Kiwoom Securities, First Value-Up Disclosure

Samsung Securities, High Dividend Around 35% for Years

Reducing Hive Stake Amid 'Management Rights Dispute'

Stocks in the securities sector are classified as prime beneficiaries of the financial authorities' stock market stimulus policy, the 'Corporate Value-Up Program.' This is because most of them are undervalued with a price-to-book ratio (PBR) below 1. The 'value-up securities stocks' favored by the National Pension Service (NPS) have been identified as Samsung Securities and Kiwoom Securities.

According to the Korea Exchange's disclosure system on the 5th, the NPS announced changes in its shareholdings of Kiwoom Securities and Samsung Securities on the 3rd. This was in accordance with the disclosure obligation for 'large holdings' of 5% or more. Kiwoom Securities' shareholding increased by 0.08 percentage points from 11.27% to 11.35%. Samsung Securities raised its stake from 10.57% to 10.72%.

Kiwoom Securities' 'Value-Up No.1 Disclosure', Samsung Securities' 'Stable High Dividend'

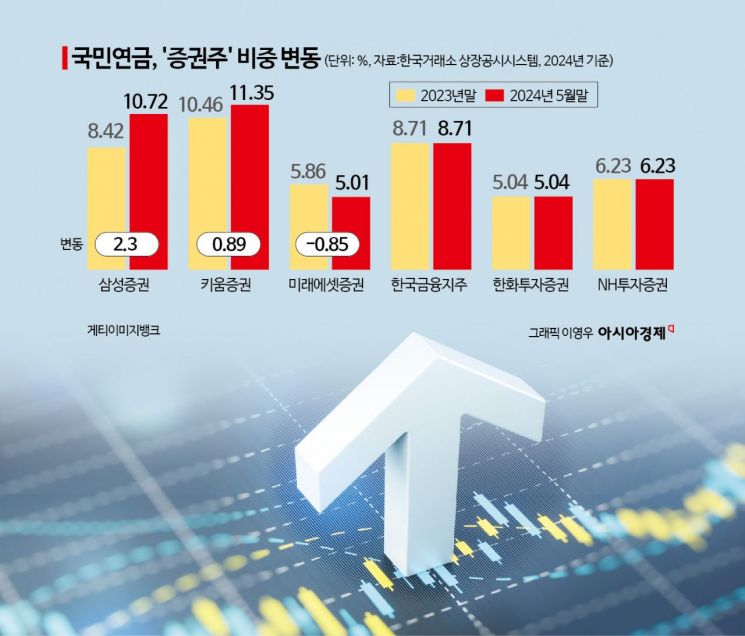

Currently, the NPS holds large stakes of 5% or more in a total of six listed securities companies. These include Samsung Securities, Kiwoom Securities, Mirae Asset Securities, Korea Financial Group, Hanwha Investment & Securities, and NH Investment & Securities. Among these, only Samsung Securities and Kiwoom Securities have increased their stakes this year. They have steadily increased their holdings since the end of 2023. Samsung Securities' shareholding rose by 2.3 percentage points (from 8.42% to 10.72%), and Kiwoom Securities by 0.89 percentage points (from 10.46% to 11.35%). These two are the only securities companies where the NPS is a 'major shareholder' with over 10% ownership. Mirae Asset Securities' stake decreased from 5.86% to 5.01%, and the other three showed no change.

Kiwoom Securities is the most friendly securities company toward the value-up policy. It is the 'No.1 company' to disclose a value-up plan. It was the first listed company to announce a value-up plan, which includes goals such as achieving a return on equity (ROE) of over 15% within three years, a shareholder return ratio of over 30%, and a PBR above 1. Kiwoom Securities is also the only domestic listed securities company that holds performance-related conferences. In this disclosure, Kiwoom Securities also announced plans to further expand meetings with domestic and international investors.

Samsung Securities is also recognized as a securities company that has practiced shareholder returns, a core aspect of value-up. A Samsung Securities official stated, "Since 2019, we have maintained a stable dividend payout ratio of around 35% annually, which differentiates us from other securities companies," adding, "Most securities companies have fluctuating dividend payout ratios depending on their performance." Since the announcement of the value-up program, Samsung Securities has not released any additional value-up plans. However, the NPS is interpreted to have given high marks for the sincerity Samsung Securities has consistently shown in enhancing corporate value.

Holding Financial Groups and Cosmetics, Reducing Stake in Hive Amid Management Dispute

Meanwhile, besides securities companies, the large holdings whose stakes the NPS increased last month include Krafton (5.51% → 6.52%), LG Household & Health Care (9.09% → 9.48%), HDC Hyundai Development Company (6.55% → 7.56%), Hanwha Ocean (5.01% → 5.54%), SeAH Besteel Holdings (7.11% → 7.4%), Doosan (7.77% → 7.8%), OCI Holdings (9.97% → 9.98%), and Hyosung TNC (10.07% → 10.67%). It is notable that the basket includes three holding companies (Doosan, OCI Holdings, SeAH Besteel Holdings), which are also beneficiaries of the value-up program, and LG Household & Health Care, a leading company in the recently spotlighted cosmetics sector.

On the other hand, the NPS reduced its stake in the entertainment 'leader' Hive from 7.63% to 6.57%, a decrease of 1.06 percentage points. It was the stock with the largest decrease in shareholding. The NPS sold 438,898 shares on the 31st of last month. Coincidentally, this was the day after the court approved a provisional injunction filed by Min Hee-jin, CEO of Hive's subsidiary Adore, to prohibit Hive from exercising voting rights. Based on the closing price at the time (200,000 KRW), the transaction amounted to approximately 87.8 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)