Urgent Demand for Cash 'Insurance Policy Loans' Increase by 1.9 Trillion

Delinquency Rate and Non-Performing Loan Ratio Also Rise

In the first quarter of this year, household loans by insurance companies increased by 700 billion KRW compared to the same period last year. The largest portion of this was 'insurance policy loans,' which are taken out when urgent funds are needed. Concerns have been raised about the need for soundness management as the delinquency rate has also nearly doubled.

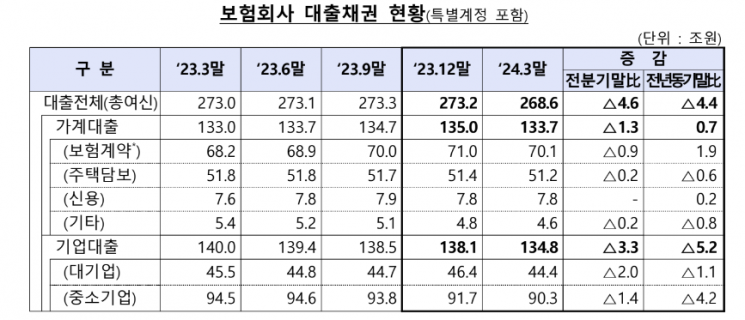

According to the 'Status of Insurance Company Loan Claims as of the End of March' released by the Financial Supervisory Service on the 7th, the balance of loan claims by insurance companies was recorded at 268.6 trillion KRW. This is 4.6 trillion KRW less than the end of the previous quarter (273.2 trillion KRW) and 4.4 trillion KRW less than the end of the same period last year (273 trillion KRW).

However, when broken down into household loans and corporate loans, the figures are contrasting. Household loans amounted to 133.7 trillion KRW, an increase of 700 billion KRW compared to the same period last year. Corporate loans decreased by 5.2 trillion KRW to 134.8 trillion KRW during the same period.

In particular, among household loans, insurance policy loans, which cater to urgent cash needs, increased by 1.9 trillion KRW, making up the largest portion. According to the Financial Supervisory Service's data, the balance of insurance policy loans held by insurance companies as of the end of the first quarter this year was 70.1 trillion KRW. Insurance policy loans are loan products where borrowers can borrow 79-95% of the surrender value without canceling the insurance policy. There is no screening process such as credit rating checks, and repayment can be made at any time without prepayment penalties. Typically, these loans are used by people with low credit scores who find it difficult to obtain bank loans or those with unstable cash flow.

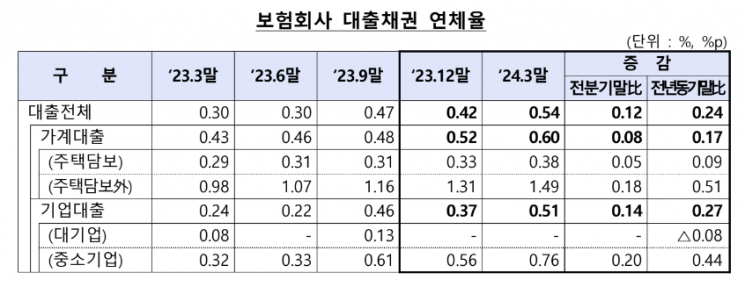

The delinquency rate is also a concern. The delinquency rate on insurance company loan claims (based on principal and interest overdue by more than one month) was 0.54% at the end of the first quarter this year. This is nearly double the 0.3% recorded in the first quarter of last year. Both household and corporate loan delinquency rates are on the rise.

For household loans, the delinquency rate rose by 0.17 percentage points to 0.6% compared to the same period last year. The delinquency rate for mortgage loans was 0.38%, up 0.09 percentage points from the previous year. The delinquency rate for loans other than mortgages increased more sharply, jumping 0.51 percentage points during the same period to 1.49%, exceeding 1%.

For corporate loans, the delinquency rate was 0.51% at the end of the first quarter, more than doubling from 0.24% at the end of the first quarter last year.

The ratio of non-performing loans (loans classified as substandard or below) was recorded at 0.76%, an increase of 0.48 percentage points from 0.28% in the same period last year. This represents more than a twofold increase. During the same period, the non-performing loan ratio for household loans rose from 0.34% to 0.43%, while the ratio for corporate loans surged 3.5 times from 0.26% to 0.91%.

A Financial Supervisory Service official stated, "We will continuously monitor the soundness indicators of insurance company loans, such as delinquency rates," adding, "We will also ensure sufficient provisions for loan losses, including reserves, and work to enhance loss absorption capacity and promote early normalization of non-performing assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)