SK Group Draws Market Attention with Semiconductor and Battery Affiliates for Sale

Triple Challenges of Interest Rates, Battery Industry, and Divorce Lawsuit Lead to Hasty Restructuring

Concerns Over Technology Leakage in Semiconductor, Battery, and Used Battery Recycling

"Among SK Group affiliates, there are some assets worth paying attention to. We are also planning to conduct a full-scale analysis of SK Group."

The CEO of a domestic and international private equity firm, well-versed in carve-out deals (sale transactions of specific business units) involving large corporations, stated that they are seeking deal opportunities amid the sale of affiliates following SK Group's governance restructuring.

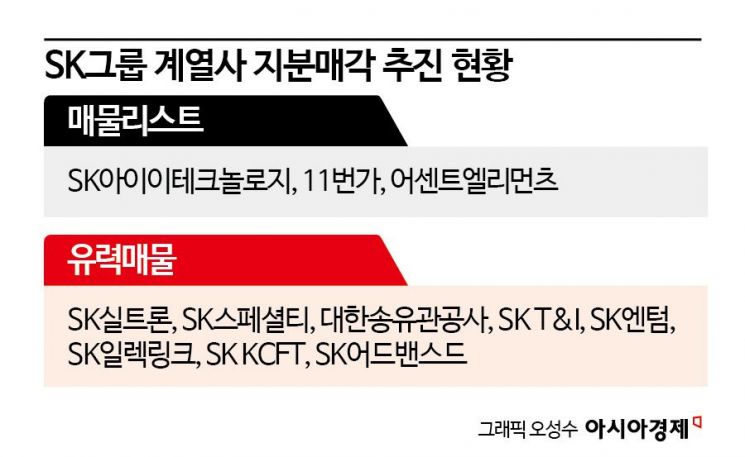

The SK Group affiliates currently mentioned as potential sale targets include SK IE Technology (SKIET), SK Siltron, 11st, and Ascent Elements. The investment banking (IB) industry is also analyzing that governance restructuring could take place in SK Group's pharmaceutical and bio sectors.

SK Siltron, considered the top candidate for share sale, is the only domestic wafer (semiconductor substrate) manufacturer. It mainly supplies SK Hynix and Samsung Electronics. Chairman Chey Tae-won participated in acquiring a 29.4% stake through a total return swap (TRS) when SK Inc. acquired SK Siltron from LG. At that time, Chairman Chey's stake was valued at approximately 253.5 billion KRW. The current value is estimated to be between 600 billion and 800 billion KRW.

SK Group is also pushing forward with the restructuring of its battery business division, including the sale of management rights of SKIET, which produces battery separators. As of the closing price on the 7th, SKIET's market capitalization stands at 3.1157 trillion KRW, with SK Innovation holding a 61.2% stake. Simply calculated, SK Innovation's stake value amounts to about 1.9 trillion KRW, and the price is expected to be higher when adding a management premium.

Shares of a company related to used battery recycling have also been put up for sale. SK Ecoplant is pursuing the sale of its stake in the U.S. used battery recycling company Ascent Elements. SK Ecoplant holds a 13.09% stake in Ascent Elements. The enterprise value of Ascent Elements is estimated to be in the 2 trillion KRW range. If all shares are sold, SK Ecoplant could secure approximately 260 billion KRW.

Capital Market Focused on SK Group... Semiconductor, Battery, and Used Battery Recycling 'Technology Stagnation - Talent Drain' Warning

While SK Group's governance restructuring presents an opportunity for profits from the capital market perspective, it could result in losses from an overall industry standpoint.

Amid sluggish battery market conditions, prolonged high interest rates, and the division of the chairman's assets, SK Group, cornered, may make negative management decisions in the long term due to hasty rebalancing.

Many of the affiliates SK Group has put up for sale handle technologies critical to the national industry, such as semiconductor and battery materials and used battery recycling technologies, raising concerns about technology stagnation and talent outflow.

An industry insider said, "Representative companies mentioned as sale targets include battery material companies SKIET and SK Nexilis, and semiconductor material companies SK Siltron and SK Specialty," adding, "Since the semiconductor market is very favorable, SK is unlikely to rush to sell semiconductor-related companies like SK Siltron."

He added, "SK is setting various directions for portfolio rebalancing, and there is a possibility that assets will be put up for sale in earnest in the second half of the year. Various possibilities, including internal mergers rather than outright sales, remain open."

SK Group had been the most watched company in the capital market even before the appellate court ruling on the divorce lawsuit between SK Group Chairman Chey Tae-won and Noh So-young, director of the Art Center Nabi.

SK Specialty (specialty gases), Korea Oil Pipeline Corporation, SK T&I (trading), SK Entum (tank terminals), SK E-Link (electric vehicle charging), SK PIC Global (petrochemical products), SK KCFT (secondary battery copper foil), and SK Advanced (petrochemicals) are mentioned as prominent potential sale targets in the industry.

Industry experts foresee that, besides the chairman's divorce lawsuit, the interest rate environment and battery market conditions will be major variables in SK's governance restructuring. Within SK Group, voices advocating for setting a clear direction for future industries such as batteries and hydrogen and adjusting the pace rather than recklessly disposing of affiliates at a loss are gaining strength.

Meanwhile, recent foreign media reports have suggested that the appellate court ruling on Chairman Chey Tae-won's divorce could materialize threats of hostile takeovers or hedge fund attacks on SK Group. On the 4th (local time), Shuli Ren, a Bloomberg opinion columnist, stated, "One of South Korea's largest conglomerates could become a target of a hostile takeover," and predicted, "Chairman Chey's control over SK could weaken."

Columnist Ren warned, "Chairman Chey and his relatives, including his younger sister Chey Gi-won, chairperson of the SK Happiness Foundation, hold only about 25% of the group's holding company (SK Inc.) shares," adding, "If Chairman Chey has to transfer or sell some shares to resolve the divorce lawsuit, the family's shareholding could fall below 20%, the threshold for domestic control."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.