Hyundai Motor Group Participates in Three Capital Increases After BD Acquisition

SoftBank Does Not Participate... Hyundai Motor Group's Stake at 85%

Chairman Chung Also Adds Personal Investment... Stake Rises from 20% to 21.27%

Additional Investment Seen as Boosting Corporate Value Ahead of IPO

IPO Planned for June 2025 with Put Option Agreement Signed

Hyundai Motor Group has increased its stake in its robotics subsidiary Boston Dynamics (BD) to 85%. This marks a 5 percentage point increase three years after acquiring an 80% stake with a 1 trillion won investment in 2021. To raise its stake, Hyundai Motor Group reportedly injected about 500 billion won through three rounds of paid-in capital increases. There is speculation that by pouring substantial funds into expanding its BD stake and increasing the company's value, Hyundai Motor Group is gearing up for a Nasdaq listing.

According to Hyundai Motor's large business group status disclosure on the 10th, as of the end of May this year, Hyundai Motor Group's stake in BD was recorded at 85%, a 5 percentage point increase compared to the acquisition in 2021.

The increase in stake is due to paid-in capital increases. Since acquiring BD in 2021, Hyundai Motor Group has conducted a total of three paid-in capital increases through the first quarter of this year. Although the company did not disclose the exact scale of the capital increases, the additional investment amount from the group, including Chairman Chung Euisun's personal funds, is estimated to exceed 500 billion won (all amounts hereafter are based on book value).

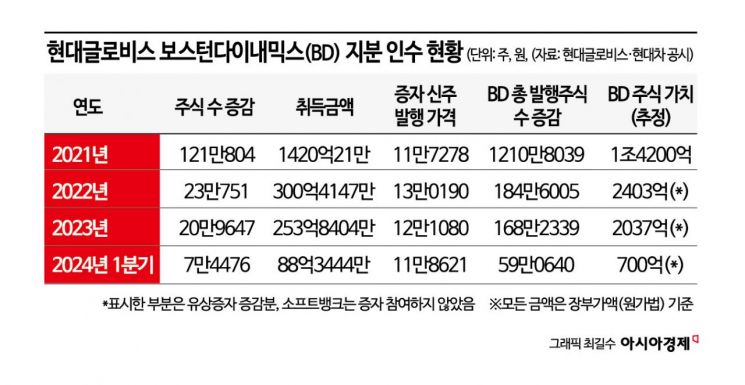

This can be indirectly confirmed from the disclosure by Hyundai Glovis, which holds BD shares. Since the year before last, Hyundai Motor, Kia, and Hyundai Mobis have controlled BD indirectly through the U.S. investment entity ‘HMG Global’. According to the disclosure, in 2021 Hyundai Glovis initially purchased 1,210,804 BD shares for 142 billion won. The purchase price per share translates to approximately 117,000 won.

Calculating the paid-in capital increase new share issuance prices in the same manner results in 130,000 won in 2022, 121,000 won in 2023, and 118,000 won in 2024. Based on the new share issuance prices and converted to 100% ownership, the group’s participation in the paid-in capital increases is estimated at about 240.3 billion won, 203.7 billion won, and 70 billion won respectively, totaling approximately 510 billion won.

Other shareholders such as SoftBank did not participate in BD’s paid-in capital increases. Therefore, with each capital increase, Hyundai Motor Group’s stake rose, securing control at around 85%. Chairman Chung’s stake also increased from 20% to 21.27%, with an estimated additional investment of over 128 billion won in the past three years.

Hyundai Motor Group’s investment of hundreds of billions of won to increase its BD stake is driven by the need to enhance corporate value. The IPO industry has long anticipated BD’s potential Nasdaq listing. When Hyundai Motor Group first acquired the stake, it signed a put option agreement with SoftBank with a listing in mind. If BD fails to list on the Nasdaq market by June 2025, Hyundai Motor Group must purchase SoftBank’s shares at a predetermined price. BD’s corporate value as an unlisted company has grown from 1.1 billion USD (approximately 1.2 trillion won at the exchange rate at the time) at acquisition in 2021 to about 1.3 billion USD as of the first quarter of this year.

Some optimistic forecasts suggest that if BD succeeds in going public, its corporate value could increase more than tenfold. Given that Chairman Chung holds about 20% of the shares, the proceeds from the IPO could be used for inheritance or restructuring of the governance structure. Samsung Securities researcher Lim Eun-young said, "Hyundai Motor Group could consider a long-term governance restructuring project similar to Toyota Group’s approach," adding, "This would involve selling the Mobis shares held by Kia and Hyundai Steel over 5 to 10 years, while the chairman uses dividends and BD’s listing proceeds to purchase Mobis shares."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.