Focus on Grocery Expansion and Non-Food Efficiency

Renovations at Jukjeon, Yongsan, and Munhyeon Branches

New Store 'Hard Discount Store'

First Launch Next Year at Godeokgangil, Gangdong-gu, Seoul

Emart will introduce a series of new types of stores this year. For renovated existing stores, the grocery (food) and experiential elements will be expanded, and non-food stores will be converted into tenant (rental) spaces. For new openings, they will be launched as Hard Discount Stores (HDS), ultra-low-price supermarkets. This attempt is intended as a strategy to improve deteriorating profitability.

The exterior of Emart Jukjeon Branch, which is scheduled to complete its renewal and open as early as August. Jukjeon Branch is aiming to transition to a Starfield mall-type model operated by Shinsegae Property.

The exterior of Emart Jukjeon Branch, which is scheduled to complete its renewal and open as early as August. Jukjeon Branch is aiming to transition to a Starfield mall-type model operated by Shinsegae Property. [Photo by Emart]

According to the industry on the 10th, Emart will renovate and reopen four stores this year: Jukjeon, Yongsan, Munhyeon, and Gwangju. Additionally, next year, a new store will open in Godeokgangil, Gangdong-gu, Seoul. Afterwards, Gayang and Seongsu stores will also expand their footprint through re-openings. An Emart official said, "The new stores will be designed as spaces where customers can spend more time, tailored to changing lifestyles," adding, "Our goal is to introduce a new type of store different from the existing ones."

The first store reflecting Emart’s plan is the currently under-renovation Jukjeon store, scheduled to open as early as August. Jukjeon is attempting to transform into a Starfield shopping mall-type model operated by Shinsegae Property. The strategy is to position the grocery category as the anchor store and attract experiential tenants, including food and beverage (F&B), for the non-food category. Emart stated, "Jukjeon is being prepared as a 'mall-type renovation' model, an evolution from the Yeonsu and Kintex stores renovated last year."

If Jukjeon succeeds, the mall-type model is expected to expand. Currently, Emart operates 131 stores nationwide. As of last year, 42 stores have undergone renovations. Previously, Emart renovated 19 stores in 2021, 8 stores in 2022, and 15 stores in 2023, starting with The Town Mall Wolgye store in May 2020. This year, renovations will be carried out on the aging Yongsan, Munhyeon, and Gwangju stores in addition to Jukjeon.

Emart Yeonsu Branch, which was significantly renewed last year by greatly expanding grocery and experiential elements. The photo shows a cooking robot frying chicken at the deli corner next to the seafood section.

Emart Yeonsu Branch, which was significantly renewed last year by greatly expanding grocery and experiential elements. The photo shows a cooking robot frying chicken at the deli corner next to the seafood section. [Photo by Emart]

This attempt is based on the success of the Yeonsu and Kintex stores renovated last year. These stores significantly enhanced experiential content by reorganizing space and products. Examples include the 'Order Made' corner where seafood is prepared according to customers’ desired cooking methods, and a deli corner where cooking robots fry fried chicken. As a result, Yeonsu saw a 28% increase in customer numbers during the one-year period after reopening (March 30 last year to March 29 this year) compared to the same period the previous year. Kintex, which completed renovations in July last year, also experienced a 75% increase in customer numbers during the eight months after reopening compared to the same period the previous year. An Emart official said, "The stay-type content where customers can shop, eat, play, and rest attracted foot traffic and played an important role in offline store customer attraction."

Emart plans to launch new stores as 'grocery-specialized HDS.' HDS is an ultra-low-price store that minimizes in-store facilities and operating costs while leveraging a wide chain store network to significantly reduce product prices. This method is used by Germany’s Aldi and Lidl across Europe. Domestically, Emart’s 'No Brand' stores embody this concept. An Emart official said, "We are reviewing small-format grocery-focused stores for new store openings," adding, "We are examining the business viability of stores that strengthen EDLP (Every Day Low Price), such as the new pricing policies Emart is implementing, including price shocks and price reversals."

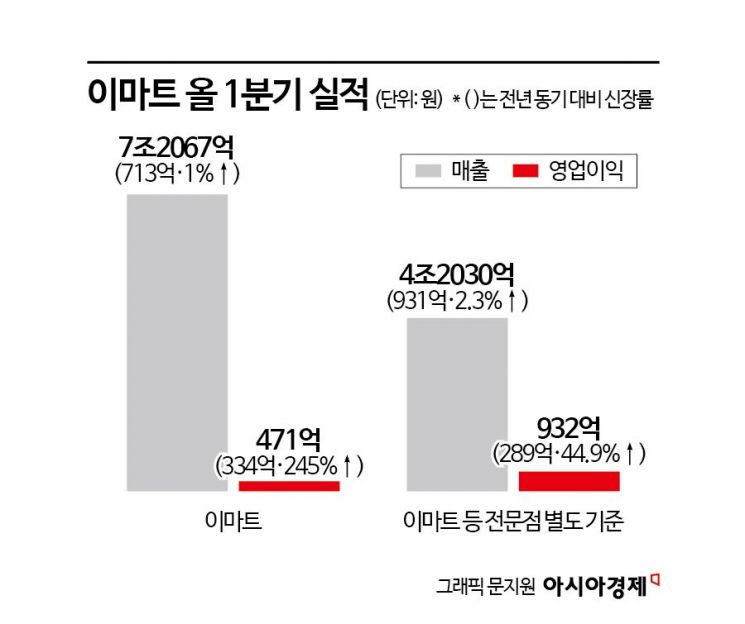

Following renovations, Emart appears to have gained confidence in its core business competitiveness as performance improves. In the first quarter, Emart recorded consolidated sales of 7.2067 trillion KRW and operating profit of 47.1 billion KRW. Compared to the first quarter of last year, sales increased by 71.3 billion KRW (1%), and operating profit rose by 33.4 billion KRW (245%). On a separate basis, including only Emart, Traders, and specialty stores, operating profit was 93.2 billion KRW, up 28.9 billion KRW (44.9%) from the first quarter of last year, and sales grew by 93.1 billion KRW (2.3%) to 4.203 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.