As the won-dollar exchange rate rises, export stocks are gaining attention, and advice has emerged that portfolios should be tailored according to regions and product categories. In particular, attention should be paid to items such as bio-health, petrochemicals, petroleum products, automobiles, home appliances, and IT hardware.

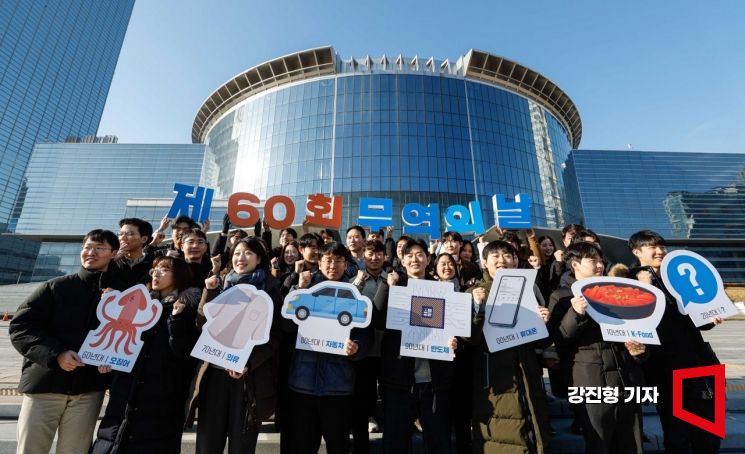

On the 4th, executives and employees of the Korea International Trade Association are holding major export products from different eras and taking commemorative photos at COEX Plaza in Gangnam-gu, Seoul, to celebrate the 60th anniversary of Trade Day. Photo by Jinhyung Kang aymsdream@

On the 4th, executives and employees of the Korea International Trade Association are holding major export products from different eras and taking commemorative photos at COEX Plaza in Gangnam-gu, Seoul, to celebrate the 60th anniversary of Trade Day. Photo by Jinhyung Kang aymsdream@

On the 5th, Labor Gil, a researcher at Shinhan Investment Corp., explained in a report, "Export stocks are in an environment where they are likely to attract attention in the domestic stock market," attributing this to "the combination of a low export base effect and the rise in the won-dollar exchange rate."

Export stocks tend to record earnings surprises, and in the first quarter of this year, KOSPI net income exceeded expectations by 11.4%.

The base effect of Korean exports is expected to continue through the second and third quarters. Researcher Labor Gil analyzed, "The period when Korean exports began to improve significantly was from October last year," adding, "Considering last year's figures, the export growth rate can maintain a high level until September this year." Additionally, the rise in the won-dollar exchange rate is seen as a factor contributing to profit growth.

He emphasized that the core factors are the low export base and the increase in won-converted exports due to the exchange rate rise. Researcher Noh said, "This is a favorable variable for corporate profits and consensus changes. Although the KOSPI fluctuates below 2700 points, it maintains expectations for growth in the upward trend of earnings per share (EPS)."

However, since there is differentiation by export region and product category, he suggested that investment strategies in the domestic stock market during this phase should focus more on sectors and individual stocks rather than indices.

Among the 15 major export items, the standout sectors are bio-health, petrochemicals, automobiles, petroleum products, and home appliances. Researcher Noh stated, "The export growth rate of bio-health is currently at 16.0%. Exports in the recent six months are 6.5% larger than in one year. Due to the expansion of bio-similar market share overseas and increased contract manufacturing volumes, there has been a seven-month consecutive growth trend," adding, "The forecast reflects a favorable recovery in demand from North America and Europe. Although automobiles had been sluggish, they have turned to a growth trend for two consecutive months. Chemical and petroleum products are notable for targeting the U.S. market rather than China."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)