The outstanding balance of corporate loans (loans to individual business owners) at internet banks has grown significantly, increasing by more than 1.5 trillion KRW over the past year. Internet banks, which had previously expanded their business mainly through mortgage loans, are now actively pursuing corporate loan operations to find new growth opportunities.

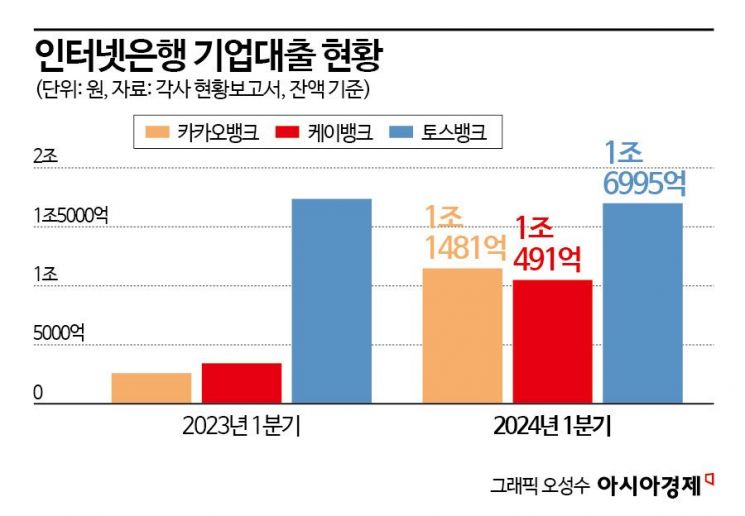

According to the status reports of KakaoBank, K Bank, and Toss Bank on the 7th, the combined corporate loan balance of the three banks stood at 3.8967 trillion KRW as of the first quarter of this year. This represents an increase of about 67% (1.5594 trillion KRW) compared to the same period last year (2.3373 trillion KRW).

Looking at each bank, KakaoBank's corporate loan balance reached 1.1481 trillion KRW in the first quarter of this year, growing approximately 345% (890.3 billion KRW) compared to the previous year. K Bank also saw its corporate loan balance rise from 343.6 billion KRW to 1.0491 trillion KRW during the same period, an increase of about 205% (705.5 billion KRW). Toss Bank had the largest corporate loan portfolio among the three internet banks at 1.6995 trillion KRW, but its balance slightly decreased by 36.4 billion KRW compared to the previous year.

Internet banks, which had primarily focused on household loans, have been gradually expanding into the corporate loan sector since launching loans for individual business owners in 2022. An internet bank official explained, "The ability to execute loans non-face-to-face and the competitive interest rates compared to major commercial banks have enabled rapid growth in a short period." In fact, when comparing interest rates for individual business owner loans available through non-face-to-face applications, internet banks offer rates in the 4-5% range, about 1 percentage point lower than those of major commercial banks.

However, since internet banks’ corporate loans are mainly centered on loans to individual business owners, managing credit quality remains a challenge. As the closure rate of self-employed businesses rises amid ongoing economic downturns, delinquency rates on individual business owner loans are also trending upward. The corporate loan delinquency rates of the three internet banks all increased year-on-year as of the first quarter of this year.

KakaoBank, which had a 0% corporate loan delinquency rate in the first quarter of last year, recorded 0.64% in the first quarter of this year. K Bank’s delinquency rate rose from 0.06% to 1.15%, an increase of 1.09 percentage points year-on-year. Toss Bank’s corporate loan delinquency rate worsened significantly, rising 2.21 percentage points year-on-year to 3.07%. In response, internet banks explained that the scale of corporate loans is not large and that the delinquency rates remain at manageable levels.

The 'corporate loans' sector, traditionally considered the exclusive domain of major commercial banks, is also a long-term challenge for internet banks. Corporate loans often come with strong demand for 'package' services from companies, including payroll accounts and retirement pensions, and due to the nature of corporate loans, many clients prefer face-to-face interactions over non-face-to-face. Another internet bank official said, "Under current laws, corporate banking is possible except for large corporations, but since there are no bank counters or branches, there are limitations in sales activities. This is a problem that needs to be overcome in the long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)