Development Bank Act. Until last year, the government completed administrative procedures for relocating the Industrial Bank to Busan, such as designating it as a public institution. However, legally relocating the Industrial Bank to Busan was impossible because Article 4, Paragraph 1 of the current law stipulates that the bank's headquarters must be in Seoul. If the amendment passes, the Industrial Bank's headquarters must move to Busan. Four bills to amend the Industrial Bank Act were proposed in the previous National Assembly but were all discarded.

A special law aiming to make Busan a global hub city, including the relocation of the Industrial Bank, has been submitted. The main content is to stipulate special provisions so that Busan can become a base for logistics, finance, and digital advanced industries, targeting international free cities like Singapore or Shanghai. Seventeen People Power Party lawmakers from Busan, as well as Representative Jeon Jae-soo of the Democratic Party of Korea, whose constituency is Buk-gu Gap in Busan, participated in proposing this bill.

Additionally, financial bills related to livelihood, such as easing debt burdens for small business owners, have been prepared. The "Partial Amendment to the Act on Protection and Support for Small Business Owners," led by Representative Min Byung-duk, aims to provide a basis for long-term installment repayment for small business owners who received policy fund loans during the COVID-19 period. Representative Wi Seong-gon prepared a bill to include mobile telecommunications operators and the National Health Insurance Corporation in the credit recovery support agreement to establish an institutional foundation for adjusting non-financial debts, such as unpaid communication fees and overdue health insurance premiums, which significantly affect debtors' job seeking and economic activities, citing the difficulty of practically adjusting such debts.

Representative Lee Jeong-moon and 11 others submitted a partial amendment bill to the Insurance Business Act to allow insurance premium payments by credit, debit, or prepaid cards. Ten lawmakers, including Representative Min Hyung-bae, submitted a bill regulating the suspension of payment of criminal proceeds from fraudulent fundraising activities such as stock leading rooms. Representative Oh Ki-hyung proposed a partial amendment to the Banking Act to protect debtors' living expenses by allowing only one living expense account per person and prohibiting seizure of deposit claims in that account.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.